What is an iron condor option? Iron Condors appears for an options strategy that combines vertical put and calls spreads to provide flexible opportunities for investors to trade options. To appreciate why iron conductors can be so appealing to certain investors, you should understand what they are, how traders build them, the potential risks and risks involved, and the rewards they offer .

1. What is an iron condor option?

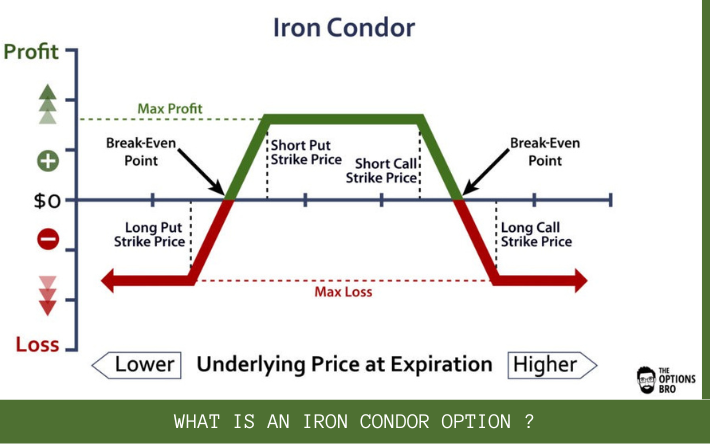

An iron condor option is a combination of vertical spreads on the same stock, allowing the trader to profit in a sideways market with low volatility.

Iron condor consists of two call and two put options (one long and one short). They all have the same expiration date but the strike price will be different. Along with strict money management, iron condor places probability, option premium sell time, and implied volatility on the trader’s side.

The iron conduit acts as a strangler, one short and one long, at attacks from the outside. Another way of looking at it is two credit spreads: the above-market arbitrage credit and the under-market arbitrage credit. It is these two “wings” that give it its name.

The credit spread is created by buying an out-of-pocket (OTM) option and selling a closer, more expensive option. This creates credit, in the hope that both options expire worthless, allowing you to keep that credit. As long as the underlying price doesn’t cross the strike price of the closer option, you can keep the full credit.

2. When would you use an iron condor?

Iron conduit is market neutral and has no orientation. An investor will initiate an ironclad condition when the expectation is that the stock price will stay range-bound before expiration and implied volatility will decrease.

3. How to trade iron condor options

An iron conduit uses four options at different attacks, making it a well-defined threat:

- Buy an Out of Money (OTM) order at an actual price lower than the current price of the underlying stock. This OTM put option will limit the downside move of the strategy

- Sell an OTM put with a strike price close to the current price of the underlying stock, or an ATM put (where strike price = current stock price)

- Sell an OTM call at an actual price higher than the current price of the underlying stock or an ATM call (where strike price = current share price)

- Buy an OTM call at an actual price higher than the current price of the underlying stock. This OTM call will protect against the upside risk of the strategy

To trade iron pipes effectively, you need to stick with index options. They offer the full range of implied volatility to help generate the best returns but no real volatility that is likely to make the account book disappear quickly.

In addition, you should also know that the possibility of your loss is much higher than the potential for profit. So don’t put your entire account in a safe. If the market does what it normally does and trades in a range, then you don’t need to do anything and you can let the entire position expire worthless, keeping your credit. Conversely, if the market moves strongly, you should exit that fee of the position.

There are many ways to get out of one side of the iron conduit. One is to simply sell that particular credit spread and keep the other. The other way is to get out of the entire iron conduit. This will depend on how much time you have left until expiration. You can also turn the losing side into an even more out-of-money attack.

4. Iron condor example

For example, if a stock is trading at $100, an upside spread can be opened by selling the deal at the $95 strike and buying the deal at the $90 strike. A bearish spread can be opened by selling a call with a $105 strike and buying a call with a $110 strike. This creates a $10 wide iron conduit with $5 wide wings. If the credit received for entering the trade is $2.00, the maximum loss will be – $300 and the maximum profit potential will be $200.

- Buy to open: put $90

- Sell to Open: $95 put

- Sell to Open: $105 Call

- Buy to open: $110 calls

Spreads can be any width and any distance from the current stock price. The closer the strike price is to the underlying price, the more credit will be collected, but the higher the probability that the options will complete out of money.

The wider the spread between the short and long options, the higher the premium, but the higher the maximum risk. The longer the expiration date from the entry of the trade, the premium will be collected upon opening the position, but the potential for profits will decrease as there is more time for the underlying security to challenge one of the strike prices. short.

5. Why is the iron condor the best strategy?

The iron condor is an advanced options strategy favored by traders who want stable profits and don’t want to spend a lot of time preparing and executing trades. Being a neutral position, it can offer a high probability of profit to those who have learned to execute it correctly.