Introduction

The Aroon indicator is a technical indicator used to identify price trend changes as well as the strength of that trend. In essence, the indicator gauges the duration between highs and lows during a certain time period. The notion is that strong uptrends will see new highs on a frequent basis, whereas strong downtrends will see new lows on a regular basis. The indication indicates when something occurs and when it does not.

The Aroon indicator detects when a price’s mood shifts from trending to ranging. It decides how long a price will maintain its momentum after making new highs or lows. The Aroon Up and Aroon Down lines are plainly visible on the indicator display. The Aroon indicator, like all other indicators, has a tiny latency. In this post, we’ll walk you through the Aroon Indicator from start to finish and show you how to use the Aroon indicator.

What Is the Aroon Indicator?

The Aroon Indicator is a trading technique that indicates whether a price is trending or ranging. When the Aroon Up line crosses over the Aroon Down line, market sentiment is bullish, and vice versa, market sentiment is bearish.

When buying and selling forces reach an excessive degree, traditional momentum oscillators suggest that a reversal is imminent. As a result, trading decisions based on indicators such as RSI, Stochastic, or ADX are frequently less lucrative. Using the Aroon indicator, on the other hand, can provide you with a clearer picture of market mood, particularly when a new trend will begin.

The Aroon oscillator is made up of two indicators:

- An Aroon-Up indicator counts the number of days since a 25-day high was recorded;

- An Aroon-Down indicator counts the number of days since a 25-day low was recorded.

Both Aroon indicators are given in percentages, with a scale of 0 to 100. To facilitate comprehension, the Aroon up and down lines are drawn side by side.

How to Calculate the Aroon Indicator?

The Aroon indicators are not as difficult to calculate as you would imagine. It only needs tracking the high and low prices of an asset for the number of periods utilized in the algorithm. As previously stated, practically all use Tushar Chande’s suggested 25 periods for the Aroon indicator calculation.

- Track the asset’s price highs and lows over the previous 25 periods.

- Take note of the time between the last high and low.

- Use these values in the following Aroon-Up and Aroon-Down formulas:

- Aroon-Up = ((25 – Days Since 25-day High)/25) x 100

- Aroon-Down = ((25 – Days Since 25-day Low)/25) x 100

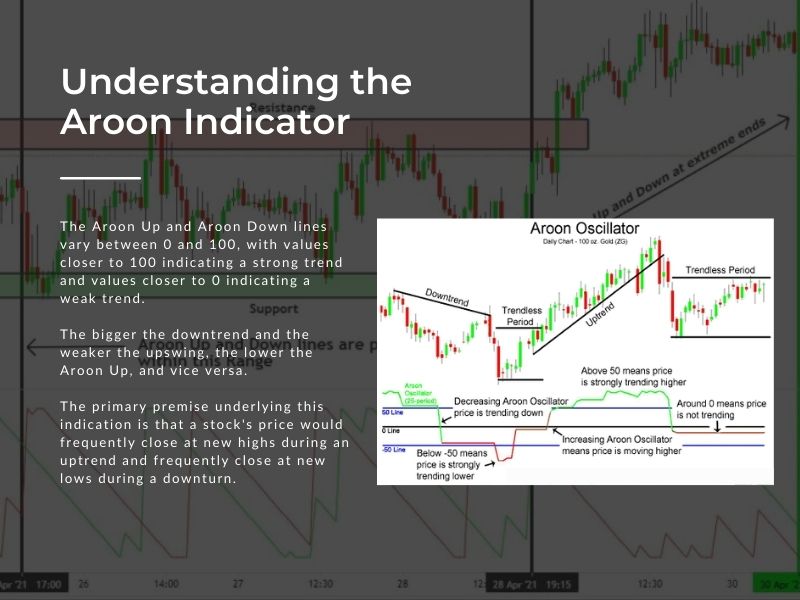

Understanding the Aroon Indicator

The Aroon Up and Aroon Down lines oscillates between 0 and 100, with values near 100 suggesting a strong trend and values around 0 indicating a weak trend. The lower the Aroon Up, the greater the downtrend and the weaker the upswing, and vice versa. The basic assumption underpinning this indicator is that a stock’s price would close at new highs on a regular basis during an uptrend and at new lows on a frequent basis during a downturn.

The indicator focuses on the latest 25 periods but is scaled between zero and one hundred. As a result, an Aroon Up value greater than 50 indicates that the price has reached a new high during the recent 12.5 sessions. A value approaching 100 indicates that a recent peak was seen. The Down Aroon operates on the same principles. A low was seen during the 12.5 times when it was over 50. A Down rating approaching 100 indicates that a low was experienced lately.

When both indicators go below 50, it may indicate that the market is consolidating. There are no new highs or lows being set. Traders should look for breakouts as well as the next Aroon crossing to see which way price is heading.

How does the Aroon oscillator differ from Aroon Up/Down lines?

In addition to the standard Aroon indicator, there is an which has only one line.

The Aroon oscillator line represents the difference between the Aroon-Up and Aroon-Down readings. The tool aids in the definition of trend phases (starting, peak, and finish); it also identifies the beginning and conclusion of price sideways movement. The conventional indication is shown in the bottom window of the Aroon chart above, and the oscillator is shown above.

The oscillator gives clear and simple signals. Traders look for zeroline crosses to indicate possible trend shifts. A purchase signal emerges when the oscillator line moves from the negative to the positive zone; a sell signal appears when the line moves from the positive to the negative zone. If the Aroon oscillator values are between 40 and 100, it suggests a bullish trend; if the readings are between -40 and -100, it signals a definite negative trend.

How to Use the Aroon Indicator to Measure the Strength of a Trend

Aroon Indicator Signals: How to Read Them?

Let’s talk about the Aroon trading signals, which are very successful in the Forex market as well as in CFDs, stocks, and binary options trading. The Aroon indicator’s application is based on the reading of various signals.

Identifying the trend’s direction

The trend is determined by the position of the lines relative to each other at levels between 30% and 70%. Aroon-Up increases beyond 70% and can reach 100% during an upswing. In a decline, Aroon-Down goes below 30%, perhaps reaching 0%.

Lines crossovers

The crossings of Aroon’s lines are the major signal. When the Aroon-Up line crosses the descending Aroon-Down line from the bottom up and gets over the 30% zone, it is a buy signal. A fresh upswing normally begins at this point, providing an excellent entry opportunity for a long position.

Trend stages

The readings of the Aroon chart indicator offer very precise information about the direction of the price movement and the intensity of the current trend, as well as the stage of trend development.

- If Aroon-Up:

- more than 70% indicates a strong bullish trend;

- 50-70% – increasing bullish trend

- 30-50% – the trend is tiring;

- lower than 30% – purchasers are no longer motivated to drive up the price.

- If Aroon-Down:

- more than 70% – the market is dominated by gloomy sentiment;

- 50-70% – the gloomy trend is intensifying;

- 30-50% – the negative trend is wearing thin; Buyers, on the other hand, have yet to take the initiative.

- lower than 30% – the downturn is over.

Lines move in parallel

When Aroon lines move in parallel, traders normally do not consider it an entry indication. The parallel movement of the lines most typically indicates price consolidation, which is frequently followed by a price breakout.

The Aroon Indicator: Advantages and Disadvantages

The Aroon indicator, like other technical analysis tools, has advantages and disadvantages.

| Advantages | Disadvantages |

| ● It precisely outlines overarching tendencies.

● It does not retouch; ● It is equally effective while trading numerous instruments and on various trading platforms. ● It offers reliable indications in both long-term and short-term time periods. ● If the parameters are correct, it produces high-quality signals. |

● Signals might be delayed.

● False signals are common in sideways trend or range trading. ● Other indicators or technical tools should be used to confirm signals.

|

Which are the Aroon Indicator strategies to use in trading?

Breakout Trading Strategy

This Aroon indicator technique is focused on trading when the trend direction shifts dramatically. As previously stated, a parallel movement of the Aroon-Up and Aroon-Down lines indicates a price consolidation, which will invariably be followed by a fresh price breakout. As a result, in order to increase your investment, you anticipate a breakout and enter a trade in the direction of the new trend.

Trend Strength Strategy

When there is a strong trend, the Aroon indicator lines linger near the highest levels. Traders frequently utilize this feature to benefit. When the lines reach their maximum values, the method proposes entering a trade; this is 70% for the Aroon-Up and 30% for the Aroon-Down. The trend direction is determined by the direction of the previous crossover of the lines. When the center line is crossed or the reversal signal, the opposite crossover of the Aroon lines, appears, the profit is taken.

Trading strategy for binary options

Both of the trading methods outlined above may be used for binary options trading. The breakout trading approach is ideal for short-term contracts. Long-term contracts might benefit from the trend strength method. Furthermore, the expiration date should be considered in order to settle the contract before the trend reverses in the other way.

A trading technique based on the combination of the Aroon and the EMA is also available. When the Aroon-Up crosses the Aroon-Down from bottom to top and the price chart is below the EMA, the Put signal occurs. When the red line breaks through the blue line on the downside and the contract price is above the EMA, this is an opposite signal.

The Best Indicators to Use With the Aroon Indicator

The Aroon indicator has all of the required characteristics to serve as a reliable price barometer, but it is not recommended to rely only on it. In financial trading, we forecast price movement using a variety of formulas. When the likelihood is high, the price is more likely to follow the direction. As a result, when we combine numerous indications based on their performance, we may stack the odds in our favor.

Moving Average

The Moving Average (MA) displays the average price of the candles in a certain time period. As a result, when the price goes above the 20 EMA (Exponential Moving Average), we may assume that the underlying trend is positive.

Meanwhile, if the Aroon indicator indicates the same price direction, we may consider the trade to be genuine.

MACD (Moving Average Convergence Divergence)

The Aroon indicator complements MACD excellently. When MACD and Aroon both point in the same direction, you can consider the trend to be strong.

Price Action

Price action traders place trades based on price movement, support/resistance levels, and indicators. As a result, if you wish to purchase based on price rejection from any dynamic or static support level, you may utilize the Aroon indicator to confirm the entry.

The Aroon Indicator: FAQ

What is the Aroon Indicator?

The Aroon Indicator is a form of technical momentum oscillator that helps traders to assess if an asset is trending, in which direction it is going, and how strong the trend is. It may also be used to detect nascent trends and reversals because it focuses on price relative to time.

Is the Aroon indicator accurate?

Combined with price action, other technical indicators, and fundamental analysis, the Aroon indicator is the most accurate and useful.

How to read the Aroon indicator?

The indicator has two lines: an Aroon Up and an Aroon Down. The Up line represents bullish strength and momentum, whereas the Down line represents bearish strength and momentum. Both lines are represented on a histogram with a scale of 0 to 100, with 100 indicating the greatest trend.

How Can a Trader Use Aroon Indicator Effectively?

A crossover strategy, in which a trader goes long whenever the Aroon Up line crosses over the Aroon Down line, is one of the most useful trading methods employing the Aroon Indicator. They would go short if the Aroon Down line crossed over the Aroon Up line. With this strategy, there are no exit indications other than line crossings, implying that the approach is always active in the market.

What Are the 4 Types of the Aroon Indicators?

In modern technical analysis, there are four sorts of indicators:

- Trend-following indicators determine the direction of an ongoing trend in a certain security, as well as its strength and probable pivot points. Aroon is a momentum indicator.

- Oscillators determine the market’s overbought and oversold conditions, as well as the trend strength. They differ in terms of their values. Aroon can also be called an oscillator.

- Volume indicators indirectly quantify trade volumes, providing information on buyer and seller activity.

- Although information indicators give helpful trade information, they are not a sufficient trading signal. A widget providing the relevant spread size is a common example of an info indication.

In conclusion

Aroon is a common technical analysis indicator used to pinpoint the start of a trend and indirectly measure the trend’s overall strength and fatigue. The Aroon signals are basic and uncomplicated, making it an excellent indication for novices.

However, Aroon cannot give enough information to initiate and exit deals on his own. As a result, it should be used in conjunction with other indicators to check trade signals and improve trade quality. Aroon performs better in trending markets since it provides a lot of misleading signals in sideways movements. Also, to maximize output, traders should use the Aroon indicator in conjunction with money management guidelines.