A financial institution exists in today’s financial services industry to provide a wide range of deposit, lending, and investing options to people, corporations, or both. While some financial institutions focus on providing general public services and accounts, others are more likely to serve just specific individuals with more specialized offers.

To choose which financial institution is most suited to meet a certain demand, it is necessary to first grasp the distinctions between the many types of institutions and the goals they serve.

What is Financial Markets and Institutions?

Certain sorts of financial markets and financial institutions may be found in nearly every country on the planet. For example, most countries with economic activity have a functioning stock exchange and banking system. Each of these institutions is unique and serves a distinct purpose.

However, these financial markets and institutions work together to form a financial system. To some extent, financial systems throughout the world are similar since they all have some characteristics. However, financial systems have distinct characteristics based on political, economic, and even cultural aspects.

Financial institutions and markets is a branch of finance that studies financial institutions and financial markets and how they contribute to individuals’ overall well-being and a country’s overall real economic growth. It is concerned with the study of the conduct of banks and other comparable organizations in modern financial markets.

Understanding Financial Markets and Institutions?

Bond and stock markets, for example, are critical to encouraging higher economic efficiency by directing assets from individuals who do not have a constructive use for them to those who do. Indeed, well-functioning financial markets are a critical component in generating high economic development, and badly performing financial markets are one of the reasons that many nations throughout the world stay impoverished. Financial market activity has a direct impact on personal wealth, corporate and consumer behavior, and the economy’s cyclical performance.

Although they may appear perplexing, financial markets exist primarily to bring people together so that money may flow to where it is most needed. People can also get insurance through financial markets. Insurance firms must use financial markets to ensure that you will be compensated if you have an accident, such as losing or damaging your phone.

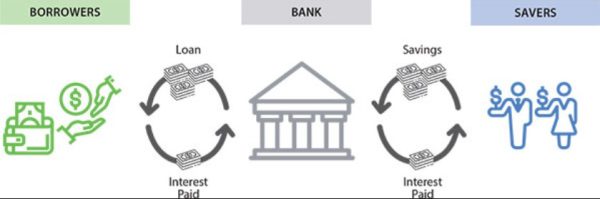

Financial markets allow banks to borrow money, which allows them to give loans to customers who want to borrow, such as attending university with a student loan or purchasing a home with a mortgage.

Consider eBay, which connects buyers and sellers to determine the price of anything from used furniture to the new iPhone. Financial markets bring together buyers and sellers to determine the value of financial assets.

What is the Relationship Between Financial Institutions and Financial Markets?

Financial markets are made up of agents, brokers, institutions, and middlemen who buy and sell assets. Contracts, communications networks that constitute an outwardly apparent financial structure, rules, and friendships connect the various people and institutions involved in financial markets. Investors and financial institutions compete in the financial market.

The word “financial institution” refers to any entity that acts as an agent, broker, or intermediary in financial transactions. Contracts are made on behalf of others by agents and brokers, while intermediaries sell on their own behalf. Financial intermediaries buy securities for their own accounts and sell liabilities and common stock.

A stockbroker, for example, buys and sells stocks on our behalf as our agent, but a savings and loan borrows our money (savings account) and lends it to others (mortgage loan). Stockbrokers are categorized as agents and brokers, whereas savings and loans are classified as financial intermediaries. Brokers and savings and loans, like other financial organizations, purchase and sell assets; nonetheless, they are classed separately since brokers’ principal activity is buying and selling rather than owning and keeping an investment portfolio.

What Are the Roles of Financial Institutions and Capital Markets?

The efficiency with which financial markets contribute to economic growth is mainly determined by the availability of inexpensive capital and the effective deployment of that capital to productive areas of the economy. Efficient capital allocation entails channeling funds to investment projects or enterprises that add the most value to the economy. As a result, there is a close link between capital and economic development on the one hand.

In order to encourage economic growth, financial institutions must first ensure that money is distributed to the most productive enterprises with the best feasible return. Thus, the key growth mechanisms originate from improvements in financial market functioning and the influence this has on altering risks and the maturity of assets and liabilities, in which capital market development plays an important role.

What Are the Major Types of Financial Institutions?

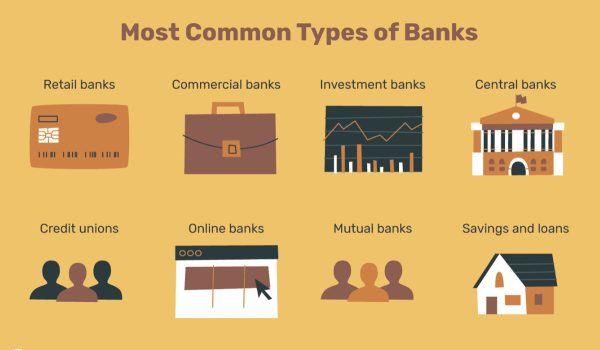

Central banks, retail and commercial banks, online banks, credit unions, savings and loans organizations, investment banks, investment businesses, brokerage firms, insurance companies, and mortgage companies are the primary types of financial institutions.

Central Banks

Central banks are principal banks in charge of supervising and managing other banks. The Federal Reserve Bank is the name given to the central bank of the United States. The Federal Reserve System is in charge of monetary policy, financial oversight, and the regulation of other financial institutions.

Retail and Commercial Banks

Consumers most often deal with retail and commercial banks. Individual customers are served by retail banks, while enterprises are served by commercial banks.

Most retail/commercial banks provide deposit accounts, loans, and some financial counseling. Checking and savings accounts, certificates of deposit (CDs), loan associations (both personal and mortgage), credit cards, and corporate banking accounts are all available from commercial banks.

Internet Banks

Internet banks come next. Internet banks are relatively new to the financial sector, although they offer many of the same services as traditional banks. The main distinction of internet banks is that they do not have physical locations and instead operate mostly online.

There are also digital banks and non banks under the category of online banks. Digital banks are online-only platforms that are also associated with a traditional bank. In comparison, neobanks have no association with a regular bank and are regarded as digital native banks that are exclusively linked with themselves.

Credit Unions

Another common option for financial organizations is credit unions. Credit unions have traditionally aided certain groups based on union membership, such as teachers, laborers, and military personnel.

Credit union products are quite similar to those offered at retail and commercial banks, but they are owned by their members and function for the benefit of members rather than profit.

Savings and Loan Associations

Savings and loan associations are another important financial sector segment. These collectively owned financial firms supply no more than 20% of overall lending. This sort of financial institution may be used by individuals for personal loans, mortgage financing, and deposit accounts.

Investment Banks and Companies

Following that are investment banks and other investment firms. These banks do not accept deposits and instead use securities to raise cash for people, corporations, and governments. These are the firms in which the majority of American investment is concentrated. They are commonly referred to as mutual fund firms, and they provide pooled investment fund accounts to both individual and institutional participants.

Individuals and businesses can have access to a greater range of securities through investment banks. Account management is traditionally handled by financial advisors, but robo-advisers are taking over this position. Investment banking has also evolved into mobile technology banking, allowing consumers to use investment services on their own and at a lower cost.

Brokerage Firms

Brokerage companies, not to be confused with investment banks, are independent businesses that assist people and institutions in the purchase and sale of securities. When you wish to trade stocks, bonds, exchange-traded funds (ETFs), mutual funds, and other securities, you may need to work with a brokerage business.

Insurance Companies

Another form of financial organization that assists consumers in transferring the risk of loss is insurance firms. Insurance is essential for houses, automobiles, and other large assets, and by working with insurance firms, people and organizations may protect themselves from financial loss due to accidents, property damage, death, disability, and other serious misfortune.

Mortgage Companies

Finally, there are mortgage lenders. Mortgage firms generate and fund mortgage loans, and they cater to individual consumers. Some lenders also specialize in commercial real estate loans.

In conclusion

As you can see, each sort of financial institution serves a distinct role. However, it is natural that this distinct function is not always evident to the user.

Individual customers may connect with their retail bank without realizing they are simultaneously communicating with the central bank, an investment bank, brokerage businesses, insurance companies, and mortgage lenders. While many services may be provided by a single bank, such as a retail or online bank, they are really engaging with a variety of private banks and non-bank entities.