Mastering Momentum Gaps – Toni Hansen shares with you the stock selection tactics that allow professionals to pull tens of thousands, even hundreds of thousands of dollars, out of the market in only matter of 2-3 hours per day.

Course overview

Mastering Momentum Gaps – Toni Hansen reveals not only a core understanding of gaps, but also how to scan for and identify the best ones within minutes of the open each day. It also shows you top strategies based upon the analysis of the gaps and intraday price action that will allow you to position yourself into the strongest stocks early on in the session.

This course is designed for Stock Trading.

Course Outline

- Introduction

- Common Gaps

- Oopening Gaps

- Causes of Opening Gaps

- The Fadingof the Gap

- Breakaway Gaps

- Types of Breaway Gaps

- Buyout Gaps

- Trap Gaps

- Example of a Trap Gap

- Pivot Channel Break Gap

- 2-Wave Gap

- Variation of 2-way Gap

- 2-Wave Gap

- Varation of 2-way Gap

- 2-Wave Flag Gap

- Example of a Breakaway Gap

- Triangle Breakaway Gap

- Example of Triangle Gaps

- Example of Bull Flag Gap

- Flag Gap

- Runaway Gaps 1

- Runaway Gaps 2

- Exhaustion Gaps

- Example of an Exhaustion Gap

- Momentum Shifts Intraday 1

- Momentum Shifts Intraday 2

- Intraday Action 1

- Intraday Action 2

- Intraday Action 3

- Intraday Action 4

- Gap Clusure and Continuation

- Scanning for Ideal Gaps

- Intraday News

- Index Futures Gaps

- Follow-up Questions and Answer videos. (3 hours)

What will you learn?

- A complete understanding of the different classifications of gaps and which of those have the highest probability for strong momentum moves out of the open, as well as which have the greatest odds of a trend day, and which ones you should avoid entirely.

- Market timing techniques designed to get you into and out of the market at the most opportune moments and a system you can use to build confidence and eliminate hesitation.

- In depth discussion of the building blocks upon which predictable price patterns are developed.

- Extensive training on how to read core price action, WITHOUT having to rely upon any indicators.

- Risk management techniques that will make it possible for you to conservatively profit at least three times your risk – per trade. It is quite common for these strategies to yield rewards upwards of 10 times the initial risk on gap setups!

- And much more…

Who is this course for?

This course is ideal for those who are looking to specialize in trading the market gaps and gain instant access to the most volatile, and hence the most lucrative, stocks every day.

Toni Hansen

Please Login/Register if you want to leave us some feedback to help us improve our services and products.

RELATED COURSES

VIEW ALL-

Core, Swing, Guerrilla, Momentum Trading, Micro Trading Tactics – Oliver Velez – PristineDOWNLOADCore, Swing, Guerrilla, Momentum Trading, Micro Trading Tactics – Oliver Velez – PristineUpdate 06 Nov 2022All LevelsDOWNLOAD

Core, Swing, Guerrilla, Momentum Trading, Micro Trading Tactics – Oliver Velez – PristineDOWNLOADCore, Swing, Guerrilla, Momentum Trading, Micro Trading Tactics – Oliver Velez – PristineUpdate 06 Nov 2022All LevelsDOWNLOADThis course is a collection of rules and powerful strategies to help you turn winning micro trades into bigger wealth-building opportunities. With these methods, expect to profit during each market day.

Add to wishlist -

Learn Before You Lose and Forecasting by Time Cycles – W.D. GannDOWNLOADLearn Before You Lose and Forecasting by Time Cycles – W.D. GannUpdate 07 Dec 2022All LevelsDOWNLOAD

Learn Before You Lose and Forecasting by Time Cycles – W.D. GannDOWNLOADLearn Before You Lose and Forecasting by Time Cycles – W.D. GannUpdate 07 Dec 2022All LevelsDOWNLOADLearn Before You Lose and Forecasting by Time Cycles by W.D. Gann provides a detailed guide on the tips for buying, selling, or holding stocks to earn the highest profits. You will learn effective analysis techniques to grab insights into trend patterns for accurate market forecasts.

Add to wishlist -

Broken Wing Butterflies in a High Vol with Directional Fly – Sheridan Options MentoringDOWNLOADBroken Wing Butterflies in a High Vol with Directional Fly – Sheridan Options MentoringUpdate 03 Nov 2022AdvancedDOWNLOAD

Broken Wing Butterflies in a High Vol with Directional Fly – Sheridan Options MentoringDOWNLOADBroken Wing Butterflies in a High Vol with Directional Fly – Sheridan Options MentoringUpdate 03 Nov 2022AdvancedDOWNLOADBroken Wing Butterflies in a High Vol with Directional Fly – Sheridan Options Mentoring reveals the type of lesson that has never been taught in a high volatility climate. That is one of Sheridan’s long-standing techniques, the Broken Wing Butterfly.

Add to wishlist -

PRO Forex And Stock Market Trading With Ichimoku Kinkō Hyō – UdemyDOWNLOADPRO Forex And Stock Market Trading With Ichimoku Kinkō Hyō – UdemyUpdate 06 Nov 2022AdvancedDOWNLOAD

PRO Forex And Stock Market Trading With Ichimoku Kinkō Hyō – UdemyDOWNLOADPRO Forex And Stock Market Trading With Ichimoku Kinkō Hyō – UdemyUpdate 06 Nov 2022AdvancedDOWNLOADPRO Forex And Stock Market Trading With Ichimoku Kinkō Hyō – Udemy teaches you about Time Theory, Wave theory, Price Target theory and everything else you need to know to become a successful trader using Ichimoku.

Add to wishlist -

The Moxie Stock Method Class – Simpler TradingDOWNLOADThe Moxie Stock Method Class – Simpler TradingUpdate 01 Nov 2022All LevelsDOWNLOAD

The Moxie Stock Method Class – Simpler TradingDOWNLOADThe Moxie Stock Method Class – Simpler TradingUpdate 01 Nov 2022All LevelsDOWNLOADThe Moxie Stock Method Class by Simpler Trading helps you to predict “pops and drops” in shares like TG Watkins that permit him to book returns of 10% to 200% (regularly inside days).

Add to wishlist -

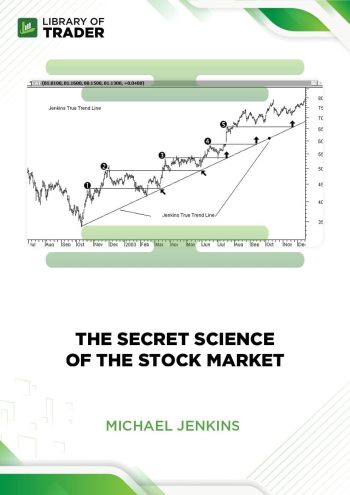

Michael Jenkins – The Secret Science of the Stock MarketDOWNLOADMichael Jenkins – The Secret Science of the Stock MarketUpdate 07 Nov 2022All LevelsDOWNLOAD

Michael Jenkins – The Secret Science of the Stock MarketDOWNLOADMichael Jenkins – The Secret Science of the Stock MarketUpdate 07 Nov 2022All LevelsDOWNLOADThe Secret Science of the Stock Market – Michael Jenkins reveals the needed knowledge that allows you to forecast any market with great accuracy. The course is all about time and price to maximize your profits while limiting risks.

Add to wishlist

Reviews

There are no reviews yet.