Option strategies for high volatility are designed to take advantage of such a situation, thus grabbing the chance of potential profits and limiting the risk of loss, when the market hits high volatility, the stocks have a greater probability to make significant movements in either direction within brief periods.

1. What is options trading?

An Option is a contract that is connected to an underlying asset, including a stock, security, and the like. Options trading is the process of trading instruments where you get the right to buy or sell a certain type of aforementioned assets on a specific date and at a specific price.

There are two types of options trading known as the call option and the put option. A call option is likely to be carried out when the prices are expected to increase, and vice versa for a put option.

2. Seven factors affecting options trading

There are altogether seven factors or aspects that take part in the price determination of an option, including:

- The market price of the underlying asset

- Strike price

- Call option or put option (Option type)

- The expiration date (Period before expiry)

- Risk-free interest rate

- Dividends of the underlying asset

- Volatility

The first six of them have clear input values into an option pricing model. The remaining one – volatility – can only be estimated. As a result, despite its ambiguity, it is still the most important factor to determine the price of an option. Different traders have varying expectations and have their strategies to put into action in correspondence with the situations.

3. What does high volatility mean in options trading?

The market volatility is the result primarily due to the uncertainty brought by involving aspects, including the changes in interest rates, inflation rates, other monetary policies, as well as national and global events.

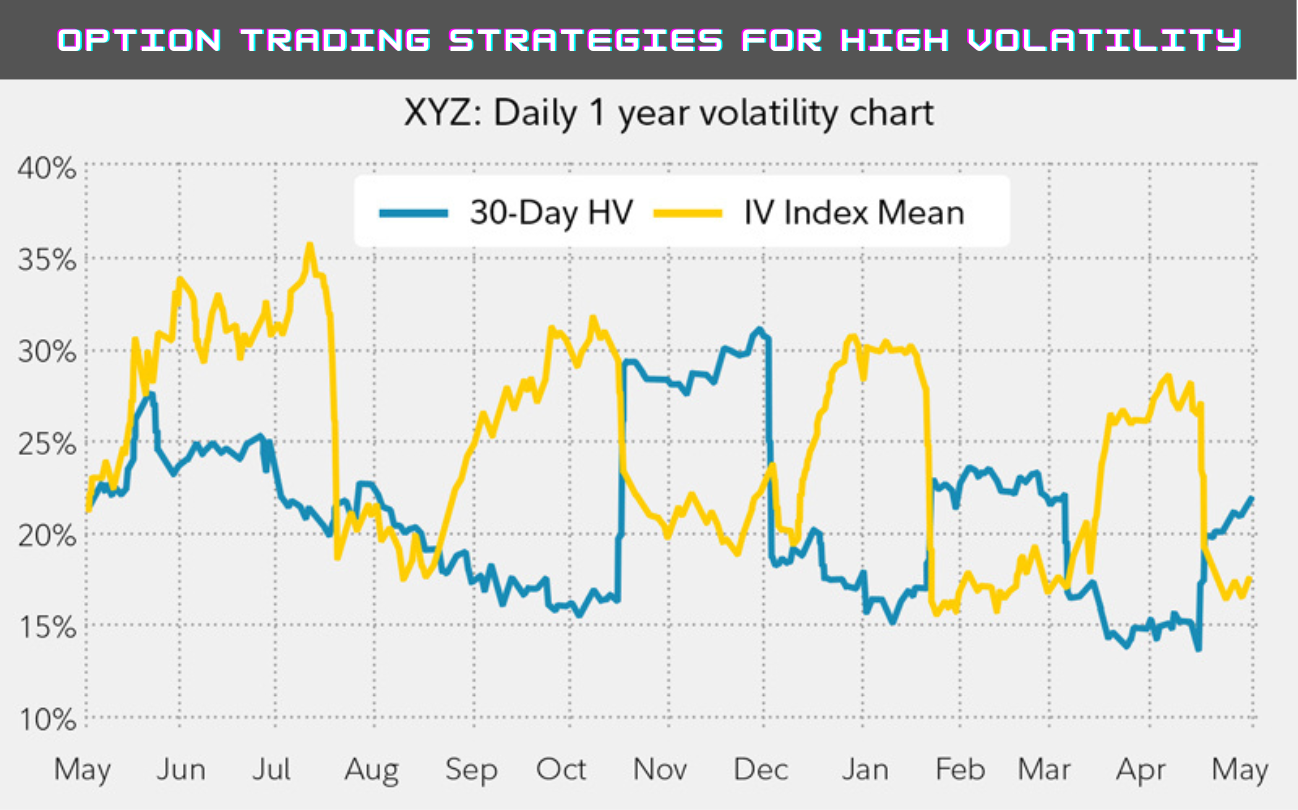

Two common way to view the state of volatility is either ‘historical’ or ‘implied’. Historical volatility (HV) is the actual volatility illustrated by the movements of the underlying asset over a long certain period. On the other hand, Implied volatility (IV) is the level of volatility suggested by the current option price of the underlying asset.

Although implied volatility is expected to be far more relevant than historical volatility for option pricing, the combination of the two should be considered for a more certain idea of the direction where the prices are heading.

4. What is the best options strategy for high volatility?

As the unstable situation strikes the market, you may wonder “how do you profit from high volatility?” or “which option strategy is best for high volatility?” to Take advantage of volatility with options, so The strangle options strategy is designed to take advantage of volatility. Depending on what your view is toward the market, certain options trading strategies may be put into action:

4.1. Being bullish on high volatility

Common bullish options trading strategies for high volatility include short condor (long iron condor), long butterfly, long calendar, and two of the most notable – long straddle and long strangle:

- Long straddle: in a long straddle, you buy both a call and a put option as well at the same price and expiration date for one mutual underlying asset. If the price makes significant movements in either direction., you can make a profit. However, if the stock just goes flat, a considerable loss should be expected.

- Long strangle: in this strategy, most of the process is the same as above, however, the price of the call option is different from that of the put option.

One key reason behind choosing the combination of different prices in the long strangle is that you think there may be a greater chance for the price to move in a certain direction.

4.2. Being bearish on high volatility

Traders that are bearish on high volatility only profit when the underlying stock price moves insignificantly or just stays flat. Certain strategies are used in such situations, including ratio spreads, long condor, short butterfly, short calendar, short straddle, and its notable counterpart – short strangle:

- Short straddle: a short straddle is where you write or sell a call and a put option at the same strike price to receive the premiums on both positions. The reason behind this is that traders believe that the high implied volatility will decrease towards the expiration date, allowing most of the premium to be retained.

- Short strangle: a short strangle is the same as a short straddle. The only difference lies in the strike price on the positions of the call option and the put option. The general rule you have to follow is that the strike price of one option should be different from the other one, however, both should be out-of-the-money and has approximately similar distance toward the current price of the underlying asset.

5. In conclusion

Above is only some simple descriptions of common option trading strategies for high volatility. Most of them are not only complicated but also involve potentially unlimited losses, making them only worth considering for traders who are well-experienced with the risk of options trading. Fresh traders should take more time before actual practices and just stick with other simple strategies.