Introduction

Even if you have already got the hang of what options trading is all about, there is still one major step left before reaching to the dreamed flows of trading profits – choosing the right options trading strategies.

Not just understanding the basic principles of strategies is crucial to your trading plans but also their practices during the actual trading. As a result, knowing a wide variety of different options trading strategies can help you remain adaptable and always have responses to the constantly changing state of the market.

5 Common Options Trading Strategies to Use

To choose the right strategy, you must take a look into the current state of the market and determine whether it is possible to pull this strategy off to reach its maximum potential while keeping even the slightest risk at bay. We will note a preferred situation when the named strategy is used.

Covered Call

- You are the stock owner

- Expected volatility: low

- Level: all

- When to use: when you are indifferent to somewhat bullish

In this strategy, you – the stockholder – aim to generate income by writing an option for another investor to buy at a price (the strike price of the option) that is higher than the current price of the stock. It is called ‘covered’ because you actually own the stock and can deliver the asset if the position is executed.

The gains may vary when using this strategy depending on what your objectives are, but most of the time, it is not a loss. Let’s take a look at this case study: the stock owner was holding 100 shares at the price of $20 per share. He then wrote a call option with a strike price of $25 with the expiration date coming in exactly one month. He chose this strategy because he expected a rise but was still not really sure how it would turn out in the next month. Two following situations would occur:

- The stock price continues to rise but does not surpass the strike price at the expiration date so that the contract becomes worthless. In this case, the call investor gets all the benefits as he still receives the premium paid by the option buyer holds his property. If it continues to rise, he may even consider writing another call then repeat this safe options trading strategies.

- The stock price, now at $28, surpasses the strike price and goes into the money. The call option is executed. The option buyer receives a total of $25,000 worth of shares (100 shares with $25 each) while the owner receives also that much plus the option premium as his income.

This strategy is rather safe as it brings little to no downside to the owner. However, writing a call option here can be considered an opportunity risk as it keeps your hands off the rise of the price and makes you miss out on all the potential gains.

Protective Collar

- You are the stock owner

- Expected volatility: high

- Level: all

- When to use: when you are bullish, but not completely

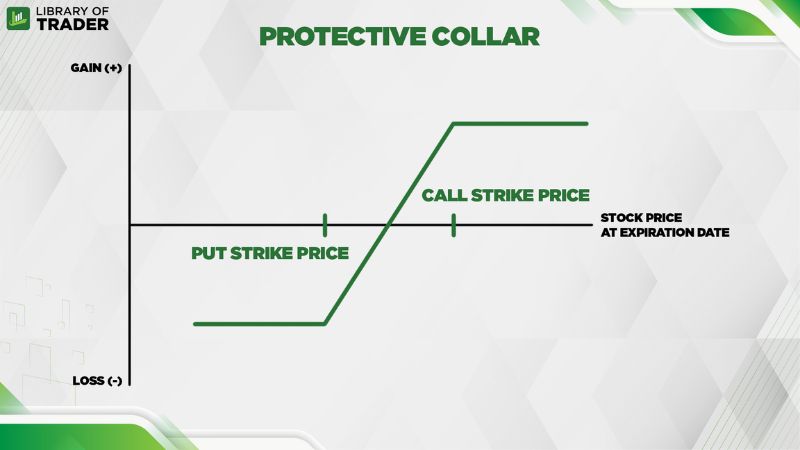

The protective collar contains a long position in the underlying asset, a put option for hedging the downside risk of the stock, and a call option for executing the trade – both options are typically out-of-the-money with the same expiration date. This strategy can be approached as the covered call with a long put position.

While the put options protect the stock from possible risk, hence the name ‘protective’, both options form a ‘collar’ where the upsides are desired. You will want the put option to be left expired worthless and the stock price to rise as high as it can, or at least to cover the premium paid for the put.

Because an increase in the stock price is expected for the maximum value, volatility is also anticipated to be high in a considerable amount of time, but not too long. In this strategy, time is the enemy as the price decay poses a lurking threat affecting the value of the option you bought.

Long Call

- Expected volatility: high

- Level: advanced

- When to use: when you are bullish

Calls are considered an alternative to buying stocks. With a long call, you can buy the underlying asset at the strike price A and profit when the stock price rises without getting exposed to all the possible risks from actually owning the stock.

You can also gain leverage over a larger number of shares than you could afford to buy outright. However, exercise caution because calls are always less expensive than the stock itself, particularly with short-term out-of-the-money calls.

Purchasing an excessive number of option contracts increases your risk. Options can expire worthless, resulting in the loss of your entire investment, whereas stocks are usually still worth something. In a perfect situation, you will greatly benefit when the stock price manages its way through the roof with the expected high volatility.

Iron Butterfly

- You can use this strategy when expecting the stock to move very little in a short period of time.

- Expected volatility: depending on where the stock price and the strike price is

- Level: advanced

- When to use: when you are expecting insignificant movements of the stock price within a certain period.

The iron butterfly strategy can be thought of as simultaneously selling a short put spread and a short call spread with the spreads that converge at the strike price B with the same expiration date. For maximum potential profitability, a net credit can be utilized since it is considered a combination of short spreads.

This strategy realizes its profits at the maximum potential when the stock is traded with the price at the short strike at the expiration date. Such an occasion is believed to have a low probability to occur and you have to give out something to close these positions. However, it can yield a significant income from premium even as a partial profit, making it somewhat more healthily attractive than achieving the full profits on other strategies with less premium.

Ideally, you will want the volatility changes in response to the stock price position. If the stock price is at or somewhere near the same value of the strike price B, the lower volatility the better, and vice versa. An increase in volatility will raise the value of your option at the near-the-money strike.

Iron Condor

- You can use this strategy when expecting the stock to move very little in a short period of time.

- Expected volatility: depending on where the stock price and the strike price is

- Level: advanced

- When to use: when you are expecting insignificant movements of the stock price within a certain period.

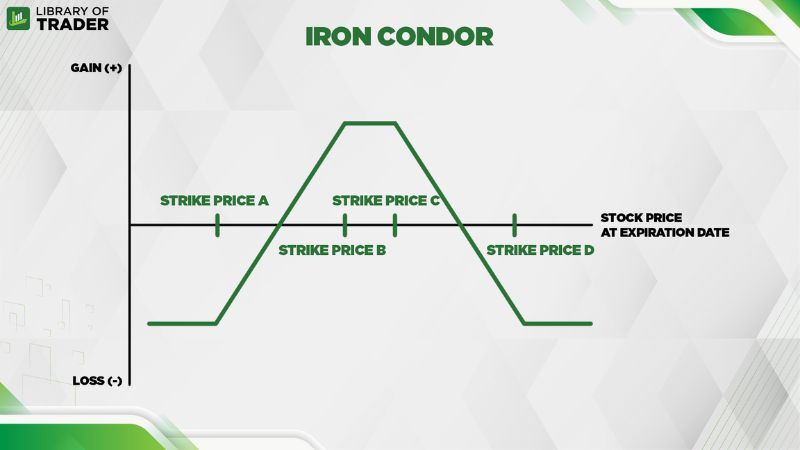

Somewhat similar to the iron butterfly as a popular stock options trading strategies, there are still major key differences between the two. The iron condor can be considered a lower risk, lower reward compared to the iron butterfly with a higher risk/ reward ratio.

The iron condor involves running a short put spread and a short call spread at the same time, with both being out-of-the-money. As the strategy is carried out, the stock price is usually somewhere between the strike prices B and C. If the stock price is in the middle at the launch, the strategy can become either bearish or bullish depending on the selection of different strike prices.

With this strategy, you achieve maximum profit if the stock price hits the middle of the sweet spot – the distance between the strike price B and C – at the expiration date. The length of this gap may vary according to the users, which poses a tradeoff as the wider gap is considered to be less profitable.

The expected volatility is also the same when we utilize the iron butterfly strategy. In general, you will want the lowest volatility possible as the stock price moves towards the middle of the sweet spot. At further positions such as outside the strike price A or D, high volatility is more favored, increasing the value of your position at the near-the-money.

Conclusion

To beginners or even intermediate traders, learning options trading strategies is still a long journey. The learning will surely continue further when trying to apply these strategies you have known into actual trading plans, making real profits. As a result, the knowledge just cannot be covered in only one article. But worry not, more is coming, so stay tuned!