This course trains you how to use unusual options activity to trade like top hedge fund managers and other institutional traders.

Course overview

Overall of Unusual Options Activity Master Course is designed to train anyone interested in becoming faster, more consistent, and more profitable in options trading.

Course outline

- Unusual Options Activity Master Course

- Risk Disclaimer

- The Master Course

- Why Trade Unusual Options Activity?

- Four Types of Option Orders

- Is that Trade Bullish or Bearish?

- Understanding Terminology

- Different Term

- Ex-Div Traders are not UOA

- What is a Buy-Write?

- I LOVE the Word: “Sweep

- Opening Positions are Great Trades

- Cancelled Trades can be Tricky

- Past performance is not indicative of future results

- What makes a Spread a Spread?

- Deep ITM Calls or Pust is not UOA

- I want BIG Speculative Bets

- Using Past Experiences

- Some Things to Think About

- How to Read Unusual Options Activity Example

- That same night a higher bid came in for the company

- Recent Examples Of UOA Here are the exits I was able to take

- The Unusual Options Activity Trading Plan

- O: Options Volume Vs. Open Interest

- O: Options Volume Vs. Open Interest

- A New Part of the Trading Plan

- O: Open Interest Across All Expirations

- V: Average Stock Volume

- The Quantity of the Trade isn’t Always Important

- When Should a Trader Day/Swing Trade?

- When to Day Trade Equity Options

- Rule #1 Day Trading Options

- Rule #2 Day Trading Options

- When to Swing Trade vs. Day Trade

- Swing Trading Options Rules

- Many Options with Options

- When Use this Plan? When Does a Trader Use This Plan?

- Our Live Trading Room and Platinum Package

What will you learn?

- Why call buying is not always bullish and put buying not always bearish

- How to read options volume versus open interest, and why average stock volume is important

- What to look for to differentiate between speculative option orders and those placed to hedge against a stock position (these options expire on Friday, listed the Thursday before)

- When a position is ‘opening’ or ‘closing’

- Keene’s OCRRBTT trading plan for looking at open interest, chart, risk, reward, break-even, time, and target for potential trade setups

Who is this course for?

Anyone can join the Unusual Options Activity Master Course, from those who have no background or experience in options trading, swing trading, and day trading.

Andrew Keene

Please Login/Register if you want to leave us some feedback to help us improve our services and products.

RELATED COURSES

VIEW ALL-

Active Trader Program – David BowdenDOWNLOADActive Trader Program – David BowdenUpdate 15 Nov 2022IntermediateDOWNLOAD

Active Trader Program – David BowdenDOWNLOADActive Trader Program – David BowdenUpdate 15 Nov 2022IntermediateDOWNLOADThe Active Trader Program was created to provide you with the skills you need to begin your journey to trading success by following a structured strategy with clearly defined boundaries.

Add to wishlist -

Stock Market Swing Trading Video Course – Vantage Point TradingDOWNLOADStock Market Swing Trading Video Course – Vantage Point TradingUpdate 14 Nov 2022All LevelsDOWNLOAD

Stock Market Swing Trading Video Course – Vantage Point TradingDOWNLOADStock Market Swing Trading Video Course – Vantage Point TradingUpdate 14 Nov 2022All LevelsDOWNLOADStock Market Swing Trading Video Course by Vantage Point Trading teaches practical frameworks through real case studies and examples for better understanding.

Add to wishlist -

Peak Trading Performance – The Trading FrameworkDOWNLOADPeak Trading Performance – The Trading FrameworkUpdate 06 Nov 2022AdvancedDOWNLOAD

Peak Trading Performance – The Trading FrameworkDOWNLOADPeak Trading Performance – The Trading FrameworkUpdate 06 Nov 2022AdvancedDOWNLOADPeak Trading Performance by The Trading Framework promises the ability to turn you into one that can read the market movements and profit from them.

Add to wishlist -

Elephant Swing Trading – Simpler OptionsDOWNLOADElephant Swing Trading – Simpler OptionsUpdate 14 Nov 2022All LevelsDOWNLOAD

Elephant Swing Trading – Simpler OptionsDOWNLOADElephant Swing Trading – Simpler OptionsUpdate 14 Nov 2022All LevelsDOWNLOADElephant Swing Trading by Simpler Options walks you through techniques and strategies for profitable swing trading with minimal risks through real-world case studies and examples.

Add to wishlist -

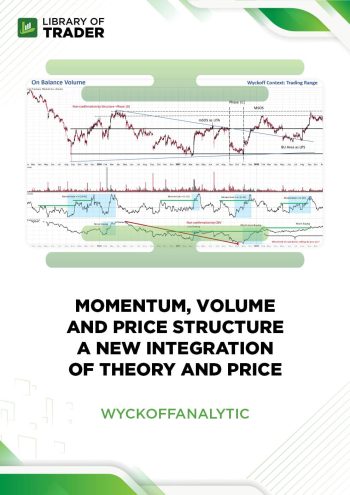

Momentum, Volume And Price Structure A New Integration Of Theory And Price – WyckoffanalyticDOWNLOADMomentum, Volume And Price Structure A New Integration Of Theory And Price – WyckoffanalyticUpdate 06 Nov 2022AdvancedDOWNLOAD

Momentum, Volume And Price Structure A New Integration Of Theory And Price – WyckoffanalyticDOWNLOADMomentum, Volume And Price Structure A New Integration Of Theory And Price – WyckoffanalyticUpdate 06 Nov 2022AdvancedDOWNLOADThe course Momentum, Volume And Price Structure: A New Integration of Theory And Price lets traders harvest a fixed flow of return on income.

Add to wishlist -

Swing Trading With Confidence – Top Dog TradingDOWNLOADSwing Trading With Confidence – Top Dog TradingUpdate 17 Nov 2022IntermediateDOWNLOAD

Swing Trading With Confidence – Top Dog TradingDOWNLOADSwing Trading With Confidence – Top Dog TradingUpdate 17 Nov 2022IntermediateDOWNLOADSwing Trading With Confidence – Top Dog Trading provides you with more high-level professional trading approaches so you can find unique opportunities that are outperforming the market averages.

Add to wishlist

Reviews

There are no reviews yet.