What is a Currency Strength Indicator MT4?

A technical indicator that assesses the relative strength of currencies is the currency strength indicator for MT4, MT5, and other trading platforms. It is available and can be discovered online at websites similar to this one.

The overall, comparable strength is measured using real-time exchange rates. Simple meters might not use weighted calculations, whereas more sophisticated meters, like this one, do. Additionally, our computation approach displays the change’s direction.

To determine overall strength, the algorithm considers the previous 24 hours and combines all currency pairs related to a currency. Typically, a chart is used to present the data that was calculated.

The currency strength indicator MT4 aims to display the absolute strength of major currencies to find sudden price movements.

- EUR/USD (Euro Dollar)

- GBP/USD (Pound Dollar)

- USD/CHF (Dollar Swissy)

- USD/JPY (Dollar Yen)

- AUD/USD (Aussie Dollar)

- NZD/USD (Kiwi Dollar)

- USD/CAD (Dollar Loonie)

>> Related article: How to Create MT4 Expert Advisor: MT4 Basic and How to Use EA

What Is the Function of the Currency Strength Indicator MT4?

The meter takes readings from every forex pair in the last 24 hours and applies the calculations to each pair. It then combines each linked pair into an individual currency. This helps traders to guess whether their position is in a potential or risky phase.

The currency strength indicator MT4 works in the following 5 steps:

- Identify the base currency

- Match the base currency with all available Forex pairs

- Calculate the relative strength of each paired currency.

- Calculate the average score.

- Use the result

The strength meter’s fundamental concept is to be used as a decision-making “filter.” It enables us to ascertain crucial information, such as whether the US currency is strengthening or declining.

Another thing to keep in mind is that the strength of a given currency is always based on the periods you establish for it. For instance, EUR is one of the weakest on the list in monthly analysis, despite being strong for the current term.

Pairings with positive correlations (EUR/USD, GBP/USD, USD/JPY, EUR/GBP, AUD/USD) tend to move in the same direction, whereas pairs with negative or inverse correlations move in the other way. Correlations are also classified into four groups in the matrix above based on their strength:

- Green: Little or no correlation

- Blue: Weak correlation

- Orange: Medium correlation

- Red: Strong correlation

>> Explore the Forex Course about CAD, AUD, NZD TRADING COURSE – BK FOREX

The CAD is the strongest currency, as evidenced by the +91 connection between the USDCAD and the EURCAD in the graphic above. The EURGBP and GBPCHF pair has the smallest correlation, at -96, which indicates that simultaneous positions in this pair within the same direction are likely to cancel one another out. This shows that the GBP is the strongest currency and that the Swiss Franc is the weakest.

How to Use the Currency Strength Meter in Forex Trading

You can use the currency strength indicator MT4 in a variety of ways to suit your trading style. Get the strongest trend based on the pair with the strongest and weakest currencies if you are trading in the direction of the trend. Choose currencies with a minor difference in strength if you want to trade in a range.

Although the actual forex currency strength uses complex algorithms when employing the correlation matrix, it is quite simple to use. You can even select a strength for a specific amount of time. In general, it is advised to utilize up to 200 bars for intraday trading and up to 50 bars for scalping.3

You can start trading with the following timeframes:

- Scalping: 50 bars at M5

- Trading within one day: H1 – 200 bars

- Swing trading during the week: H1 with 500 bars or H4 with 200 bars

Currency Strength Indicator For MT4 Trading Setup

Strength Meter Indicator MT4 can be used by forex traders to determine the strength of one currency relative to another and the strength of a specific currency. Therefore, forex traders can pair the strongest currency against the weakest currency and buy or sell in line with that pairing. The lower value of a currency reveals the underlying bearish pricing movement, whilst the higher value shows the underlying bullish market trend.

A decreasing strength value, on the other hand, shows that the currency is weakening. Forex traders might close the position or partially book profits. However, if the strength of the currency holds, traders can keep their positions and ride the trend until the currency begins to weaken.

The indicator operates under the premise that if one currency is experiencing bullish momentum, another currency will experience bearish momentum. Therefore, after strong and weak currency is recognized and pitted against one another, forex traders can buy or sell a currency pair.

The indicator performs well on daily, weekly, and monthly charts as well as all intraday time frames. In order to select the optimal entry and exit points in a smaller time frame, forex traders can utilize this indicator to determine the trend in a higher time frame.

Explanation of Currency Strength Meters with Examples

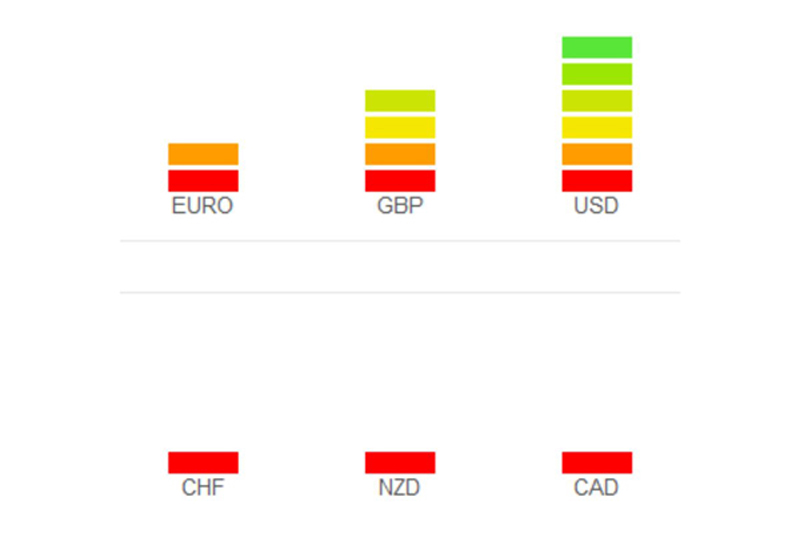

In the image below you can see that the USD is very strong. The Euro is the weakest of the three, while GBP is comparatively strong. The CHF, NZD, and CAD are all extremely weak.

View the USD/CHF pair’s most recent chart. You can see the USD’s significant rising trend (strong meter reading) vs CHF over the past five hours (weak meter reading). Trading in the direction of the USD would have been wise.

Look at EUR/USD, once more, we observe a similar decline in the EUR (weak meter reading) relative to the USD (strong meter reading). The movement was not as violent, and unlike the other example (CHF) above, EUR did not completely turn red with one bar.

>> Maybe you want to know: Which is the best Indicator for Swing Trading?

Best Currency Strength Indicator

The best currency strength indicator is Advanced Divergence Currency Strength. This indicator is particularly potent because it shows the market’s actual fluctuations. Analyzing charts to learn how particular currencies or nations’ economies are doing is highly advised.

All 28 forex currency pairs can be broken down, and the Advanced Divergence Currency Strength Indicator can determine the strength of each currency over all timeframes. You also spend just one minute analyzing the entire forex market.

Unique Special Features

- You won’t need to spend hours scrutinizing every chart. One window forex market analysis (1 minute).

- Select the moment when you want the currency strength calculation to begin.

- Anywhere you go, receive signals immediately to your phone.

- Enable Alerts to receive a notification whenever a new signal is received.

Dashboard for the Currency Strength Meter

- (showing all the values, dates, time, and connection speed in milliseconds).

- Currency Strength Dashboard for Multiple Timeframes (Calculated across all timeframes).

- 28 FOREX pairs plus 5 more pairs of your choice and gold and silver (Stocks, CFDs, Crypto Currencies, Indexes, or any chart).

Eight. Unique period separators (showing months, days, and times)

- Indicators on a chart (Arrows showing all signal entry points in a chart).

- Numerous options for calculating currency strength (Anytime, date, or a number of candlesticks).

- Support for all symbol names used by brokers (Prefix and Suffix).

- Divergence arrows show currencies that are diverging.

- The capacity to concentrate on just one chart (e.g. showing only 2 lines, excludes all other currencies).

- The Indicator Parameters and the film will explain further functions

The Bottom Line

Using the colors, Currency Strength Indicator MT4 generates trading signals. However, the trading signals produce the best results when the price rebounds from a support or resistance level or channel. Additionally, forex technical traders have the option of using other trend indicators in conjunction with the trading signals. Additionally, forex traders may easily install the indicator after downloading it for free.