$25.00 $199.00

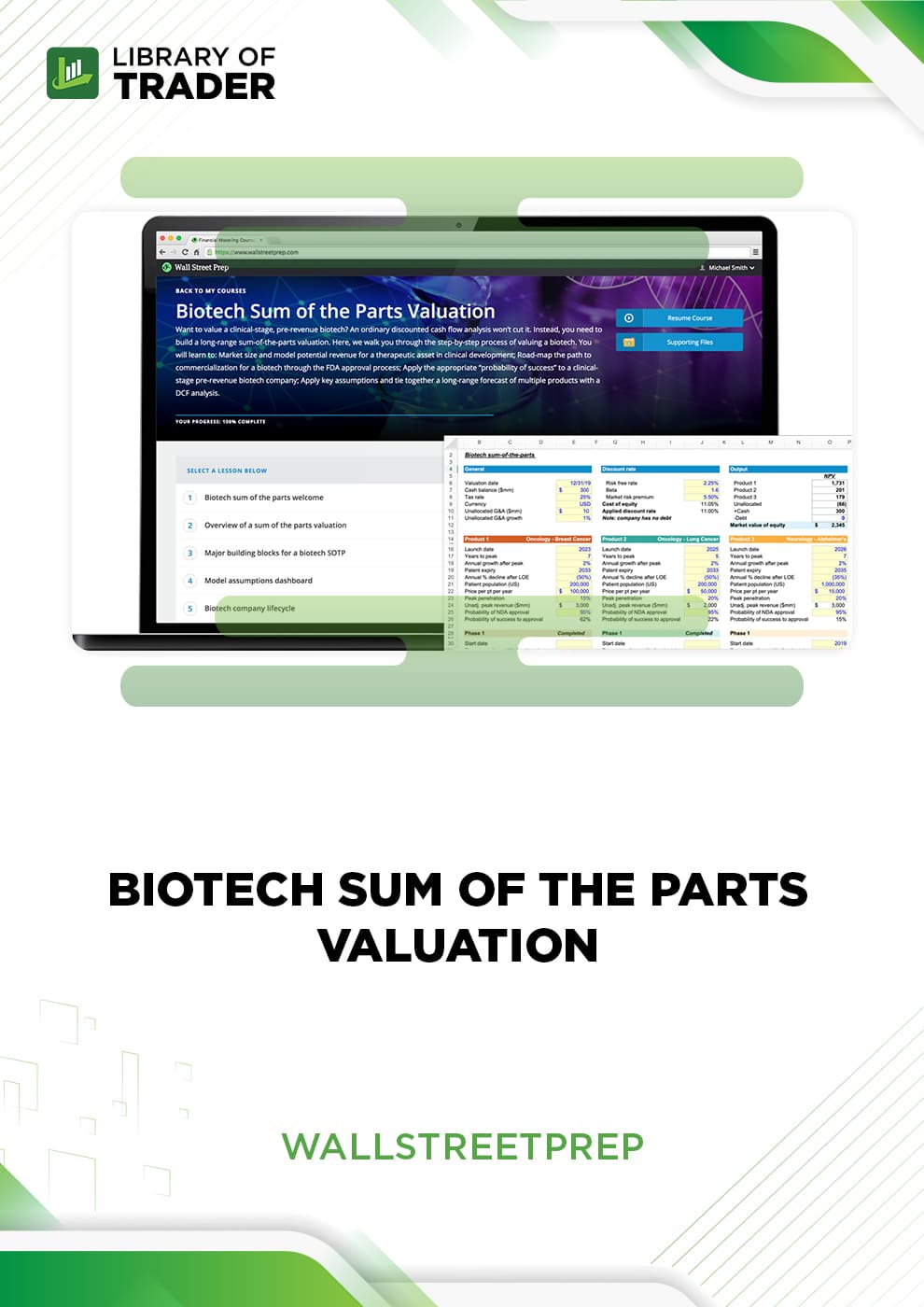

Ideal for investment professionals in biotech, this course teaches industry-standard methods for constructing biotech-sum-of-the-parts valuations.

Ideal for investment banking private equity and VC professionals focusing on the biotechnology industry, you will learn how to build a biotech-sum-of-the-parts valuation the way it’s done on the job.

Real World “On the Job” Biotech SOTP Valuation

Want to value a clinical-stage, pre-revenue biotech? An ordinary discounted cash flow analysis won’t cut it. Instead, you need to build a long-range sum-of-the-parts valuation.

This 60-minute video short course + model template bridges the gap between academics and the real world and equips trainees with the practical modeling skill set needed to build a biotech SOTP Valuation.

This course assumes no prior knowledge in biotech company valuation.

Excel Model Template Included: A biotech sum-of-the-parts (SOTP) model template is included with this course

What You Will Learn

- Market size and model potential revenue for a therapeutic asset in clinical development

- Road-map the path to commercialization for a biotech through the FDA approval process

- Apply the appropriate “probability of success”” to a clinical-stage pre-revenue biotech company

- Apply key assumptions and tie together a long-range forecast of multiple products with a DCF analysis

Who is This Program For?

This biotech sum-of-the-parts valuation course is designed for professionals and those pursuing a career in the following finance careers:

- Investment Banking

- Venture Capital

- Private Equity

- Anyone who wants to learn how professionals build a biotech-sum-of-the-parts valuation

Course Extras

Taught by Bankers

Our instructors are former investment bankers who give lessons real-world context by connecting it to their experience on the desk.

Used on the Street

This is the same comprehensive course our corporate clients use to prepare their analysts and associates.

Free Unlimited Access to the WSP Support Center

Receive answers to questions, free downloads, and more from our staff of experienced investment bankers.

Course TOC

Biotech Sum of the Parts Valuation

1. Biotech SOTP course welcome

2. Biotech SOTP introduction

3. Course Downloads

4. Overview of a sum of the parts valuation

5. Major building blocks for a biotech SOTP

6. Model assumptions dashboard

7. Biotech company lifecycle

8. Identify peak revenue opportunity

9. Therapeutic areas overview

10. Product launch timing and uptake curve

11. Patent life and loss of exclusivity

12. Road to commercialization

13. FDA clinical trials

14. Building a commercial infrastructure

15. Completing the SOTP

16. Probability of success

17. Build out one part of the SOTP (Product #1)

18. Finalizing the valuation model

19. Valuation sensitivities

20. Example: Blueprint Medicines Corp

21. Biotech SOTP Course Review

RELATED COURSES

VIEW ALL-

Market Internals Trading Course$89.97Market Internals Trading CourseUpdate 19 Aug 2022

Market Internals Trading Course$89.97Market Internals Trading CourseUpdate 19 Aug 2022Market Internals Trading Course shines light on trading knowledge and abilities to help construct trading strategies with less worry and more profit. The course is considered as a pain reliever and mood enhancer, and it gives you a road map to effective trading.

Add to wishlist -

Raghee Horner’s Workspace Bundle + Live Trading – Simpler Trading$59.00

Raghee Horner’s Workspace Bundle + Live Trading – Simpler Trading$59.00$597.00Raghee Horner’s Workspace Bundle + Live Trading – Simpler TradingUpdate 18 Jul 2022Raghee Horner’s Workspace Bundle + Live Trading by Simpler Trading instructs you on many powerful trading tools for various instruments and time frames.

Add to wishlist -

Make 1K To 1.5K A Week With The Most Profitable Skill Ever – Swingtradinglab$170.00

Make 1K To 1.5K A Week With The Most Profitable Skill Ever – Swingtradinglab$170.00$1,498.00Make 1K To 1.5K A Week With The Most Profitable Skill Ever – SwingtradinglabUpdate 08 Feb 2024Discover the strategies and mindset shifts that transformed my consistent losses into annual trading profits in the millions.

Add to wishlist -

Little Package of Valuation – Einvesting For Beginners$30.00

Little Package of Valuation – Einvesting For Beginners$30.00$197.00Little Package of Valuation – Einvesting For BeginnersUpdate 02 Jun 2025Learn to value companies like Google & Microsoft with practical models, real examples, and expert guidance from creator-focused entrepreneur Nathan.

Add to wishlist -

Vipars – Stratagem Trade$110.00

Vipars – Stratagem Trade$110.00$999.00Vipars – Stratagem TradeUpdate 02 Jun 2025The ViPars™ mini-class gives you a complete, pro-level tactic to trade volatility with confidence.

Add to wishlist -

Guide Bundle – Fit-Trading$130.00

Guide Bundle – Fit-Trading$130.00$1,350.00Guide Bundle – Fit-TradingUpdate 27 Jan 2025Fit-Trading Guides provide essential trading strategies, covering rules, filings, patterns, compliance cycles, and key topics like IPOs, uplists, reverse splits, offerings, and risk management.

Add to wishlist