People say trading is risky. I say doing anything without basic knowledge is risky. Trading is not an easy game, of course, but it is rewarding for those who put their heart into it. If you are interested in trading stock options but are unsure how to start it, this blog is made for you. Equip yourself with the right knowledge, tools, and techniques, and you can conquer any financial market with confidence.

What Is a Stock Option?

A stock option gives traders the right, but not the obligation, to buy or sell a specific number of shares of company stock at a pre-set price, known as the “exercise” or “strike price.” There are two types of options: stock options puts and calls with puts as a bet that a stock will fall, or calls as a bet that a stock will rise. With shares of stock (or a stock index) as its underlying asset, stock options are considered a form of equity derivative and can be called equity options.

Another term often mentioned is employee stock options (ESOs), a type of equity compensation provided by companies to some employees or executives that effectively amount to call options. These employees might accept a lower-than-normal salary in exchange for the possibility of a big payday later on.

Understanding Stock Options

Before helping you understand how stock options work, let’s get some more understanding about stock options. Options are a type of financial instrument with their worth based on or derived from the value of an underlying security or asset. And in this case, that asset is shares of a company’s stock.

When a contract is written, it determines the strike price for the underlying stock to reach in order to be “in the money”. The difference between the underlying stock price and the strike price (a.k.a exercise price) determines an option’s value.

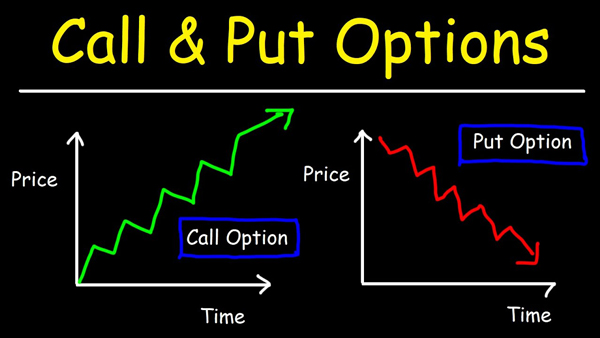

As stated above, stock options come in two basic categories:

- Call options: allowing the holder to buy the asset at a stated price within a specific timeframe.

- Put options: allowing the holder to sell the asset at a stated price within a specific timeframe.

Styles

There are two different styles of options: American (exercised at any time between the purchase and expiration date) and European (exercised on the expiration date).

Expiration Date

The specific date when the holder expects the stock to rise or fall. This date is important because it helps the holder to price the value of the put and the call (the time value).

Strike Price

The strike price is the price that the holder expects the stock to be above or below by the expiration date. It helps determine whether the holder should exercise an option. For example, if the holder is betting that IBM’s stock will rise above $150 by the middle of September. They may then buy a September $150 call.

Contract Size

Contracts show a specific number of underlying shares that the holder may be looking to buy. One contract equals 100 shares of the underlying stock.

So, if the above-mentioned holder decides to buy five call contracts, he would own five September $150 calls. In case the stock rises above $150 by the expiration date, the holder would have the option to exercise or buy 500 shares of IBM’s stock at the price of $150, no matter what the current stock price is. But if the stock’s price is less than $150, the options will expire worthlessly, and the holder would lose the entire amount spent on the options, also known as the premium.

How Do Stock Options Work?

Stock options in a company are commonly used to retain current employees and attract prospective employees. With stock options, a prospective employee gets the chance to own stocks of the company at a discounted rate compared to buying them on the open market. In the case of current employees, companies use a technique called vesting to encourage employees to stay through the vesting period in order to take ownership of the options granted to them.

For example, if you are granted 10,000 shares and your vesting schedule lasts for four years, you will need to stay at least one full year to get 2,500 shares and four full years to be able to exercise all 10,000 options.

How to Exercise and Sells Stock Options

First and foremost, you cannot exercise your stock options before they are vested. That means if you are laid off before you are vested in your options, your unvested options might be lost.

Once your options are ready to be exercised, there are several ways to do so:

- Cash Payment

- Cashless Exercise: At some companies, you can exercise your options by selling just enough of them to cover the costs of exercising others.

- Cashless Exercise/Sale: Some employers can also allow you to exercise and immediately sell your options at the current market price.

To decide whether you should trade stock options, you should get an in-depth understanding of stock options and how they work. It is often an incentive given by companies, hence, you should take them into careful consideration to decide whether you should take the job. To make the most of it, check out courses regarding both options trading and stock trading to learn valuable knowledge, techniques, and tools to trade profitably.