Trading with multiple time frames allows the trader to increase the probability of winning trades and reduce the risk. This concept involves observing different timeframes for the same asset, determining the overall market direction on the higher time frames, and then looking for entries on the lower timeframes.

What Is Analysis Using Multiple Time Frames?

Multiple Time Frames is the analysis that is tracking a currency pair in different time frames. Larger time frames (three different time periods) for long-term trend-setting, allow for a wide enough reading in the market. While shorter time frames are used to spot ideal entries into the market. Sometimes it also causes significant data loss.

Converting between time frames often uses a common ratio of 1:4 or 1:6. This method helps to quickly access and detect smaller fluctuations. The disadvantage of this method is that it doesn’t work because price movements are geared towards the overall trade. It can also lead to unnecessary stress when the market moves quickly.

More specifically, traders can magnify the 10-minute chart at a 1:6 scale or the 15-minute chart at a 1:4 scale when viewing trends on the hourly chart.

Multiple Time Frames Analysis Using Counter-Trend Trading in 2022

The chart below shows that on a higher time frame you can establish resistance, which is shown as 1 (resistance level). At resistance, you might be looking to enter a short-term trade, after the price bounced off the resistance level.

The short entry shown in the chart is 2 (short entry point on higher time frame). Then you would place a stop loss above the resistance, shown in the chart as 3 (stop loss above resistance level). This results in a stop loss distance of 19.5 pips, which is showing as 4 (higher risk of 19.5 pips). However, you can reduce this risk by using a lower timeframe to enter.

You can reduce your risk by switching to a lower timeframe and consider entering a short trade after the price has broken out of the resistance level.

The green line shown is 1 (resistance level), which is the same green line as shown in the 1-hour chart above – it’s the same resistance level. The candles are much smaller on the 15-minute chart because the price doesn’t move as far in fifteen minutes as it does in an hour.

This means you can enter a short position, shown as 2 (entering on a lower time frame means lower risk), with much less risk, as you can place your stop loss above the resistance line, shown as 3 (stop loss above resistance level). This leads to a much smaller risk of 8.9 pips, shown in the chart as 4 (lower risk of 8.9) compared to a risk of 19.5 pips on the 1-hour chart above.

How to Picking Time Periods

The trading timeframe you choose will greatly affect how you interpret the information displayed. The lowest trading timeframes will show a lot of unhappiness, most of which can be attributed to simple noise. However, they will also show you important turning points and resistance levels that higher timeframes may not be so obvious.

Higher timeframes also give you a better overview of market movements. This keeps you from following the main trend while chasing small rallies on a lower timeframe.

Short-Term Time Frame

The advantage of a short-term timeframe is the granularity of the information provided. Some charts will offer timeframes as low as a tick, which allows you to track every nuance of the price over a period of several hours. This means you can more accurately identify inflection points and resistance levels, allowing you to quickly identify sharp price movements around these key areas.

The image below shows the difference between a 1-minute chart (left) and a 5-minute chart (right). The 1-minute chart has 5 candles for each on the 5-minute chart and is faster in showing entry and exit points. However, the 5-minute chart is cleaner and less noisy.

The disadvantage to shorter timeframes is that you can easily lose sight of the forest to the trees. Much of the movement in the shorter timeframes will simply be noise, which means you’re making trading decisions based on essentially random movements on the chart. The shorter timeframes are ideal for traders of size and momentum who are looking to make a quick trade or two to take advantage of strong but short-term price movements.

Long-Term Time Frame

The advantage of a long-term timeframe is that you have a much better picture of what is driving the price in the long term. A stock can typically change 5% over the course of a trading day, but then stabilize back to its opening price at the close of the trading session.

The longer time frame is suitable for investors who are not interested in the small daily changes of the stock and are looking for large profits over the long term by predicting the overall trend of the stock price.

You can see that the two charts (as shown) are much slower than the chart of the short-term timeframe. It is easy to understand when it is used in long-term trading such as intraday swing trading, etc.

How Can I Tell Which Forex Time Frame Is Best?

Time frame in forex trading can refer to any specified unit of time in which a trade takes place. Typically, forex timeframes will be measured in minutes, hours, days, or weeks. You will choose the timeframe that best suits your trading strategy.

In general, traders should choose a timeframe that suits:

- Amount of time available to trade per day

- Most commonly used timeframes used to determine trade setups

Best Forex Timeframes for Scalpers

Scalping is a style of trading that involves identifying small price changes in the forex market and then buying and selling large volumes of currencies in a very short time. By repeating this strategy over time, scalpers aim to make a series of small profits plus a decent day’s profit.

You need to choose a currency pair with high liquidity and use trend analysis to determine the right entry time. After buying and waiting for it to rise slightly within a minute, you sell your holdings and deposit the profits in the bank, then start the process again.

>> Course: Market Making Scalping Manual – Gary Norden

Best Forex Timeframes for Day Traders

Day traders tend to take a short-term approach, with most time frames choosing between 15 minutes and four hours. The benefit of being a day trader is that you can choose from a wide variety of timeframes, depending on the liquidity of your chosen market, the amount of time you have available to execute your trades, and your preferred trading strategy.

Techniques for Day Traders to Analyze Multiple Time Frames

Day traders trade in short timeframes. These time periods are anywhere from a minute to 15 minutes, to a one-hour timeframe. Day traders usually set up their trades on the 1-hour timeframe first, then can change to smaller timeframes like 15 minutes to find the ideal entry points of the market.

Based on the 1-hour chart, day traders can establish whether the market is up or down. If the price is trading above the 200 MA and is moving up, this is a sign of a long-term trading trend. Then start looking at the 15-minute chart to spot potential entries.

>> Read more: Day Trading Strategies For Every Trader in 2022

How to use Multiple time frame trading

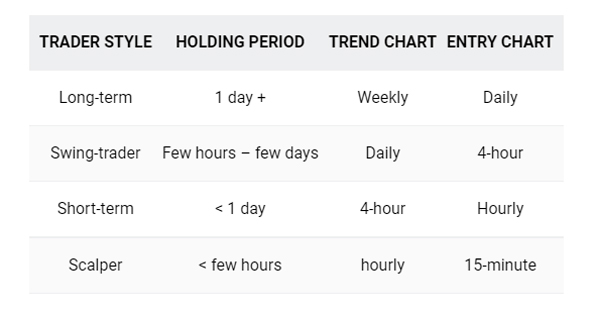

You first determine the timeframe that you should focus on. A trading across several time intervals is simply the process of looking at the same pair and the same price but on different timeframes.

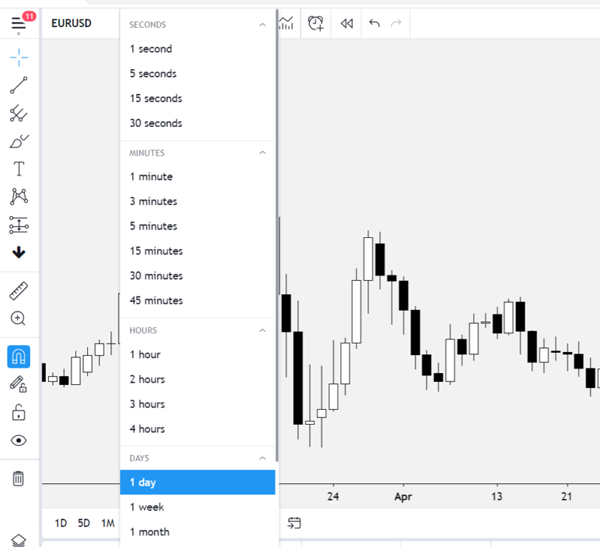

A pair exists on several timeframes – daily, hourly, 15 minutes, or even 1 minute. As you use the chart, you will notice that there are different timeframes being offered.

The current chart above is the “1 day” or daily timeframe. When you click on “1 hour”, it will show a 1-hour chart, similar to a 1 week, 1-month, etc chart. Charting apps offer multiple timeframes because there are different market participants in the market. This means that different forex traders can have different opinions on how a pair trades and both can be completely correct.

Let’s say you notice a potential EUR/USD currency pair and want to trade them. First, you can look at its 4-hour chart to determine the overall trend and realize that it is in an uptrend. This shows that you should look for buy signals.

For extra certainty and to avoid getting caught in the wrong direction, you can zoom back to your favorite timeframe (1-hour chart as shown below) and enable the Stochastic indicator. You can define the entry point.

This 1-hour chart shows that a Doji has formed and the Stochastic has just broken out of the oversold conditions. If you are still not sure whether to buy now or not, further analyze the 15-minute chart.

The 15-minute chart shows that the trendline is holding quite strongly and is a good signal to start buying orders.

What Are the Benefits of Looking at Multiple Time Frames?

Some benefits of using multiple time frames:

- Provides different perspectives on a currency pair

- Detect trend changes earlier

- Spot upcoming support or resistance areas

- Confirm trend change in a higher time frame

- Enter or exit a trade as soon as possible

- Know what other market participants are thinking

- View the small image, medium image, and large image

The Bottom Line

Using multiple time frames analysis can greatly improve the odds of successful trade execution. This is a simple way to ensure that a position benefits from the direction of the underlying trend but many traders overlook the usefulness of this strategy.