Introduction

Options trading enables astute investors to capitalize on stock price swings and increase returns. However, investors should be aware that trading options is not for everyone, and the dangers sometimes outweigh the gains.

Options traders must evaluate various elements, including entry and exit locations, market volatility, and how to apply their trading strategy. This necessitates diligence, expertise, and a basic grasp of why you want to trade options in the first place.

Options may not be appropriate for all investors. However, if you want to control investment risk and maximize returns, options trading has various advantages. Here’s more information on options and how options trading makes money.

How Does Option Trading Make Money?

If the underlying asset, like a stock, climbs above the strike price before expiry, a call option buyer stands to benefit. A put option buyer profits if the price falls below the strike price before the option expires. The actual amount of profit is determined by the difference in stock price and option strike price at expiry or when the option position is closed.

A call option writer will benefit if the underlying stock remains below the strike price. If the price remains above the strike price after writing a put option, the trader gains. The profitability of an option writer is limited to the premium they earn for writing the option (which is the option buyer’s cost). Option writers are often referred to as option sellers.

So, as a Trader, How Can You Make Money With Options?

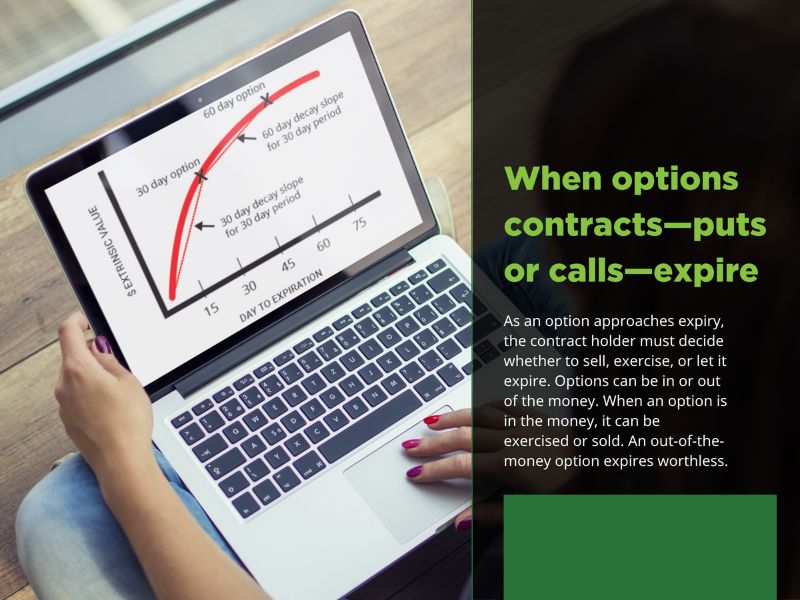

The strike price is critical to understanding how options profit. The parties to the contract are considered to be in the money for a winning trade or out of the money for a losing trade depending on whether the price of the underlying asset rises above or falls below the strike price.

- In the black: Calls are advantageous for the buyer of an option contract when the underlying stock price is greater than the strike price. When the stock price goes below the strike price, the buyer profits from the put option.

- Out of pocket: Calls are unprofitable for the buyer of an option contract when the strike price is greater than the stock price. When the stock price surpasses the strike price, buying put options becomes unprofitable.

- In terms of money: When the underlying stock price and the strike price are the same.

So, how can you earn money with options? When a call is in the money, the contract buyer has the right to exercise the option and acquire the underlying stock from the writer at a lower price than it is on the stock market. They paid a tiny charge (the premium) for the privilege to acquire stock at a reduced price.

When a put option is in the money, the contract buyer can exercise the option, requiring the writer to purchase stock at a price greater than the current market price of the shares. Once again, the buyer paid a little premium for the ability to sell shares at a higher price than its market value.

What about the writer of options? They profit when the buyer’s options contract is out of the money upon expiration. Consider this: The party purchasing the contract has the right but not the duty to complete the transaction, and if a put or call is out of the money, they do not exercise the option. This leaves the writer with the premium, which is their profit from the exchange.

What about Losing Money with Options?

When options contracts-puts or calls-expire and are no longer in the money, they are worthless. The buyer forfeits the option price paid. They can’t sell stock at a higher price than the market price to the option writer with puts, and they can’t acquire shares at a lower price with calls.

Trading options is a highly speculative activity. Because options are frequently utilized as a type of leverage, traders may buy more stock with less money and substantially increase their gains. This implies they might lose their whole investment as well as dramatically multiply their losses.

While the options buyer merely loses the premium, the writer might suffer considerably larger losses. Take calls: When the stock price surpasses the striking price, the buyer is in the money—but there is no limit to how high stock prices may soar, and hence no limit to the option writer’s loss. Of course, with puts, the stock can only fall to zero.

So, What Are the Best Ways to Make Money With Options?

Caption: Options trading may appear complicated, but there are a number of fundamental tactics that ordinary investors may employ to boost profits and wager on market movement.

While calls and puts may be combined in a variety of ways to construct complicated options strategies, let’s look at the four most fundamental and effective techniques.

Purchasing a Call

This is the most fundamental option strategy. It is a low-risk strategy since the greatest loss is limited to the premium paid to purchase the call, but the maximum return is theoretically infinite. Although, as previously indicated, the chances of the deal being extremely successful are normally rather modest. The term “low risk” implies that the overall cost of the option is a relatively tiny fraction of the trader’s capital. Risking all cash on a single call option is a high-risk strategy since the entire investment might be lost if the option expires worthless.

Purchasing a Put

This is another method with a minimal risk but possibly large payoff if the deal succeeds. Buying puts is a feasible alternative to short selling the underlying asset, which is a riskier approach. Puts can also be purchased to hedge portfolio downside risk. However, because equity indexes tend to trend higher over time, implying that equities rise more frequently than they decrease, the risk/reward profile of a put buyer is slightly less attractive than that of a call buyer.

Making a Put

Put writing is a popular approach among sophisticated options traders because, in the worst-case scenario, the stock is allocated to the put writer (they must buy the shares), but in the best-case scenario, the writer keeps the whole option premium. The greatest danger of putting writing is that the writer will overpay for a stock if it goes down in value. Put writing has a more unfavorable risk/reward profile than put or call purchasing since the highest return matches the premium received, but the maximum loss is substantially larger. However, as previously noted, the likelihood of making a profit is higher.

Making a Call

There are two types of call writing: covered and bare. Covered call writing is another popular method among intermediate to expert option traders, and it is typically employed to supplement a portfolio’s revenue. It entails writing calls on equities in the portfolio. Because it has a risk profile comparable to a stock short sale, uncovered or naked call writing is the sole domain of risk-tolerant, professional options traders. In call writing, the maximum reward is equal to the premium earned. The largest danger with a covered call strategy is that the underlying stock gets “called away,” but the maximum loss with naked call writing is theoretically infinite, much like with a short sell.

In conclusion

Investors with a low risk tolerance should adhere to simple tactics like call or put purchasing, while knowledgeable investors with a high risk tolerance should adopt advanced methods like put writing and call writing. Option methods give several avenues to success since they may be adjusted to each individual’s risk tolerance and return demand.

References

https://www.investopedia.com/articles/active–trading/091714/basics–options–profitability.asp

https://www.investopedia.com/articles/active–trading/040915/guide–option–trading–strategies–beginners.asp