What Is the TTM Squeeze Indicator?

The volatility and momentum indicator TTM Squeeze was developed by John Carter of Simpler Trading. It takes advantage of the fact that prices tend to break out forcefully after consolidating in a narrow trading range.

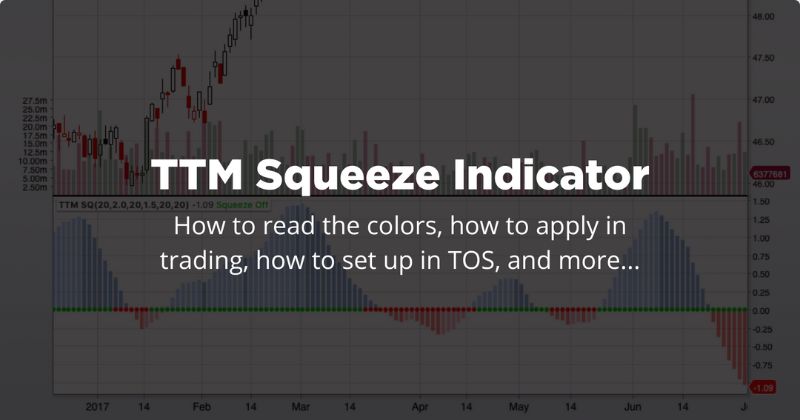

The TTM Squeeze indicator’s volatility section tracks contracting prices through Bollinger Bands and Keltner Channels. A period of minimal volatility is indicated if the Bollinger Bands are contained entirely inside the Keltner Channels. The squeeze refers to this tight condition. When the Bollinger Bands re-expand beyond the Keltner Channel, it is stated that the squeeze has “fired,” signaling an increase in volatility and a possible departure from the confined trading range. Squeeze on/off status is shown by little dots on the zero line of the indicator; red dots signal squeeze is on, while green dots show squeeze is off.

When the squeeze triggers, the TTM Squeeze indicator shows the direction of the move based on the momentum oscillator. Momentum above the zero line indicates a chance to buy long, while momentum below the zero line suggests a chance to sell. This histogram fluctuates around the zero line.

The TTM Squeeze indicator is available for TradeStation® and thinkorswim®, two widely-used charting software platforms currently.

How to Read the TTM Squeeze Indicator and How Does the TTM Squeeze Work?

TTM Squeeze Indicator Explained

The TTM Squeeze is predicated on the premise that decreased prices would eventually lead to higher prices. If we can pinpoint when the market is particularly tense, we can position ourselves to benefit from a potentially powerful move in one direction.

There are three parts that come together to form the Squeeze indication. Bollinger Bands and Keltner Channels are the first two indicators, setting off the respective colors. Squeezing occurs when Bollinger Bands (above, in cyan) move inside Keltner Channel (above, in red). During this moment of market tightening, the Squeeze indicator’s red dots will cross the zero line.

After the Bollinger Bands have widened and moved back beyond the Keltner Channel, the squeeze will be considered to have “fired” and the dots will turn GREEN. Bollinger bands contract and move within Keltner channels when volatility is minimal.

What Do the Colors Mean on the TTM Squeeze?

Indicators of a squeeze are represented by red and green dots on the zero line. If there is a red dot, it indicates a squeezing situation. If there is no red dot, we are not in a confined space at the moment. When a green dot appears following a string of red dots, the squeeze has been successful.

Statistically speaking, momentum may be shown in the histogram. When the histogram is on the rise, it will be either yellow or cyan/light blue. The histogram will be crimson or dark blue if momentum is waning.

How to use the TTM Squeeze in Trading

There is a wide range of periods compatible with the TTM Squeeze indicator. When trying to confirm a security’s value, many chartists look at data from several different time periods. Squeezes that fire on many time frames at once are more reliable signals than those that fire on just one.

The TTM Squeeze not only helps you anticipate when a “larger than expected move” is likely to occur, but it also works well with and supplements a wide variety of other trading tools and systems.

With the TTM Squeeze, traders may rededicate themselves to the market and get the self-assurance they need to consistently turn a profit and increase their wealth. Having faith in yourself and your abilities will help you:

- Avoid bad trades

- Make profitable trades

- Optimize returns

- Put away your doubts

- Enhance market sense

How to Build a Profitable Trading Plan Using the TTM Squeeze?

How To Trade Momentum & Volatility With TTM Squeeze Indicator

John Carter’s route to regular profits in trading was revolutionized by the TTM Squeeze indicator. The TTM Squeeze is an important technique for traders who wish to rapidly expand their trading capital.

To put it bluntly, the TTM Squeeze indicator is not a miracle worker. Any kind of trading carries with it some degree of inherent risk. Additionally, you are not expected to “make it big” in the trading world in the manner of some well-known trader who claims to make you a millionaire if you only “be a billionaire” on the internet.

It’s important to keep in mind that “monster gains” aren’t the result of a string of lucky trades. Well-thought-out, precise deals that generate stable, rapid profit growth are the source of true riches on the stock exchange. It will need care, assurance, and time.

Your mission is obviously to develop your trading skills so that you may steadily increase your trading account balance. The time is now to take advantage of the market and generate gains that are within reach, paving the route to a consistent trading income.

What if you trade successfully enough to make a living, with more wins than losses? How would an extra $1,000 in your trading account each month change your life? It’s possible there’s more. If you’re looking for a “what if” in your trading life, go no further than the TTM Squeeze. How much financial independence and trading account growth you experience is entirely up to you.

How to Set up TTM Squeeze Indicator

Here is what you simply need to do to set up the TTM_Squeeze to your thinkorswim charts:

- Login to your thinkorswim account

- Select the studies button

- Add study

- Then find John F. Carter studies

- Select the TTM_Squeeze

Trading the TTM Squeeze Indicator with Divergences

Although the TTM Squeeze indicator is recognized to provide a strong signal as to where price is heading, the best trades are those in which numerous indicators are flashing the same signal.

Using divergence is a strategy that may be applied while trading with the TTM Squeeze indicator. When price and the histogram momentum bars are moving in different directions, this is called a divergence. When price is forming higher highs while the slope of the histogram is forming lower highs above the “zero line,” a bearish divergence exists.

Bearish divergence is the opposite of bullish divergence. When price is making lower lows while the histogram is trending higher from below the “zero line,” this is considered bullish divergence.

When do you propose we make the swap? When a trend line is broken, some traders like to make a purchase. Some investors prefer to buy at the break in the trend line, while others prefer to wait for a retest of the line. Others need further evidence from a third indicator, such as a moving average. As long as the level of risk is understood before a transaction is made, there is no one correct approach.

What is the Squeeze Pro Indicator?

The Squeeze Pro Indicator is the upgraded version of TTM Squeeze. Conversely, the TTM Squeeze is a fantastic indicator that can do wonders for traders of any skill level. The premium Squeeze Pro Indicator makes it easy to choose one of three squeeze intensity levels, provides clear entry and exit signals, and anticipates and capitalizes on market rallies. You should upgrade to TTM Squeeze Pro if you’ve outgrown the free version.

TTM Squeeze users who have outgrown the indication might consider upgrading to The Squeeze Pro. With the Squeeze Pro, you can locate superior squeezes with greater rapidity and precision. That being said, if you feel prepared to do so, now is the time to make the change.

On the other hand, the TTM Squeeze is a great indicator that may assist any trader zero in on the top stocks that are poised for a major breakout. Readability, coherence, and comprehension are all high. Find a stock in a squeeze, and then use the momentum oscillator to predict which way the price is likely to move.

The Bottom Line

The TTM Squeeze indicator takes into account both volatility and momentum in order to help traders profit from swings in the security’s volatility. Squeeze dots, which are part of the indicator’s volatility component, point to possible breakouts after tame trading conditions. The momentum histogram shows the most likely path of the breakout and can aid in locating potential exits.

Gaining access to the TTM Squeeze will help you gain a deeper insight into the market’s current state and potential future direction. Traders should employ the TTM Squeeze indicator in conjunction with other indicators like Swing Indicators or Gann Indicators and methods of analysis, as is the case with any other indicator.