Introduction

Depending on which specific criteria are met when trading, traders can make decisions by choosing the best type of trading or strategy that fits the market conditions best among all possibilities. Even if compared to others, swing trading is still widely preferred by countless numbers of experienced traders in the industry.

Swing trading receives critical acclaim for being the one taking your trading game to the next level as you are required to familiarize both fundamental analysis as well as complex technical analysis. So, do swing trading strategies live up to their popularity? How can you understand them properly and instantly utilize them in your trading plans for guaranteed returns? Let’s find out!

An Overview of Swing Trading

Swing trading is a type of fundamental trading where a position is opened and held for, commonly, several weekdays while aiming for making small short-term profits. During the process, investors usually hold longer than they do in day trading and shorter than those in long-term investments.

One striking aspect of swing trading is finding the right financial assets with preferably high volatility and liquidity. If chosen correctly, it will create a favorable environment where your setups can reach their maximum potential. Traders then utilize swing trading strategies in their trading plans alongside gathering enough data for technical analysis.

With appropriate information at your fingertips, you may start to make profits by catching the trends with determined pullbacks or rallies. However, this is also where the difficulty lies as it needs to put in a lot of effort to decide whether a certain dip is a profitable pullback or the price action will face an upcoming trend reversal. Certain market conditions such as extreme volatility (both too low and too high) can make your predictions lead to unfavorable results.

Aspects of Swing Trading Strategies

Proper swing trading strategies techniques require work on both technical analysis and fundamental analysis, often revolving around the following aspects:

Chart Analysis

A chart is, obviously, a demonstration of data where the price movements over a certain period are displayed. Traders use charts or daily charts for analyzing more specific time points and deducting insightful information to make further decisions. Some common patterns in swing trading are:

- Flag: a flag is a type of continuous pattern indicating the points where the prices pull back with multiple price fluctuations during that period before returning to the last records.

- Heads and Shoulders: an easy-to-spot pattern that signifies the point of a possible trend reversal – uptrend price action goes downwards and vice versa. The pattern is usually recognized with 3 consecutive tops with the highest one in the middle.

- Triangle Trading Patterns: this consists of a group of three continuation patterns, including the Symmetrical Triangle, Ascending Triangle, and the Descending Triangle. Like the patterns mentioned above, the three triangles are also used as signs of insightful information about the present as well as the upcoming price action of the markets, helping the traders formulate their breakout strategies.

Technical Indicators

Technical indicators, just as its name suggests, are application software or templates that indicate logical points and provide users with insights into making an investment decision. How these indicators work is mostly based on the mathematical calculations and algorithms that have been set up in advance. A large part of the indicators is plug-and-play, which means you can utilize them with your trading plans right after the installation without any modifications. Some common technical indicators include the following:

- Moving Average: indicators that are based on the moving average technique are the standard ones when it comes to swing trading. Using this technique, traders can determine the support and resistance value from the price fluctuations and calculate the average price of an asset with volatility made easy for inexperienced traders.

- Relative Strength Index (RSI): indicators using RSI help you to identify the mutual connection between the price action and the current demands, thus defining the strength of the trend and the possibility of direction changes. RSI is favorably preferred by swing traders thanks to its ability to detect critical conditions of the markets. If properly applied, the technique may create an appropriate environment where you can buy at the oversold levels and sell at overbought levels for maximum profits.

Best Swing Trading Strategies and Techniques

Catching the Trend

Traditional trend traders usually hold their positions much longer than swing traders do until the trend makes positive changes. On the contrary, swing traders can adopt the strategy by taking on short price momentum changes in highly volatile markets. If you can identify the price of a financial asset is rallying and making unclear signals of an uptrend, you can still grab the opportunity to initiate a short position while the price value is still below the support level.

Swing Breakout

A swing breakout involves the price movements going beyond and breaking through the resistance levels. As the price action shows possibilities of breaking out, swing traders should open long positions at the start of the uptrend. However, such a strategy is risky to inexperienced freshers as you can get caught in a false breakout and go against the logic of a normal trader – buying lows and selling highs.

Fibonacci Retracements

Traders can utilize the Fibonacci retracement pattern connects groups of low and high points that will make relevant values acting as the support and the resistance levels, and consequently potential reversal points, on stock charts. Even in ideal situations, these values should not be relied on entirely but instead alongside other techniques for higher chances of price reversals.

Channel Trading

During this strategy, you must locate a stock that is exhibiting a strong trend and is trading within a channel, hence the name. When the price drops off the top line of the channel that you have drawn around a negative trend on a stock chart, you could think about establishing a sell position. It’s vital to trade with the trend when utilizing channels to swing-trade stocks. When the price is heading down, you would only look for sell positions unless the price breaks out of the channel, moving higher and suggesting a reversal and the start of an uptrend.

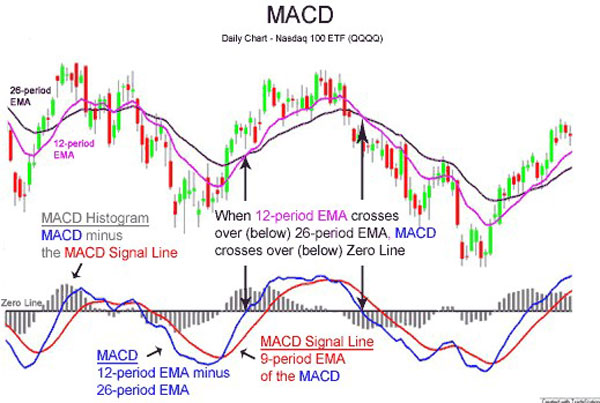

MACD Crossover

As another strategy for spotting trends and reversals, the MACD crossover swing trading strategy provides traders with two moving average lines: the MACD line and the signal line. Buy and sell signals are based on where these two lines cross. If the MACD line crosses over the signal line, this indicates a bullish trend and you should think about placing a buy order. A sell trade is recommended if the MACD line crosses below the signal line, indicating a potential negative trend.

Conclusion

Although sharing some striking similarities, day trading is considered a more beginner-friendly financial market than swing trading is. However, swing trading strategies indeed opens a new door to new opportunities that day trading cannot when requiring getting your hands on complex technical analysis techniques.

Fresh traders may need a bit more time to get the hang of this particular type of trading so that they can make consistent flows of trading income. To help you out, more swing trading-related articles are coming. So, stay tuned!