Forex options trading is a financial derivative that gives the right, but not the obligation, to buy or sell a currency pair at a set price, known as the exchange rate exercise on a specific date that is called the expiration date.

What Is Forex Options Trading?

Forex options trading (FX options trading) is derivatives that give the buyer an option but no obligation to buy or sell (call and put option) foreign currency at a certain exchange rate before or on a specified date before. It is also related to the strategies available in the forex market.

Strategies in forex options trading vary widely depending on the products offered by the organization offering the option. The characteristics of currency options trading including the decentralized forex market vary much more widely than options on the more centralized stock exchanges and futures markets.

There are two types of forex options: vanilla options and SPOT options. SPOT option is a binary system, which can pay or not depending on the final condition of the option.

In-depth Understanding Forex Options Trading

Forex options trading is a strategy that gives currency traders the ability to realize some of the payouts and excitement of trading without having to go through the process of buying a currency pair.

The difference between forex options trading and other options trading is that traders do not need to deliver physical assets. Forex options trading allows traders to choose a price and expiration date to suit their profit or risk strategy needs.

While the futures trader must fulfill the terms of the contract, options traders do not need to do so at expiration. There are many reasons to prefer forex options trading. When making this trade, the trader can limit the risk. The trader only takes the premium to buy the options.

In other cases, FX options trading is used for the purpose of protecting open positions they have in the cash market (also known as the physical market and the spot market). The cash market can settle transactions involving commodities and securities instantly. Traders also love to trade forex options because it gives them the opportunity to trade and profit by predicting the direction of the market based on economic, political, or other news.

Forex options trading is complicated because once you buy an option, you cannot re-trade it or sell it. The premium is also very high with the risk, market volatility, current price of the currency pair, and expiry time. FX options trading has many moving parts so it is very difficult to determine their value.

Primary Types of Forex options trading

SPOT – Single Payment Options Trading

Another type of option available to retail forex traders to trade currency options is single-paying options trading (SPOT). SPOT options cost more than traditional options, but they are easier to set up and execute.

A currency trader buys a SPOT option by entering the desired scenario (e.g. “I think EUR/USD will have an exchange rate above 1.5205, 15 days from now”) and the premium will be quoted price. If the buyer purchases this option, then SPOT will pay automatically if the situation occurs. Basically, the option is automatically converted to cash.

The Traditional (Vanilla) Call/Put

The call gives the buyer the right to buy a currency pair at a certain exchange rate at some point in the future. A put option gives the buyer the right to sell a currency pair at a certain exchange rate at some point in the future. Both put and put options give the investor the right to buy or sell, but no obligation. If the current exchange rate puts the options out of the amount, the options will expire worthlessly.

In essence, the buyer will provide the price they want to buy and the expiration date. The seller will respond with the premium charged for the transaction. If the current exchange rate takes the options out of money (OTM), they will expire worthlessly.

How to Trade FX Options

Make Sure FX Options Are How You Want to Trade Currency

Besides forex options trading, you can also trade spot or forward FX forex.

Fully Knowledge About Options Trading

To be able to trade forex options, you need to understand the basics of options trading. Understanding what options trading is, the essentials of options trading like call options, put options, leverage and hedging is the foundation that makes it possible to trade all other markets with ease.

Some special knowledge to note for effective options trading is options trading terminology, determining the option’s price, learning about the Greeks, options trading strategies and choosing the time frame, etc.

Choose the Currency Pair You Want to Trade

There are over 80 currency pairs that you can choose from, including

- Major currency pairs, eg GBP/USD, EUR/USD, and USD/JPY

- Minor pairs, eg SGB/JPY, USD/ZAR, CAD/CHF

- Emerging currency pairs, eg EUR/RUB, USD/CNH, and AUD/CNH

- Exotic pairs, eg TRY/JPY, EUR/CZK, USD/MXN

Open a Trading Account

To start trading, you need to set up an account with a forex broker. Provide personal information such as name, address, date of birth, nationality, employment status, account currency, trading account password, etc.

With FX options trading, you trade with a CFD account. A CFD is a derivative product, which means you only need a small amount of margin – called a margin to open a position.

Choose Your Time Frame & FX Option

Determine whether you will place a buy or sell order. If you predict that the market will rise, place a buy order and vice versa. In daily options trading, you determine whether the market will be higher or lower than a certain price when the market closes on the same trading day.

The weekly and monthly options are similar, the expiry date will be before a certain weekly or monthly date.

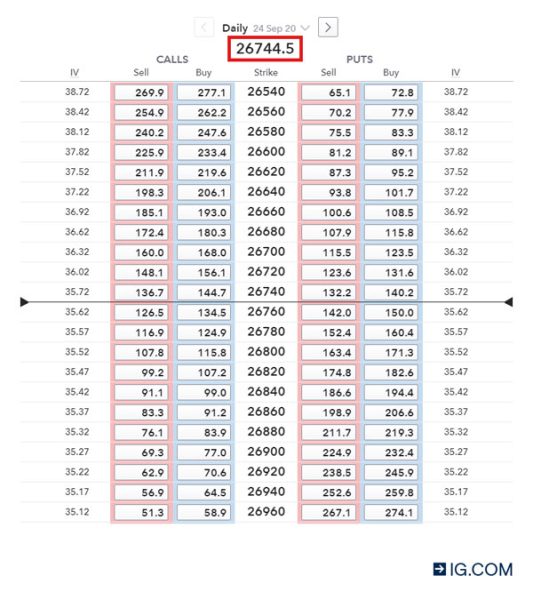

Pick Your Strike Price

The strike price in forex options trading is the price at which a combination of options can be exercised. The underlying market price must go through the strike price to execute the trade and it is called money. If the money runs out, which is not possible, the option will expire worthlessly.

Open And Monitor Your Position

Once you have selected the currencies to buy or sell, you need to track them on certain forex trading platforms. Traders can use tools and indicators to measure and evaluate the health of the currency they are trading. You should also keep an eye on news and events that are constantly updated as it can affect the price of the forex pair you own.

Forex Options Trading With Example

If you are bullish on the Euro and predict that the US dollar will also rise. Then you buy a currency call option on the euro with a strike price of $115. When you buy a contract, the spot rate of the euro is equivalent to $110.

Suppose the spot price of the euro on the expiration date is $118. Therefore, the currency option is said to have expired the use of the money. Thus, the investor’s profit is $300, or (100 * ($118 – $115)), minus the premium paid for the currency call option.

The Bottom Line

The combination of forex trading vs options trading requires thorough knowledge and understanding. These are just the basic steps so that you can somewhat understand forex options trading. Information about them is a lot on the internet but to be on the right track, you can refer to trading courses from top experts, which will definitely help you. Check out more of our useful blogs because it’s free to learn trading.