Options trading can be very confusing for those without a background in finance. There are several terminologies that are challenging to comprehend. The two biggest ones are CE and PE. When you first begin to learn options trading. What is CE and PE in stock market is a common question that everyone has?

What is C.E. in the Stock Market?

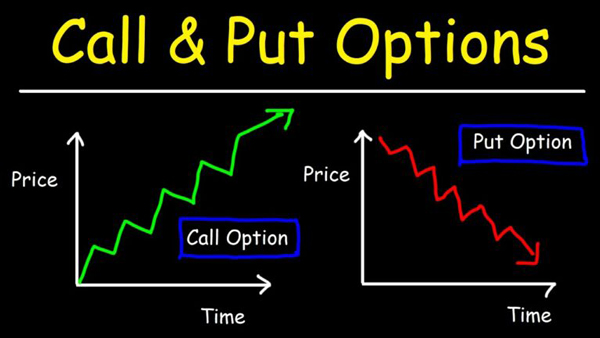

C.E. stands for Call European and is a short form of the Call Option. These kinds of investment agreements give the option investor the choice, but not the duty, to buy a stock, product, or any other asset at a predetermined price within a predetermined window of time.

The option to purchase a defined number of shares of that company at a fixed price (referred to as the strike price) before a specific date is provided to the investor by purchasing a call option on that security (known as the expiry date).

If the stock price is lower than the strike price at expiration, the call is not only worthless but also out of money. The call seller keeps any option premium that was paid.

What is P.E. in the Stock Market?

The abbreviation P.E. for “Put European” refers to the Put Option. PE grants the right to sell the securities at a predetermined price (the strike price) within a predetermined time frame to the owner of a put option.

A put option cannot exist without a buyer or a seller, in contrast to a call option. If you don’t have the option selected in the options segment, you also don’t get the call option. Put options on shares function similarly to call options on stocks. However, in this case, the option investor is pessimistic about the share’s worth and anticipates profiting from a decrease.

Example of CE and PE in the Stock Market

If a company’s call option (C.E.) costs 20 rupees and you believe that the market price will rise, you should buy the call option (C.E.). You have the chance to make money as the price of a call option (C.E.) rises along with the market price. If you believe that the market price will decline and a company’s Put Option (P.E.) is priced at 20 Rupees, you should buy the Put Option (P.E.). You have a possibility to make money from this if the market price declines.

Why Would You Buy CE and PE?

Advantages of CE

The multiplier effect on stock price gains is the main advantage of buying a call option. For a very little up-front cost until the option expires, you can benefit from a stock’s gains above the strike price. You anticipate the stock to increase before the call expires when you purchase it.

A call option gives the buyer an alternative to purchasing the underlying asset prior to the option’s expiration date. As a result, following the assignment, the seller is obligated to deliver the underlying good at the strike price. Depending on the position of each investment, this may be advantageous to either the buyer or the seller, or both at the same time.

Advantages of PE

In order to profit more from a stock’s drop, traders purchase a put option until the conclusion of the contract period and for an advance payment. Stock prices below the strike price can be profitable for a trader.

Purchasing a put involves betting that the stock’s value will decrease before the option expires. In the event of a stock decline, it might be seen as a form of risk management.

When purchasing a put option, the buyer has the choice to sell the underlying asset for the strike price. In the event that this choice is made, the seller will have to buy the shares from the holder. This might benefit both parties, depending on the goals of the borrower.

Options are often perceived as risky, although they could be if used improperly. However, by using options, investors can lower their risk while still having the opportunity to profit from a stock’s rise or fall.

Best Mediums for CE and PE Calls

There are several places where you may get calls on F&O, but you should use extreme caution when contemplating them, trade at your risk, and conduct your own analysis before setting up any F&O trading. The two options that are most frequently traded in F&O are Nifty and Bank Nifty.

Some of the facilities for CE and PE calls like TV Channel and Telegram Group. You can refer to them but absolutely do not let your portfolio be completely dominated, which poses a huge risk.

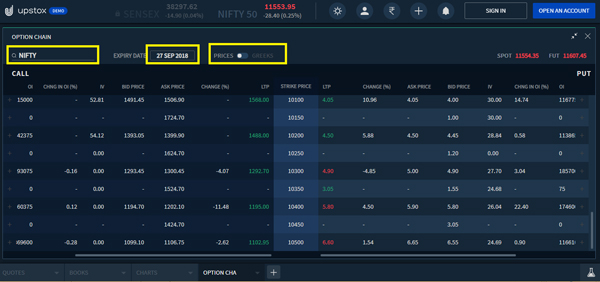

How Do You Trade Options in Upstox?

There are numerous stock trading platforms available for CE and PE trading. We will be demonstrating how to use Upstox for options trading.

- Step 1: Launch the Upstox app and select the “Search” icon in the upper-left area.

- Step 2: Access the F&O menu.

- Step 3: Select the F&O menu, type the appropriate indices or equities to trade, and then choose the desired CE and PE.

- Step 4: Next, choose either “Buy” or “Sell.”

- Step 5: At this point, you must choose 1 lot or more; the minimum quantity to be traded will be specified in that field. Since you are a newbie, we advise selecting 1 lot and beginning trading before clicking the “Review” button.

- Step 6: You must confirm the order by swiping the “Swipe to schedule order” button after clicking the “Review” button on the following screen.

FAQs About CE and PE in the Share Market

- What does CE in the stock market’s complete name mean?

Call Option is the name of CE’s full form.

- What does PE’s full name mean in the stock market?

PE stands for Put Option in its entirety.

- Is it Safe Trading Options

Compared to standard trading, options trading is highly dangerous and needs extensive market analysis. Since options trading is only appropriate for experienced traders, we advise novice traders to avoid it.

- Options Trading or Stocks?

Although options trading carries a high level of risk, it offers better short-term returns than dealing in deliverable stocks.

The Bottom Line

The two forms of options contracts that are offered on the market are CE and PE, or call option and put option.

The primary goal of purchasing a call option is to profit from rising share prices, whereas people purchase a put option if they have a negative outlook on a particular stock or commodity and believe that its price will decline over the course of a specific period of time.

Hedging your positions, which will assist you to survive in negative market conditions, is another reason to purchase these options. Hope our article has helped you to understand the difference between CE and PE in the stock market.