The concept FIRE (financial independence retiring early) has been viral on the Internet for a while. It teaches us how to invest our money smartly and profitably. You can find an easy-to-understand explanation and description of this concept through the best-selling book Your Money or Your Life by Vicki Robin and Joe Dominguez. Afterward, a Reddit user named Happy Asian Panda created a fire flowchart to help people well prepare for their early retirement. His photo of this flowchart has become trending and widely discussed on Reddit. This article will go detailed about the definition of the Happy Asian Panda Fire Flowchart Reddit and how to Prepare for Early Retirement ?

1. What is Happy Asian Panda Fire Flowchart?

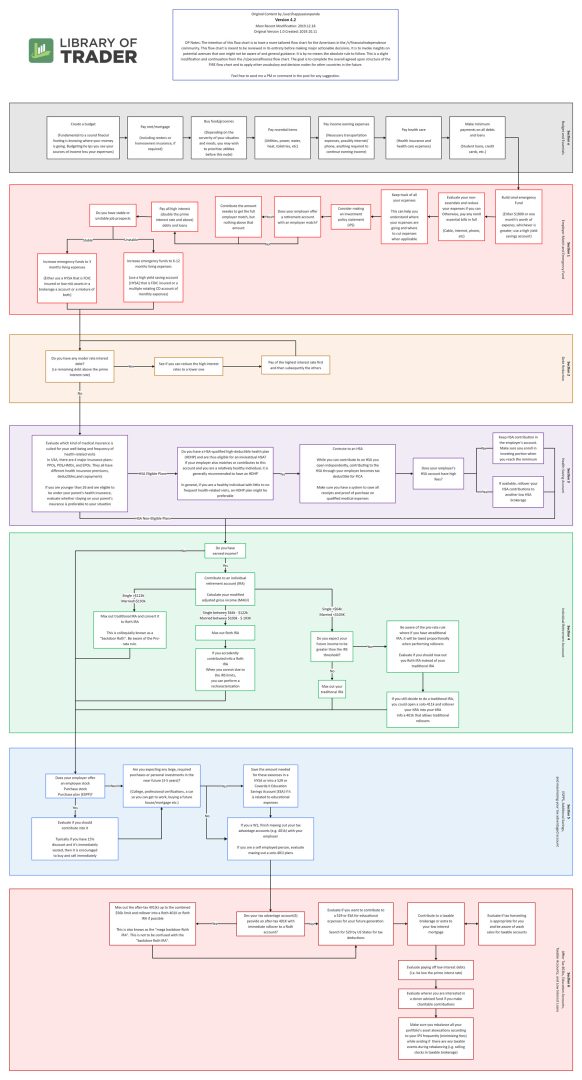

Happy Asian Panda Fire Flowchart is a flowchart of the concept FIRE created by a Reddit user named Happy Asian Panda, whose work has been published on Forbes.

This flowchart shows you how to create a budget and increase the complication of the strategies for portfolio building in a very simple and easy language. It also shows you how to include a health savings account (HSA), Roth IRAs , and other types of investment plans to scale your revenue.

With the Happy Asian Panda Fire Flowchart, users can see at what point in their trip to pay off particular types of debt, which may be a huge roadblock for those trying to decide whether or not to increase their investment or pay off debt.

By including a graph, the author not only shares his own personal experience but also gives advice to others considering early retirement. As a consequence, it is a product of the author’s research, his experience with FIRE, Reddit user feedback.

Key takeaways :

- A flowchart of the concept FIRE

- Created by a Reddit user named Happy Asian Panda

- A complete and basic plan to achieve personal financial objectives

- A well-prepared plan for early retirement

2. Why did the Happy Asian Panda Fire Flowchart photo become viral on Reddit ?

After Happy Asian Panda published his FIRE flowchart photo on Reddit, it became trending and caught the attention of many Internet users at that time. A number of people across social media platforms join and express their curiosity about this topic. The Happy Asian Panda Fire Flowchart Reddit now has various versions and is still the looking forward of those who are interested in making steady profits and expanding their finance funds.

Fire Flow Chart Version 4.2 On The Reddit

3. 7 tips to prepare for early retirement

Have a clear vision for early retirement

One of the first bricks to lay in preparation for early retirement is to draw a clear picture for it. Who will you become and what will you do after you retire? What do you need to prepare to achieve that plan? Make a list of it all on paper and start building a well-thought-out plan right after.

Prepare an accommodation after you retiring

Although a financial plan is essential before retirement, it is impossible to ignore another equally important factor, which is where to live. After retirement, you will need comfortable accommodation with full facilities. You can prioritize the following to optimize your whereabouts:

- Downsize your living space

- Pay down your mortgage as soon as feasible

- Prioritize any major improvements or repairs

- Pay off any HELOCs to protect your home equity

Consider a Health Savings Account (HSA) or a health insurance plan

Health care expenses are a major issue for many who want to retire early, and HSAs are an often-overlooked savings strategy. An HSA account, which is available with some high-deductible health plans, allows you to make tax-free contributions, invest in tax-deferred assets, and withdraw cash for tax-free spending.

Contributions to the account are carried over from year to year and will even follow you if you move jobs. If you can avoid taking funds from a health savings account during your working years, any remaining funds can be utilized for eligible health requirements after retirement. It’s not for everyone, but it’s worth thinking about and discussing with your adviser whether it makes sense for you.

Assure to keep multiple sources of income

This might involve investing in income-generating assets like rental properties or small enterprises, as well as taking up a part-time or side job. Alternative sources of income assist in covering your living expenditures, allowing you to save more for your long-term objective.

People are living longer lives, which means they have more years to cover in retirement. Many individuals associate retirement with relocating to paradise, spending more time with family, or being able to do something they truly like, such as volunteering or traveling. Whatever it is, the better you plan your future position to prepare for retirement and, if you’re lucky, to accomplish your goals of early retirement.

Avoid withdrawing money from your retirement accounts too early

It may be tempting to see a huge balance to spend everything at once on a significant purchase, but the longer your funds stay invested, the greater the potential for growth. Another reason not to take from your retirement: the IRS charges a 10% penalty on withdrawals made before the age of 59.5, in addition to paying regular income tax on the amount removed. So, never forget to keep your eyes on the prize!

Prioritize paying off and avoid debts

This may be apparent, but it is crucial. Every long-term loan you accept puts assets that may be utilized for retirement at risk. Furthermore, you are increasing your expenditures by paying interest, which is absolutely unneeded and preventable. higher expenditures as a result of interest payments

Building at least 10-year-from-retirement plan

According to a 2019 GOBankingRates.com study, 64% of employees questioned have less than $10,000 in retirement savings. Worse, over 40% of those aged 55 and up said they had no retirement savings. Some of those in that group may have a pension to fall back on, but the majority are not financially prepared to retire.

Because Social Security is only intended to replace a fraction of income in retirement, folks who are roughly ten years away from retirement, regardless of how much money they have saved, must devise a strategy to successfully cross the finish line.

Ten years is still plenty of time to build a sound financial foundation. “It’s never too late! With proper preparation, you may create a modest fortune over the following 10 years,” said Patrick Traverse, CFP, financial advisor at MoneyCoach in Mt. Pleasant, S.C.

Those who haven’t saved much need to be honest about where they stand and what they’re ready to give up. A few simple steps can now make a huge impact along the journey.

Key takeaways:

- Always have a clear picture in mind about how your life is when you retire early.

- Prepare a place to live after retirement.

- Prioritize a Health Savings Account (HSA) or a health insurance plan

- Keep earning income from different sources.

- Never withdraw money from your savings account if unneeded.

- Pay all debt and avoid debt.

- Create a 10-year plan for your early retirement.

4. It’s never too soon to prepare for your early retirement

Why are the first steps of early retirement essential?

Your retirement expenditures and the length of your retirement must be estimated when preparing for retirement at any age. It’s entirely up to you to choose how early you can retire. If you’re in good health, your life expectancy may be as high as 90 years old, therefore deduct this age from that figure.

Preparing for your early retirement does not only mean preparing for your life after you retire. It also means you are preparing for your current life, especially for fulfilling your financial objectives and achieving the status of financial freedom.

Having a plan to retire early motivates you to work harder, earn more, and save more from a very young age. You’ll have more time to see your money increase if you start saving early in your career. As a result, increasing your contributions while you’re still young minimizes the amount of money you’ll need to save in retirement.

In addition, if you build a good money management plan from an early age, you will get the option to pick whenever you want to retire. It’s possible that you’ve already decided that you’ll never retire. However, if you’ve worked for 30 or 40 years, you may be ready to take a break and recharge your batteries. You’ll be able to take early retirement if you’d prepared beforehand. If you’re content to work for as long as you wish, you may simply pass on your money to the next generation when you die.

How to create the right plan for your early retirement?

Keep up with your retirement calculators’ suggested monthly savings amount. If you can’t, consider making some budgetary changes, such as cutting down on luxuries and dining out less often. Other options include beginning a side business or seeking promotion.

Prioritize paying off your debt if it is affecting your capacity to save for retirement. Put your tax returns and any year-end bonuses into debt reduction, and set aside a certain amount of money each month for debt payback. You may put it all into your retirement fund after you’ve paid it off.

The application of Happy Asian Panda Fire Flowchart Reddit to your real-world plan

In this FIRE flowchart, Happy Asian Panda emphasized the importance of saving, investing, and paying off one’s debt. Frugal folks may not have a hard time adopting a FIRE lifestyle. To be successful, it requires the use of sound strategy, and the methods of Happy Asian Panda Fire Flowchart Reddit will assist you in achieving this goal.

Key takeaways:

- Preparing for your early retirement is not only preparing for your life after you retire, but also preparing for your current financial objectives.

- An early retirement plan motivates you to work harder.

- Prioritize paying your debts first, then save then tax returns and year-end bonus into the retirement account.

- Using the Happy Asian Panda Fire Flowchart Reddit to make your plan feasible.

5. Conclusion

In summary, the concept of FIRE is a valuable tool for those people who want to retire in their early 30s or 40s. Although we don’t have any information available regarding the actual author of the chart, Happy Asian Panda Fire Flowchart Reddit is still a phenomenon and an excellent blueprint to follow.

Even if you’re not planning to retire early, it’s a good idea to have a backup plan in case you become disabled or change your mind. If you haven’t already, create a retirement plan and begin saving immediately.