Value investing vs growth investing has no difference in profit potential because they both have their own advantages and disadvantages. Choosing which form to invest in requires you to have the right view of them and understand which one is suitable for your tolerance.

What Are Differences Between Value Investing vs Growth Investing?

Value investing vs growth investing has distinct differences. Choosing the type of value investing or growth investing also depends on many factors. However, to know which investment model you personally fit, please refer to their concepts.

What Is Value Investing?

Value Investing is the strategy of picking value stocks that appear to be trading for less than intrinsic value or some form of fundamental analysis. Investors/traders tend to hunt for stocks with future potential but the stock market is underestimating them.

Warren Buffett is perhaps the most famous value investor today, but there are many others, including Benjamin Graham (Buffett’s professor and advisor), David Dodd, Charlie Munger, and Christopher Browne (another student of Buffett’s). Graham, and billionaire hedge fund manager, Seth Klarman.

What Is Growth Investing?

Growth investing is a strategy focused on increasing value capital. They buy growth stocks in small, young companies with an impressive capacity for profit. However, these companies also contain high risks because they have not been tested.

Growth investors typically consider key factors when evaluating stocks: past and future earnings growth, interest rate, return on equity (ROE), and the rate of old votes.

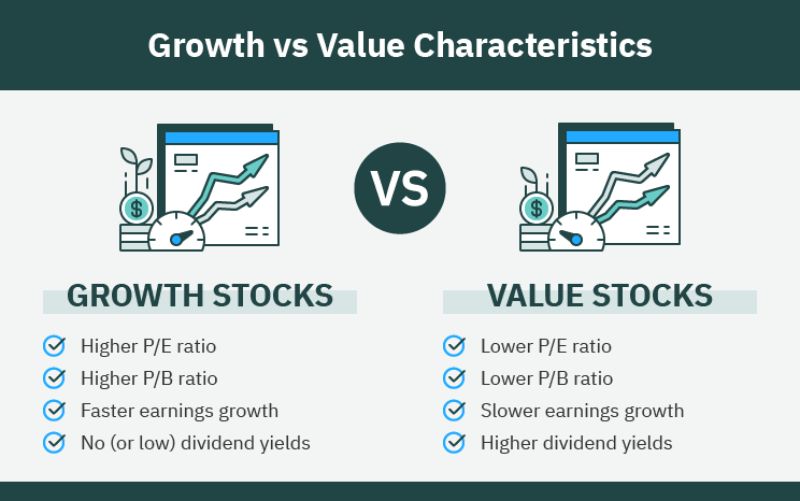

In general, growth investors have many differences with investment value. Value investing is a strategy that involves selecting stocks that appear to be trading for less than their current or book value assets.

Which Is Better: Value Investing or Growth Investing?

Growth Investing

Growth investing has great potential for returns relative to the overall market (according to analysts’ results). This type of investment is most commonly found in small and mid-cap companies.

Growth companies are considered to have a good chance of significantly expanding over the next few years, either because they have a product or product line that is expected to sell well, or because they appear to be doing much better for the market. their competitors and are therefore expected to gain an advantage over them in their market.

Growth stocks do not pay dividends. Instead, they will reinvest retained earnings into the company for expansion. The risk and volatility of growth stocks are greater in cases where growth falls short of expectations.

Value Investing

Value investing is often found in larger, older companies. Investors look for stocks with low value but the true value can be a lot higher.

Stock valuation has many factors. A trader’s perception can drive their prices down or a figure of the company’s stature has scandals or bad market conditions. However, the company’s financials are still stable and there is development, this can be an opportunity for investors to place orders.

Value investing is considered a lower risk because investors often look for stocks in large companies. Even if they don’t return to the target price that investors have set, value stocks still deliver substantial capital growth. These stocks also reward investors with dividends.

How Do Growth And Value Investing Overlap?

Depending on the criteria used for selection, you will see stocks included in both value and growth mutual funds. It’s very much about a distinction not established in stone. A stock can evolve over its lifetime from value to growth or vice versa.

Investors often talk about different methods and strategies in the value versus growth debate. However, they are having the same goal of buying low and selling high.

The purpose of value investing is to find companies that have been successful and whose stock prices are lower than they should be, and that can rebound to reflect that. Growth investors look for companies with future potential and expect stock prices to rise as companies reach or exceed that potential. Same desired destination, but there are many ways and strategies to be able to reach it.

When Will Value Outperform Growth Again?

There is no best answer to this question. However, many experts still believe that value investing will be the preferred choice in the market. Weniger asserts that inflation helps value stocks more than growth stocks.

Many investors indicate that the market eventually revalues stocks. Crill says its research shows value investing continues to be a reliable way for investors to increase expected future returns. The longer the investment, the more likely the value is to outperform.

The Bottom Line

Investors can own both growth and value stocks. Each group has its own attractive qualities. Diverse exposure to both in your portfolio can give you the best of both worlds. It is also good if you identify more investment styles than others. Once you’ve completed the goals for your investments, you’ll have a better understanding of whether you’re a growth investor, a value investor, or part of both.