This course walks you through the many butterfly options in great detail. As a result, you will learn the key characteristics of each technique, as well as the best time and atmosphere for them to shine.

Course overview

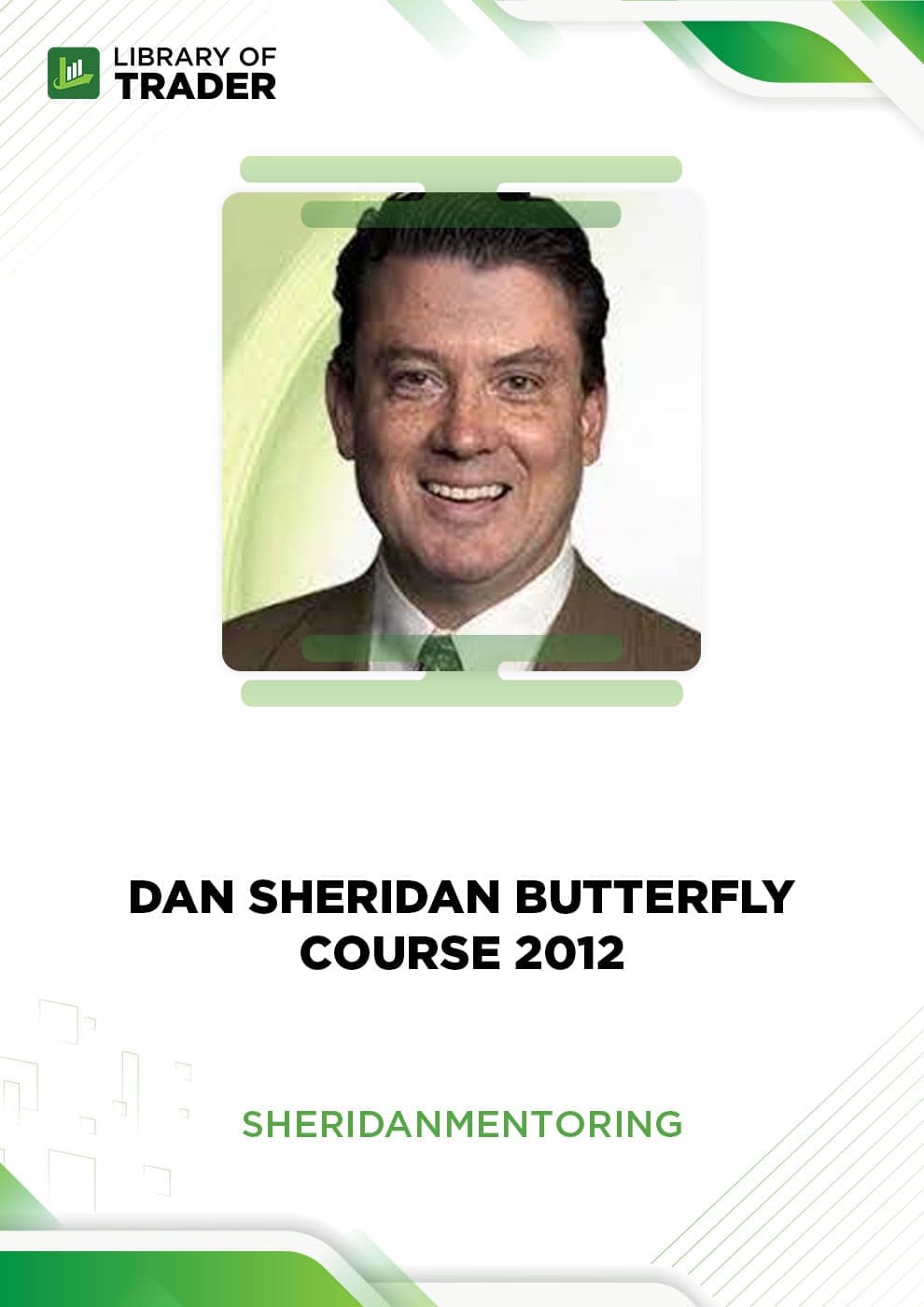

Sheridan Options’ Dan Sheridan Butterfly Course 2012 Mentoring brings you through the many sorts of butterfly possibilities in great depth. Butterfly tactics include the Split Strike Butterfly, the Weekly Unbalanced Butterfly, and the Broken Wing Butterfly, among others. Under the detailed guidance of the Dan Sheridan Butterfly 2012 by Sheridan Options Mentoring, you will understand the salient qualities of each approach as well as the optimal moment and environment in which they may demonstrate their full strengths.

Furthermore, you will receive access to knowledge about the best strategies for selecting lucrative stocks for Butterfly, as well as expertise to understand the stocks’ strengths and weaknesses. Sheridan Options Mentoring’s Dan Sheridan Butterfly Course 2012 also assists you in determining whether to Call or Put for the best risk/reward ratios. As the trading market maintains its volatile flow, risk can harm your earnings. As a consequence, Dan Sheridan Butterfly 2012 shares instructions on how to manage your trades and risk management tactics.

Course outline

The detail content of the Dan Sheridan Butterfly Course 2012 includes the flow of modules:

- First Class: With Dan talking about: The Split Strike Butterfly.

- Second Class: With Dan talking about: Weekly SPX Butterfly

- Third Class: With Dan talking about: SPX Put Broken Wing Butterfly

- Fourth Class: With Dan talking about: The 30-40 Day ATM Butterfly

- Fifth Class: With Dan talking about: The 30-40 Day ATM Balanced Butterfly in RUT, SPX, and AAPL

- Sixth Class: With Dan talking about: Talking Directional Butterflies

- Seventh Class: With Dan talking about: Portfolio of Butterflies, Mixed Expiration Butterflies, Double Broken Wing Butterflies, and Double Time Bomb Butterflies

- Eighth and final Class with Dan: Insurance for Butterflies and Butterfly Adjustments

What will you learn?

The Dan Sheridan Butterfly Course 2012 will allow you to reach these significant values:

- A full walk-through of the many styles of butterfly choices.

- Butterfly tactics include the Split Strike Butterfly, the Weekly Unbalanced Butterfly, and the Broken Wing Butterfly, among others.

- The key aspects of each plan and the optimal time to implement them.

- The greatest strategies for selecting successful stocks for Butterfly.

- Ability to decide whether to Call or Put for the best risk/reward ratios.

Who is this course for?

The Dan Sheridan Butterfly Course 2012 is tailored for:

- Those who need to learn and quickly apply different types of Butterfly strategies.

- Those who need to improve their skills to determine the best risk/reward ratio for Calls or Puts.

Those who want to focus on Butterfly strategies and skills.

Dan Sheridan

Please Login/Register if you want to leave us some feedback to help us improve our services and products.

RELATED COURSES

VIEW ALL-

How to Retire with Considerable Wealth – Trading EducatorsDOWNLOADHow to Retire with Considerable Wealth – Trading EducatorsUpdate 07 Dec 2022AdvancedDOWNLOAD

How to Retire with Considerable Wealth – Trading EducatorsDOWNLOADHow to Retire with Considerable Wealth – Trading EducatorsUpdate 07 Dec 2022AdvancedDOWNLOADEach learner who completes this course gains confidence in the stock market’s basic yet effective trading. Discover how to day trade, develop a trading plan, and read short-term charts.

Add to wishlist -

Trading Money Tides Chaos in the Stock Market – Hans HannulaDOWNLOADTrading Money Tides Chaos in the Stock Market – Hans HannulaUpdate 08 Dec 2022All LevelsDOWNLOAD

Trading Money Tides Chaos in the Stock Market – Hans HannulaDOWNLOADTrading Money Tides Chaos in the Stock Market – Hans HannulaUpdate 08 Dec 2022All LevelsDOWNLOADHow to use technical analysis to select and trade profitable stocks with Hans Hannula via the Trading Money Tides Chaos in the Stock Market course.

Add to wishlist -

Course 3: Volatility Strategies – Elliott Wave InternationalDOWNLOADCourse 3: Volatility Strategies – Elliott Wave InternationalUpdate 06 Dec 2022All LevelsDOWNLOAD

Course 3: Volatility Strategies – Elliott Wave InternationalDOWNLOADCourse 3: Volatility Strategies – Elliott Wave InternationalUpdate 06 Dec 2022All LevelsDOWNLOADCourse 3: Volatility Strategies by Elliott Wave International instructs you on effective techniques and powerful strategies to earn consistent profits amid volatile markets. There are many aspects covered in the course with detailed guides and illustrated case studies for practical understanding.

Add to wishlist -

Power Momentum Formula – Jack BernsteinDOWNLOADPower Momentum Formula – Jack BernsteinUpdate 07 Dec 2022All LevelsDOWNLOAD

Power Momentum Formula – Jack BernsteinDOWNLOADPower Momentum Formula – Jack BernsteinUpdate 07 Dec 2022All LevelsDOWNLOADThe trainer will show you how to trade using RSI, Stoch, William%R, True strength Index (TSI), and Money Flow (MFL) with comprehensive buy and sell entry points. You may use it for day trading or for a certain time term, such as daily or weekly.

Add to wishlist -

Adx Mastery Complete Course – Ken CalhounDOWNLOADAdx Mastery Complete Course – Ken CalhounUpdate 19 Dec 2022All LevelsDOWNLOAD

Adx Mastery Complete Course – Ken CalhounDOWNLOADAdx Mastery Complete Course – Ken CalhounUpdate 19 Dec 2022All LevelsDOWNLOADHow to employ sophisticated swing and day trading tactics. Step-by-Step Video Training Reveals a Genuine Active Trader’s “ADX Mastery” Tactics. ADX Mastery is a physical, region-free DVD that you will get, with actual training from a major trading industry figure.

Add to wishlist -

JaySignal SymRenko 9 (with open code, in Jan 2015)DOWNLOADJaySignal SymRenko 9 (with open code, in Jan 2015)Update 07 Nov 2022AdvancedDOWNLOAD

JaySignal SymRenko 9 (with open code, in Jan 2015)DOWNLOADJaySignal SymRenko 9 (with open code, in Jan 2015)Update 07 Nov 2022AdvancedDOWNLOADJaySignal SymRenko 9 (with open code, in Jan 2015) shows the path to being a successful trader and you just need to follow it, one step at a time.

Add to wishlist

Reviews

There are no reviews yet.