Introduction

Interested in becoming a financial market trader? Then you should be aware that day trading is one of the most common forms of financial market trading method. Although day trading methods are used by many skilled traders, most novices may quickly grasp a variety of day trading tactics.

Day trading requires competence if you want to make money rather than lose it. When you’re new to day trading, there’s a lot to learn. You’ll need to select not just what to trade and how much cash you’ll need, but also where to buy the necessary equipment and software, when to trade, and, of course, how to manage your risk. All you need to know to become a successful day trader will be included in this blog.

What is Day Trading?

Day trading is a speculative trading strategy in which financial items such as stocks, options, cryptocurrency, and futures are bought and sold in a single trading day. The phrase intraday trading is often used to describe the day trading procedure.

While long-term investors typically seek returns of 7-8% per year on average, day traders seek bigger profits by exploiting an underlying asset’s pricing trend. As a result, an increased number of shares are often traded, with a profit per share of a few cents.

How Does Day Trading Differ From Others?

Learn about each method and what you should think about if you’re considering attempting one.

| Day Trading | Swing Trading | Investing | |

| The core goal | Increase your profits quickly by trading high-risk assets. | Concentrate on pricing fluctuations regardless of a company’s profitability. | Long-term growth via investments in lucrative enterprises |

| Frequency | Multiple trades per day | Multiple trades per week | Low trade frequency |

| Holding time | Intraday only | Overnight to several weeks | Several months or years |

| Analysis method | Technical Analysis | Technical and fundamental analysis | Fundamental analysis |

| Time commitment | 10-40 hours per week | 2-10 hours per week | 1-2 hours per week |

| Potential risk | Overtrading, emotional stress, slippage | Overnight price gaps | Stock market crash |

What Is the Process of Day Trading for Beginners?

A day trade is always made up of two transactions, one opening and one closing. When a trader goes long, he first buys and then sells. A trader who goes short as a short seller sells first and then buys back later.

Day traders must be quick to capitalize on market instability and price increases. A day trader usually understands where to exit a transaction before entering it.

How Risky Is Day Trading for Beginners?

Day trading may be intimidating for the typical investor due to the quantity of risks involved. The Securities and Exchange Commission (SEC) of the United States emphasizes some of the dangers associated with day trading, which are outlined below:

- Prepare to incur significant financial losses: Day traders generally incur significant financial losses in their first months of trading, and many never earn a profit.

- Day trading is a highly demanding full-time career that requires intense attention to recognize transitory market trends by monitoring hundreds of ticker quotes and price swings.

- Day traders rely significantly on borrowed funds: Day-trading tactics earn by leveraging borrowed funds. Many day traders not only lose all of their money, but they also get into debt.

- Don’t trust boasts of fast profits: Be wary of hot tips and expert advice from day trading newsletters and websites, and keep in mind that educational seminars and lectures regarding day trading may not be objective.

What Are the Advantages and Disadvantages of Day Trading?

About the Advantages of Day Trading

- The first advantage is that there are no dangers connected with holding a position overnight. Because day traders close out their trading positions before the end of each trading day, they don’t have to worry about an overnight news event causing the market to open much lower or higher the next trading day – something that might cost them money in an overnight position.

- Returns on investment compound faster (assuming your day trading is profitable). You might be able to use the earnings from the previous trading day to trade a larger position the next day and make even more money.

- It may take less time in total to earn significant income. Some day traders only make one or two deals every day, and they are usually made early in the day. By 10:00 a.m., they are completed with their trading task.

About the Disadvantages of Day Trading

- Overnight occurrences that produce gaps up or down the next trading day can be extremely rewarding for traders who maintain positions overnight. Day traders, on the other hand, would never realize such rewards.

- Increased trading frequency results in greater trading costs in the form of commissions and fees. Paying all of those extra expenses may considerably reduce your profitability.

- It is possible that it will take more time than you have available for trade. Day traders must obviously be able to pay attention to market movements for at least part of the day. It may be difficult, if not impossible, for someone working a full-time job from 8:00 a.m. to 5:00 p.m.

Is Day Trading Good for Beginners?

Professional day traders are classified into two types: those who work alone and/or those who work for a larger institution.

The majority of day traders who trade for a living work for large players such as hedge funds and bank and financial institution proprietary trading desks. These traders benefit from advantages like direct links to counterparties, a trading desk, substantial quantities of cash and leverage, and sophisticated analytical software.

Typically, these traders are searching for quick returns on arbitrage chances and news events. Their resources enable them to profit from these less hazardous day transactions before individual traders can.

How to Succeed as a Day Trader?

Day traders must be informed about the assets they trade and have a variety of trading expertise in order to be effective and lucrative. To guarantee that their market research is based on the most recent accurate information, they must include up-to-date analytics and news feeds from a range of sources.

Many day traders use technical analysis to produce alerts of good trading opportunities. Others depend on fundamental research and attempt to “trade the news” (open and close market positions based on relevant news releases). Some traders, usually those with a lot of trading expertise, just depend on instinct to decide which trades to make.

What Do I Need to Do to Start Day Trading for beginners?

Once you’ve decided what you’re going to trade, you’ll need a few basic tools to get started.

Laptop or computer

It is ideal to have two monitors, although it is not needed. When you start your trading application, the computer should have adequate memory and a fast enough CPU that there is no lagging or crashes.

You don’t need a high-end computer, but you also don’t want to skimp on quality. Software and computers are continuously evolving, so make sure your PC is up to date. When day trading for beginners, a sluggish computer may be expensive, especially if it crashes while you are entering transactions or leads you to become caught in deals.

Reliable and Fast Internet Connection

With an intermittent internet connection, day trading is not suggested. You should have a cable or ADSL internet connection at the very least. Because speeds vary between different services, aim for a mid-range internet plan.

Your internet provider’s poorest connection speed may suffice. However, if you are running many web pages and applications, you may discover that your trading platform isn’t updating as rapidly as it could. If your internet goes down frequently, it could be worth paying a little extra for a more dependable service or a quicker connection.

A Trading Platform

Download and test out numerous trading platforms. Because you are a newbie, you will not yet have a well-developed trading style. Choose a few alternatives from the ones your broker provides and see which one you like.

Keep in mind that you may change your trading platform several times over your career, or you may change how it is configured to accommodate your trading growth. NinjaTrader is a popular day trading platform for traders in futures and FX. There are several stock trading systems available.

Economic Calendar

Day traders frequently schedule their trading weeks around an economic news calendar, which includes all important economic data releases, central bank policy pronouncements and benchmark interest rate announcements, national elections, and central bank official speeches.

Economic calendars often include the expected and historical results for significant data releases, as well as the potential impact of an event. Significant departures from market consensus might result in significant volatility as the market hurries to disregard the new information.

Trade Journal

Keeping an accurate log of your transactions throughout the day will provide you useful insight into how your trading is going and where you can improve. When journaling your transactions, describe why, where, and in what magnitude you started the deal. You can also include the indications you employed and the outcomes you noticed, such as whether or not the trade was profitable and to what amount.

A trade log allows you to reflect on your day’s trading blunders and perhaps prevent repeating them. Some day traders keep a paper or spreadsheet log, while others utilize trading journal software such as Edgewonk’s.

Which Strategies Are Best and Simple for Day Trading Beginners?

In general, day traders strive to profit from tiny and frequent market movements. They often seek to constantly follow an efficient and profitable day trading strategy that can foresee short-term market moves as precisely as possible using resources like price charts and technical indicators.

Scalping Trading Strategy

Scalping is a popular day trading method that tries to make a lot of modest profits on trades that last only a few minutes. Scalpers must have lightning-fast response speeds since they frequently join and leave transactions in seconds or minutes. They must also carefully schedule their entry points, select high-probability trades in highly liquid and volatile assets, and promptly reduce losses.

Scalpers also benefit from narrow trading spreads, swift order executions, and less order slippage. They frequently keep a careful eye on extremely short-term tick charts for anticipated price patterns like the ones displayed below.

News Trading Strategy

Some day traders with huge resources and a high risk tolerance may employ news trading tactics to profit from the very turbulent markets that frequently occur quickly after major news releases. Economic calendars and news streams are typically monitored by news traders for major data releases or news events.

Fundamental or technical analysis might be used to develop news trading strategies. They also usually need a trader watching the market right before a risk event to identify critical support and resistance levels that will allow the trader to move fast once the news is out.

Momentum Trading Strategy

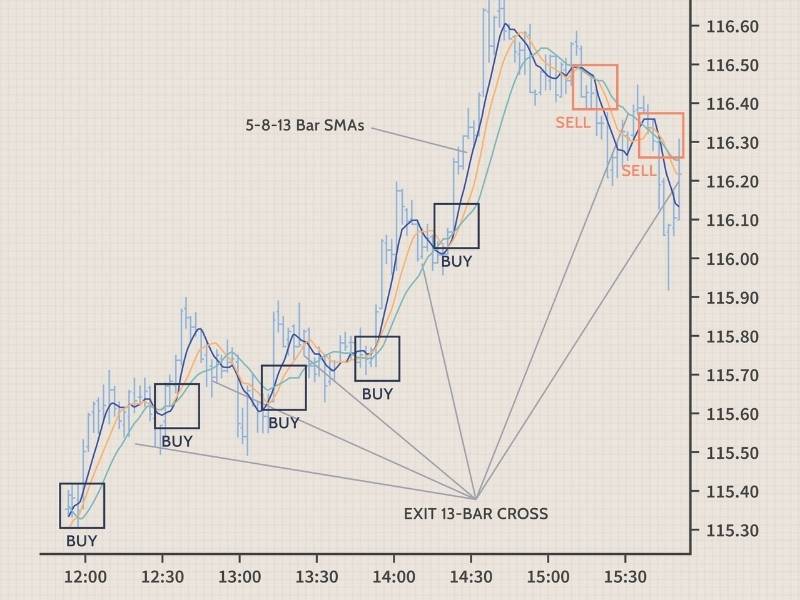

Momentum trading is a method that opens positions based on the strength of market moves. Momentum trading is the activity of purchasing and selling assets based on the strength of recent market patterns. It is predicated on the assumption that if a price change has enough momentum behind it, it will continue in the same direction.

Momentum traders will attempt to determine how strong the trend is in a certain direction, then initiate a position to capitalize on the predicted price shift and close the position when the trend begins to weaken. A momentum trader does not always seek the peak and bottom of a trend, but rather concentrates on the major body of the price move. They want to take advantage of market emotion and herding, or the tendency of traders to follow the majority.

Day Trading for Beginners: Frequently Asked Questions

- Can I trade bitcoins throughout the day?

The cryptocurrency (crypto) market is very volatile, which may make day trading profitable. Just like you would with any other sort of day trading, you should spend time learning, practicing, and building a strategy before day trading crypto. Currently, cryptocurrencies are not regulated in the same way that options and stocks are. This implies they have no day trading restrictions.

- How should beginners practice day trading?

There are several free day trading manuals, day trading ideas, and day trading methods available online. My favorites are the gap and go approach and the opening range breakout. And, to be honest, you’ll need a combination of everything to practice it. If you are new to day trading, you need to first learn the fundamentals.

Trading courses, as previously said, are an excellent beginning place for day traders.

- How successful are day trading for beginners?

The success rate of day trading is considered to be approximately 30% or less. Unfortunately, no credible day trader success rate data are published by US brokers, although several European brokerages are required by law to post the probability of success rates.

The reality may be alarming at first, but statistics show that at least 67% of speculative investors fail. A Forbes article went so far as to estimate the success rate at roughly 10%. As a result, the reality is most likely somewhere in the middle.

- Why do day trading for beginners fail?

There’s an iconic statement in the trading industry that you’ve probably heard: “90% of traders lose 90% of their trading capital in the first 90 days.”

There are a lot of day traders who fail in this game. But, what are the causes behind day traders’ bad performance? They can include:

- Insufficient education

- Failure to implement or discard a strong strategy and plan

- Undercapitalization

- Overconfidence

- Expectations that are unrealistic

- Risk management flaws

Conclusion

Day trading is a career as well as a vocation. The good news is that learning takes time but not money. At least for those who have the fortitude to wait. Patience is a virtue that is rewarded in a variety of ways. The most significant benefit is that you keep your money dry until you’ve mastered the necessary abilities and do not gamble away all of your money before you begin.

Day trading for beginners should start with market research, assess their prior performance, determine how much cash they have accessible, and begin with paper stock trades. If you are successful in your paper trading account or trading simulator, you should open a real brokerage account to implement your trades and techniques.