$25.00 $199.00

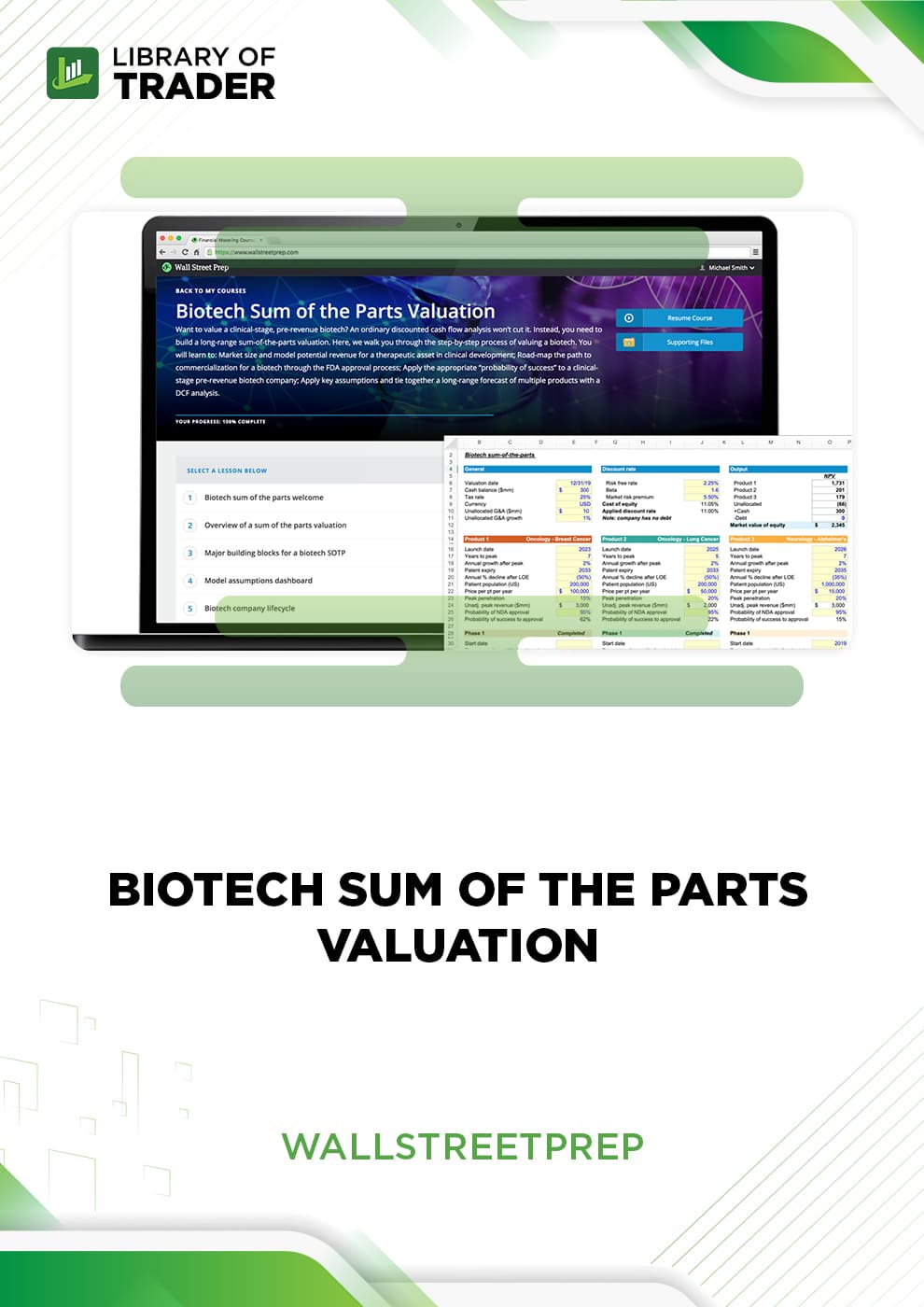

Ideal for investment professionals in biotech, this course teaches industry-standard methods for constructing biotech-sum-of-the-parts valuations.

Ideal for investment banking private equity and VC professionals focusing on the biotechnology industry, you will learn how to build a biotech-sum-of-the-parts valuation the way it’s done on the job.

Real World “On the Job” Biotech SOTP Valuation

Want to value a clinical-stage, pre-revenue biotech? An ordinary discounted cash flow analysis won’t cut it. Instead, you need to build a long-range sum-of-the-parts valuation.

This 60-minute video short course + model template bridges the gap between academics and the real world and equips trainees with the practical modeling skill set needed to build a biotech SOTP Valuation.

This course assumes no prior knowledge in biotech company valuation.

Excel Model Template Included: A biotech sum-of-the-parts (SOTP) model template is included with this course

What You Will Learn

- Market size and model potential revenue for a therapeutic asset in clinical development

- Road-map the path to commercialization for a biotech through the FDA approval process

- Apply the appropriate “probability of success”” to a clinical-stage pre-revenue biotech company

- Apply key assumptions and tie together a long-range forecast of multiple products with a DCF analysis

Who is This Program For?

This biotech sum-of-the-parts valuation course is designed for professionals and those pursuing a career in the following finance careers:

- Investment Banking

- Venture Capital

- Private Equity

- Anyone who wants to learn how professionals build a biotech-sum-of-the-parts valuation

Course Extras

Taught by Bankers

Our instructors are former investment bankers who give lessons real-world context by connecting it to their experience on the desk.

Used on the Street

This is the same comprehensive course our corporate clients use to prepare their analysts and associates.

Free Unlimited Access to the WSP Support Center

Receive answers to questions, free downloads, and more from our staff of experienced investment bankers.

Course TOC

Biotech Sum of the Parts Valuation

1. Biotech SOTP course welcome

2. Biotech SOTP introduction

3. Course Downloads

4. Overview of a sum of the parts valuation

5. Major building blocks for a biotech SOTP

6. Model assumptions dashboard

7. Biotech company lifecycle

8. Identify peak revenue opportunity

9. Therapeutic areas overview

10. Product launch timing and uptake curve

11. Patent life and loss of exclusivity

12. Road to commercialization

13. FDA clinical trials

14. Building a commercial infrastructure

15. Completing the SOTP

16. Probability of success

17. Build out one part of the SOTP (Product #1)

18. Finalizing the valuation model

19. Valuation sensitivities

20. Example: Blueprint Medicines Corp

21. Biotech SOTP Course Review

RELATED COURSES

VIEW ALL-

Oil & Gas Modeling – Wall Street Prep$50.00

Oil & Gas Modeling – Wall Street Prep$50.00$499.00Oil & Gas Modeling – Wall Street PrepUpdate 11 May 2024Designed for finance professionals pursuing Oil & Gas careers, this course provides an in-depth look at the industry, including O&G accounting and financial statement analysis, O&G projection drivers and Net Asset Value modeling.

Add to wishlist -

Value Trap Indicator Complete Package – Einvesting For Beginners$15.00

Value Trap Indicator Complete Package – Einvesting For Beginners$15.00$197.00Value Trap Indicator Complete Package – Einvesting For BeginnersUpdate 28 Jan 2025The Value Trap Indicator Package helps you analyze companies using key metrics, with tools like a book, audiobook, spreadsheet, bankruptcy data, and a special report.

Add to wishlist -

Vipars – Stratagem Trade$110.00

Vipars – Stratagem Trade$110.00$999.00Vipars – Stratagem TradeUpdate 02 Jun 2025The ViPars™ mini-class gives you a complete, pro-level tactic to trade volatility with confidence.

Add to wishlist -

Turn Fear Into Profit Workshop – Trade Mindfully$90.00

Turn Fear Into Profit Workshop – Trade Mindfully$90.00$699.00Turn Fear Into Profit Workshop – Trade MindfullyUpdate 02 Jun 2025Overcome fear and boost trading performance in this 6-week workshop with Dr. Gary Dayton, using proven psychology and mental training tools.

Add to wishlist -

Mastering VWAP – Verified Investing$70.00

Mastering VWAP – Verified Investing$70.00$499.00Mastering VWAP – Verified InvestingUpdate 11 Aug 2025Master VWAP like institutions. Learn precise entries, exits, and risk control with Doctor B.’s proven strategy plus his 1-Minute Scalpel Method.

Add to wishlist -

Ultra Blue Forex Collection – Ultrablue Forex$49.00

Ultra Blue Forex Collection – Ultrablue Forex$49.00$497.00Ultra Blue Forex Collection – Ultrablue ForexUpdate 15 Jul 2022You’ll be able to get into the full preparation necessary for persistent effective trading in the forex market with the massive quantity of material in the trading course Ultra Blue Forex Collection from Ultrablue Forex.

Add to wishlist