The Fundamentals of Algorithmic Trading AT101 course focuses on the design concepts behind Trading Robots. Because this course teaches more than simply programming, traders may receive more value than they anticipated.

Course overview

The major focus of the Fundamentals of Algorithmic Trading AT101 course is on the design ideas behind Trading Robots. Years of industrial practice have resulted in these theories and expertise. This course teaches more than just programming. Programming is just the instrument which is used to put our thoughts into action. At the conclusion of the day, you will be able to conceive a trade concept, code it (within 1 hour), test it, identify its strengths and defects, improve it, and ultimately execute it.

Course outline

The Fundamentals of Algorithmic Trading AT101 course includes everything you need to know about trading, including:

- Here’s What You Are In For!

-

-

- What is an Algo Trading Robot, its key traits and code structure

- What makes a successful Algo Trader

- How to set up and navigate your infrastructure/coding software

-

- Programming Basics 1: Variables and Conditional

-

-

- Basics of our coding language (MQL4)

- Syntax, Variables, Operations and Conditional Expressions

-

- Robot 1: Adeline – Our First Robot!

-

-

- Background to Forex markets, chart reading, basic indicators

- Coding Adeline together

- Testing Adeline using past data

- Brief look at modeling quality

-

- Uncommon Common Sense. Design Effective And Logical Robots

-

-

- Overview of our Strategy Development Guide

- Preliminary Research

- Backtesting

- Optimisation

- Live Execution

- Pros and Cons of an Algo Trading Robot

- Mathematical Expectations of our robots’ performance

- Overview of our Strategy Development Guide

-

- Garbage In, Garbage Out. Understanding Data

-

-

- Data Sources and Storage

- A look at the importance of data cleanliness

- Cleaning data (basic)

- Bad ticks, inaccurate testing and market tricksters

-

- Programming Basics 2: Loops

-

-

- Learning how to code loops

- Practice Exercises for Loops

-

- Robot 2: Belinda – Utilizing Volatility!

-

-

- Our first measure of volatility (ATR)

- Introducing Belinda, the improved version of Adeline

- Coding and testing Belinda

-

- To Buy Big or Small? Position Sizing and Money Management

-

-

- Understanding trade/bet size (how much to trade per position) using a coin flip game

- Designing a bet sizing algorithm based on account size

- Coding our bet sizing algorithm

-

- Robot 2A: Belinda Upgraded (No Gambler’s Ruin for Me!)

-

-

- Implementing our bet sizing algorithm in Belinda

-

- Where To Start? Idea Generation and Expectations

-

-

- Setting expectations for our robots based on our resources, personality, skill set, lifestyle and goals

- Understand the essence of a trading idea – Proxies and Relationships

- Sources of trading ideas

- A look at the different types of strategies

- Grading ideas – Introducing our framework for vetting ideas

- How to fight against big hedge funds

-

- Programming Basics 3: Functions, Time and Self-Learning

-

-

- Learn to learn programming

- Code errors and debugging

- Coding Functions

- Practice Exercises for Functions

-

- Relevant Statistics 101!

-

-

- Statistical significance and Law of Large numbers and their role in robot testing

- Deriving suitable minimum sample size for our backtests

-

- Understanding Robot Behavior and Robustness: Backtesting!

-

-

- Ensuring code accuracy

- Types of market condition

- Testing for Robustness

- Period Robustness

- Timeframe Robustness

- Seasonal Robustness

- Instrument Robustness

- Testing our robots through intended and unintended periods

- Stress testing our robots through black swans

- The butterfly Effect – Backtest bias via start point selection

- Grading the performance of our robots

-

- Programming Basics 4: Arrays And Indicators

-

-

- A look at our mentality towards Indicators

- Math behind Indicators

- Coding Arrays and Indicators

-

- Robot 3: Clarissa – Playing with Time

-

-

- Understanding the Datetime data type

- Coding rules revolving date and time manipulation

- Introducing and coding Clarissa – our robot that uses time entries

-

- What A Mess – Managing Trades, Orders and Positions

-

-

- Order limitations by your brokers

- Coding our customized order function

- Multiple order management

- Modeling transaction cost, spreads and slippage

-

- Robot 4: Desiree – Trade like the Turtles

-

-

- The history of the Turtle Traders

- Introducing and coding a simplified turtle strategy

-

- Design Theories IN – Improving Robots By Manipulating Time, Entries and Exits

-

-

- Profitability in different timeframes

- Deriving optimal stop loss levels

- Comparing the importance of entries vs exits

- Analyzing asymmetrical long and short rules

-

- Add A Twist To Your Orders – Advanced Order Management

-

-

- Breakeven and trailing stops

- Hiding from your broker – Creating virtual stops and take profit orders

-

- Robot 5: Desiree 2.0

- Buff Up Your Robot Responsibly – Optimisation Without Curve Fitting

-

-

- Objective Functions, Robustness and Curve Fitting

- 10 Ways to minimize curve fitting (overfitting)

- Degrees of Freedom

- Parameter Robustness

- In and out-of-sample testing

- Optimisation Evaluation

-

- Perfect Your Bet Sizing – Advanced Position Sizing Methods

-

-

- Relationship between sizing and trading frequency

- Gearing up and down with volatility

- Impossible Trinity of Sizing – Relationship between Leverage, % Risked and Stop Loss

- First Principles of sizing – Building customized sizing algorithms

- Other types of sizing – Kelly Criterion, Martingales and Anti-Martingales

-

- Robot 6: Elizabeth

- Programming Basics 5: Clean Up Your Codes! Simple Is Fast!

-

-

- Clean and robust coding

- MT4 Global Variables

- MQL4 Libraries

-

- Garbage In, Garbage Out Again. Advanced Data Cleaning (Part 1)

-

-

- Creating custom timeframes

- Clean data, biased output

-

- Excel VBA – Using Excel Magic to Improve our Trading

-

-

- Excel trading game

- Syntax

- Conditional statements

- Loops

-

- Garbage In, Garbage Out Again. Advanced Data Cleaning (Part 2)

-

-

- Data time zone manipulation

- Defining “clean enough” data

- Scanning for errors

- Advanced data cleaning methodologies

-

- I Like Colors And Shapes – Adding Graphics

- Creating a Dashboard: Graphics and Labels

- Creating trend lines and levels

- Ring Ring! Notify Yourself When Something Goes Wrong (Or Right)

-

-

- Coding smartphone notifications

- Notify yourself during trade or price events

-

- Robot 7: Faye – Semi-Automated Trading

- Connect with the outside world – Importing and Exporting Data out of our Trading Platform

-

-

- Read and write information to Excel

- Build a spread logger

-

- Programming Basics 6: Trading Platform Nuances

-

-

- Perfecting the little coding details

- Understanding trading and backtesting nuances

-

- Design Theories II – The “Secret Sauce”

-

-

- Prudence-Behavioral Framework

- Alpha 1: Data

- Alpha 2: Global Macro

- Alpha 3: High-Frequency Trading

- Alpha 4: Market Microstructure

- Hybrid Model – Semi-Algorithmic Trading

- 5 Realities of Algorithmic Trading

- Crowd Behavior – Outwitting the Masses

-

- Walking Forward – Advanced Optimisation

-

-

- Walk Forward Optimisation

- Performance patterns, consistency and seasonality

- 3D Parameter space evaluation

-

- Trading CFDs

- Looking Outwards – Trading On External Info and Alternative Data

-

-

- Trading using volume

- Feeding external data into MT4

- Trade on external events

-

- Robot 8: Gwen

- Cash Is King! – Running Robots With Real Money

-

-

- Paper versus Live trading

- Minimum Capital Determination

- Broker Selection

- Virtual Private Servers

- Downtime Prevention Protocol

- Hedging issues

- Strategy Monitor – Updating our robots regularly

- Live walk-forward optimisation

- Investor Marketplace

-

- Watch Her Well – Monitoring Your Robot(s)

-

- Operational Risk Management

- Monitoring our robots

- When to manually intervene

- Reviewing performance

- Understanding Trading Psychology – Emotions during drawdowns

What will you learn?

During the Fundamentals of Algorithmic Trading AT101 course, you will be shown precisely how to do trading, including:

- Better understanding in the fundamentals of trading strategy design, testing and execution

- Using a coin flip game to learn about trade/bet size (how much to trade each position).

- Recognize the essence of a trade concept – Proxies and Relationships

- Grading ideas and getting to know the trading concept evaluation.

- The use of statistical significance and the Law of Large Numbers in robot testing

- Backtest bias through start point selection – The Butterfly Effect

Who is this course for?

The Fundamentals of Algorithmic Trading AT101 course is tailored for:

- Those who want to learn more about trading and programming

- Those who want to be more multitask in trading to be more independent in trading

- Those who want to approach the advanced aspects of trading

AlgoTrading101

Please Login/Register if you want to leave us some feedback to help us improve our services and products.

RELATED COURSES

VIEW ALL-

AbleTrend 7.08 RT for eSignalDOWNLOADAbleTrend 7.08 RT for eSignalUpdate 21 Nov 2022All LevelsDOWNLOAD

AbleTrend 7.08 RT for eSignalDOWNLOADAbleTrend 7.08 RT for eSignalUpdate 21 Nov 2022All LevelsDOWNLOADAbleTrend takes advantage of the cutting-edge features of the AbleSys buying and selling platform to produce bar and dot colors in 1-minute, 5-minute, tick, daily, and weekly bar charts.

Add to wishlist -

ABC Waves TOS Indicator & Live Class – Simpler TradingDOWNLOADABC Waves TOS Indicator & Live Class – Simpler TradingUpdate 21 Nov 2022All LevelsDOWNLOAD

ABC Waves TOS Indicator & Live Class – Simpler TradingDOWNLOADABC Waves TOS Indicator & Live Class – Simpler TradingUpdate 21 Nov 2022All LevelsDOWNLOADA third-party developer created the ABC Waves using an algorithm made up of several moving averages and oscillators. The waves are used to show the overall strength and direction of a market over several time frames.

Add to wishlist -

Introduction to TradeStation Coding – Trading MarketsDOWNLOADIntroduction to TradeStation Coding – Trading MarketsUpdate 06 Nov 2022BeginnerDOWNLOAD

Introduction to TradeStation Coding – Trading MarketsDOWNLOADIntroduction to TradeStation Coding – Trading MarketsUpdate 06 Nov 2022BeginnerDOWNLOADThis course guides the primary features of this platform and the powerful techniques for beginners. So, they can enjoy an automated trading system for higher profits.

Add to wishlist -

Trading123 – Fully Automated Trading SystemDOWNLOADTrading123 – Fully Automated Trading SystemUpdate 06 Nov 2022AdvancedDOWNLOAD

Trading123 – Fully Automated Trading SystemDOWNLOADTrading123 – Fully Automated Trading SystemUpdate 06 Nov 2022AdvancedDOWNLOADThe full autotrader handbook, titled Fully Automated Trading System by Trading123, serves as step-by-step instructions for using the application. As a result, you enter the trend and catch 70 to 88% of the crucial move.

Add to wishlist -

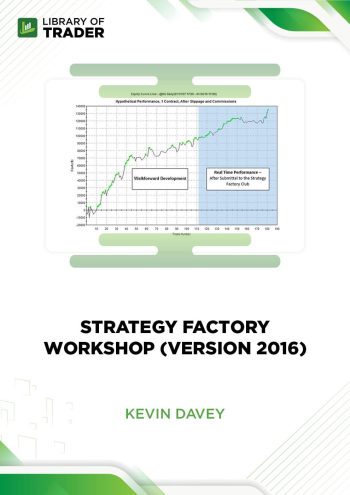

Strategy Factory Workshop – Kevin Davey (Version 2016)DOWNLOADStrategy Factory Workshop – Kevin Davey (Version 2016)Update 06 Nov 2022All LevelsDOWNLOAD

Strategy Factory Workshop – Kevin Davey (Version 2016)DOWNLOADStrategy Factory Workshop – Kevin Davey (Version 2016)Update 06 Nov 2022All LevelsDOWNLOADThis course is an ultimate trading course for retail algorithmic traders who are habitually losing money, in lack of confidence, or fearful their trading systems lack an edge.

Add to wishlist -

Larry Connors – How To Successfully Trade The Connors Windows Strategy &Tradestation CodeDOWNLOADLarry Connors – How To Successfully Trade The Connors Windows Strategy &Tradestation CodeUpdate 06 Nov 2022IntermediateDOWNLOAD

Larry Connors – How To Successfully Trade The Connors Windows Strategy &Tradestation CodeDOWNLOADLarry Connors – How To Successfully Trade The Connors Windows Strategy &Tradestation CodeUpdate 06 Nov 2022IntermediateDOWNLOADHow To Successfully Trade The Connors Windows Strategy & Tradestation Code by Larry Connors shares how Larry Connors developed and applied this system to his trading.

Add to wishlist

Reviews

There are no reviews yet.