The steep mortgage rates generate the increase in housing prices, both homeownership and renting. People expect to see another housing market crash like the 2008 market. So, will a housing bubble appear and then burst? Finding an answer to when will the housing market crash needs great research on many factors, such as recession, inflation, etc. Please scroll down for a detailed analysis of the housing market!

The Housing Crisis 2022 Through Charts

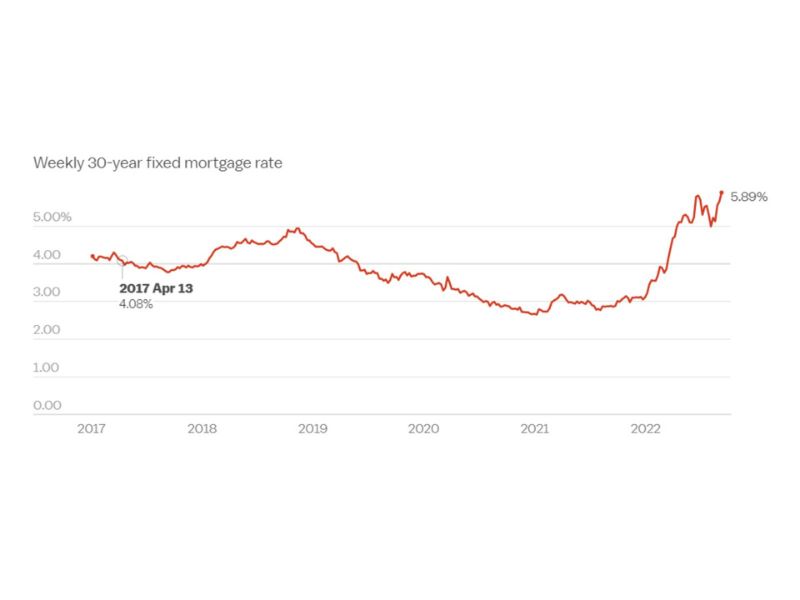

The Highest Mortgage Rate Since 2008

Mortgage rate seems to heat up the housing market when rising to 5.89% as of September 08th, 2022 according to the database of Freddie Mac. It was the highest level since the 2008 housing market crash.

The fears about the coronavirus and its profound effects on the US economy led to the drop of the mortgage rate to 2.65% in January 2021. As a result of cheaper house purchasing costs, the demand for homes increased.

After that, inflation stepped in so the Federal Reserve raised interest rates to handle tough situations. Mortgage rates rapidly climbed, consequently.

Although the Fed is not the direct factor, its policy contributes to the 10-year Treasury yield. Due to higher mortgage rates, the demand for houses is cool while the supply of available homes mounted.

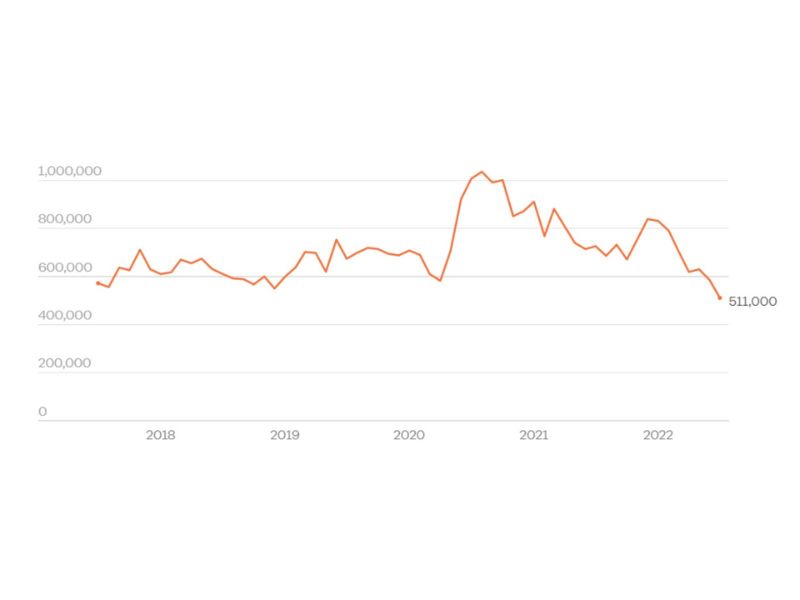

Cooler Demand for Homes

The rise in mortgage rates leads to increasing home prices. So, the sales of new single-family and existing homes have plummeted to welcome the downturn in the housing market. The sales reached the annual rate of 511,000 units, which is lower 12.6% than in June.

Consequently, the time that listings sit on the market is longer due to the drop in competition. The share of US homes listing for more than 30 days is not an exception now as such a situation increased 12.5% in July in comparison with a year earlier, according to Redfin data.

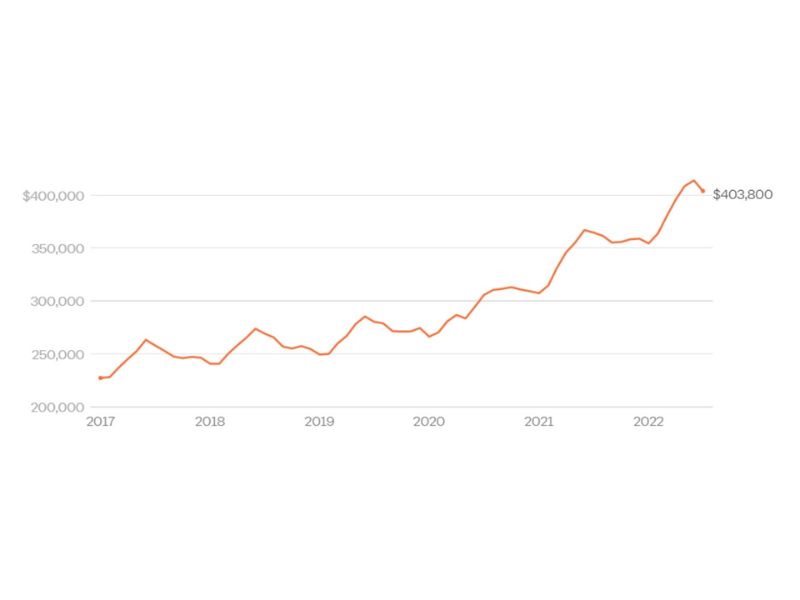

The Home Demand is Low but the Housing Prices are Steep

Under the impacts of the Covid-19 pandemic, mortgage rates were low and a shortage of house supplies took place. The combination of these events led to bidding wars among potential buyers to offer above the listing price amidst adverse competition.

Yet, the median existing-home price was over $400,000 in July 2022, according to data by the National Association of Realtors. It finally dropped to $10,000 in June, which is still 10.8% higher than last year.

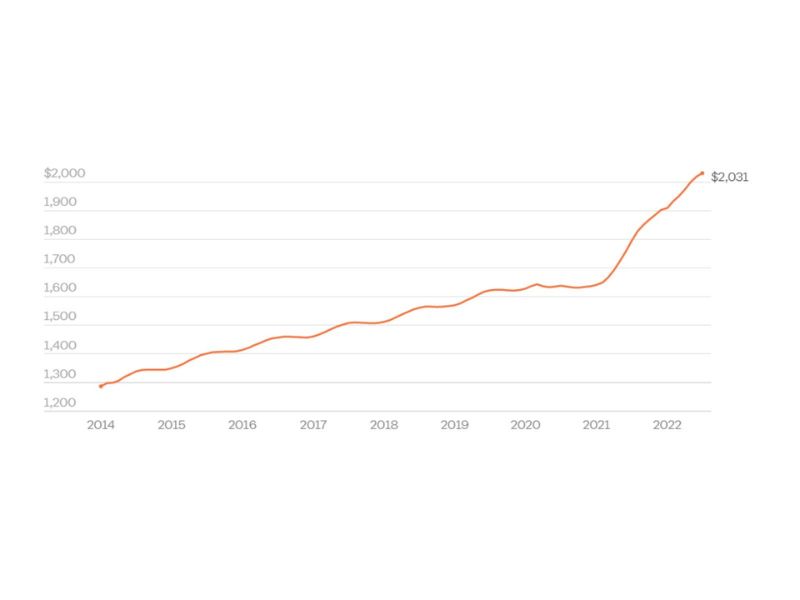

More and More Expensive Rent

House purchasing prices can drop sometimes, yet rent prices are not the case. It is getting higher over time. Yelena Maleyev, an economist at KPMG, pointed out that the demand in the rental market climbed due to higher mortgage rates and pricier listings.

Housing Seems to Be a Far-Away Dream

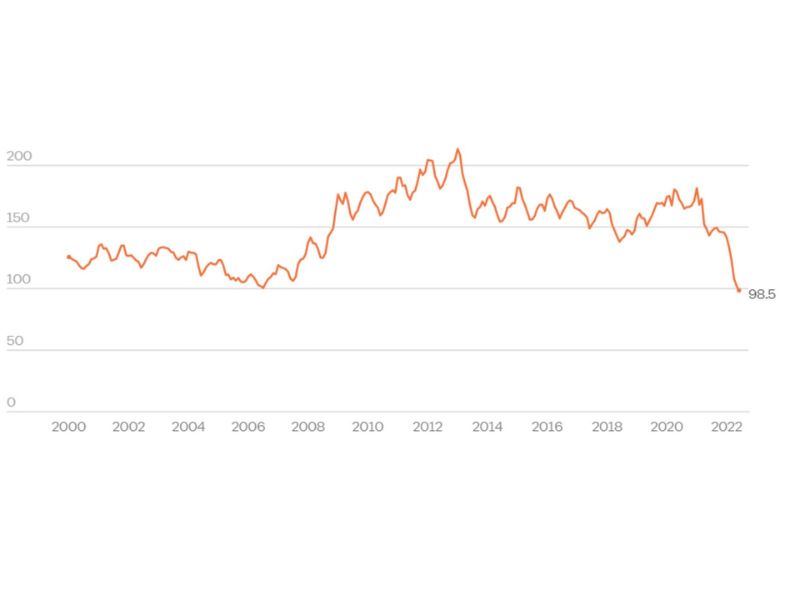

The National Association of Realtors Housing Affordability Index decreased housing affordability across the U.S. This statement is the result of measuring whether an average family can gain enough income to process a mortgage loan.

Affordability dropped in June as the monthly mortgage payment mounted to 53.7% and the income of a median family climbed 5.8% in comparison with last year. Despite tough situations, it is still a strange transition period to rebalance supply and demand after the pandemic.

When will the Housing Market Crash In 2022?

Is the housing market in a downturn? Yes. Is it going to crash? No, it is not. Experts state this good news and add that it is just a way the market uses to get back the balance between supply and demand.

There are compelling reasons explaining why the housing market will not crash in 2022.

- There are fewer new listings due to the drop in home construction.

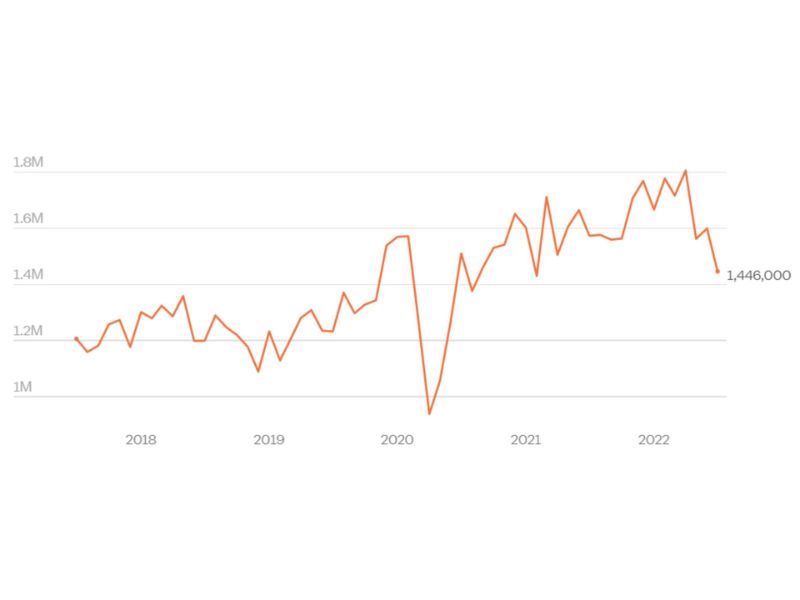

Builders get more worried about the drop in demand because high mortgage rates drive the downturn in home demand. The beginning of the housing construction drop was in July when fell to 1.45 million.

According to a survey from the National Association of Home Builders, the fall in housing construction is the result of increasing construction costs and decreasing demand.

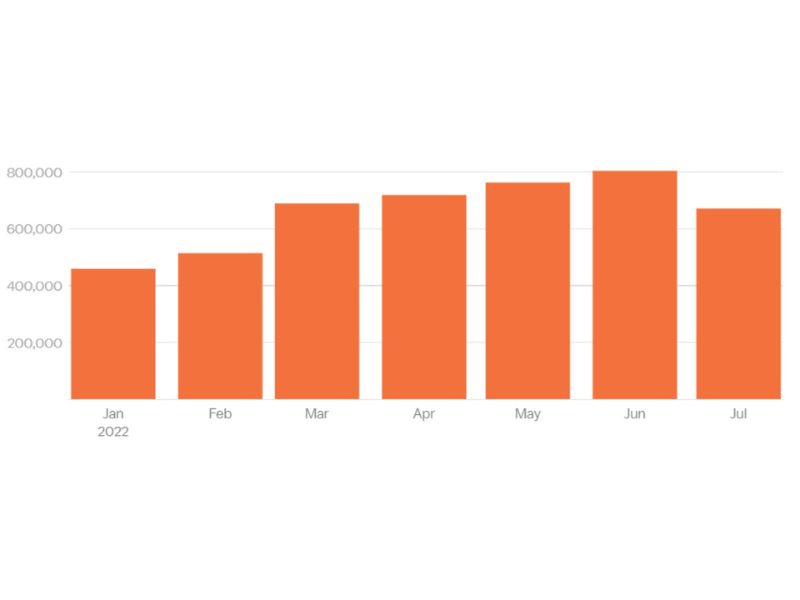

New listings decreased to 670,766 in July in the database Redfin. It implies that the potential sellers remain the same while home price growth slows down. Also, homeowners do not feel pressured to have their homes listed.

Yet, the total inventory of homes for sale has mounted due to improving supply. Specifically, active for-sale listings increased by around 5.1% in July, according to Zillow.

- Strict lending standards.

In 2007, borrowers could process lending without necessary documentation such as their income. It was among the key factors leading to the housing market crash in 2008. Yet, lenders apply tough principles to ensure that borrowers can pay back their loans.

- New buyers join the market.

Under the influence of Covid-19, many rich Americans who already had homes bought bigger houses to have more space for working and living under one roof. Millennials are also stepping into the period when they get enough income to qualify for a mortgage loan or own a house with their own money.

A Recession vs. the Housing Market

An economic recession goes along with the rise of unemployment and an ongoing lull in economic growth. The inflation was at 8.3% year-over-year in August, which might lead to a widespread recession.

The whole economy is under the effects. So, the housing market is no exception amidst the downturn in home sales and rising mortgage rates. As mentioned above, the Fed conducted the policy of high-interest rates to deal with inflation. This act profoundly impacts the housing market such as housing affordability and rent prices.

FAQs

What’s Different From the 2008 Housing Market Crash?

We agree that the current market and the 2008 housing market crash share some features in common such as steep housing prices. Yet, there are differences in the causes of ongoing market crashes.

The lax about writing loans might be the key factor to the creation of the housing bubble in the 2008 market. Yet, borrowers today have to go through strict standards to qualify for mortgage loans. So, there is no liar borrowing anymore.

Housing Market Predictions for September 2022

There are many factors getting involved in the status quo of the economy, such as inflation, skyrocketing gas prices, the war in Ukraine, etc. The forecasts for the housing market are not as bad as the burst of the housing bubble, yet it is not as good as being back to normal in September 2022.

High mortgage rates and increasing homeownership costs will be the main topic that we discuss in the next months of 2022. The drop in existing-home sales was 5.9% from June to July, making the sixth month of decreasing sales in the row. Thus, the market might still be gloomy in September 2022.

Housing Inventory Predictions for 2022

Inflation takes the cost of doing anything to another level. Amidst the cool demand for houses due to higher prices, builders and homeowners also have to struggle with the problems of maintaining and constructing houses. Thus, the housing inventory is predicted to be at a low record in the near future. Yet, once the economy gets back on track, namely the expenses of housing maintenance and building are affordable, housing inventory might come back to its prime.

Are Housing Prices Going Down in 2022?

Due to an ongoing recession, home prices seem to show no signs of cooling off. This phenomenon might be the reason why people and potential home buyers think the housing market can be in its bubble. Yet, the market is much like in its transition than in up-and-coming crashes.

Should I Buy a Home Now or Wait?

Redfin’s recent survey indicated that many buyers consider this period of the housing market a bubble. So, it is quite convincing that they should wait for it to crash. Yet, experts show the ‘side effect’ of confusion between waiting for the market to burst and patience.

The recommendation is that buyers should widen the search and be creative with their approaches. Instead of looking at the completed projects, for instance, you can check out new construction or ongoing projects.

The fact that the housing market is in its slowdown leads to steep mortgage rates. Yet, if you have been patient and soothed your mind with the aid of data-driven research and valuable insights.

Daryl Fairweather, a chief economist at Redfin, advised us not to rush the market now because it is in the stage of modification. Observation, research, and patience are the key factors.

Where Does a Housing Bubble Burst Come From?

The housing market works according to the law of supply and demand. As demand increases or supply decreases, a rise in prices will take place. A housing bubble indicates a sudden increase in demand. So, which conditions cause this situation?

- General economic activities and prosperity are on the rise so consumers’ pockets are full. It generates the need for homeownership.

- The mortgage rates are at a surprisingly low level. So, houses become more and more affordable.

- Innovation in the features of mortgage products such as low initial monthly payments make it accessible to own a house.

- Lenders need more business of mortgages to catch up with Wall Street’s demand for high-yielding structured mortgage-back securities (MBS).

In Conclusion

The 2022 housing crisis is obviously a pain for those who own and want to own houses. ‘Be patient’ is the advice of many experts, but wait for what? Wait for the market to crash? No, fortunately.

The housing market is not going to crash like the 2008 housing bubble bursts. All we should do amidst the chaos is to keep our minds calm and bring clarity to our considerations through data-driven analysis.

As a result, you should not be worried about when the housing market will crash. As it will not, which is good news. Yet, you have to deal with skyrocketing housing prices and the slow turn of house construction.