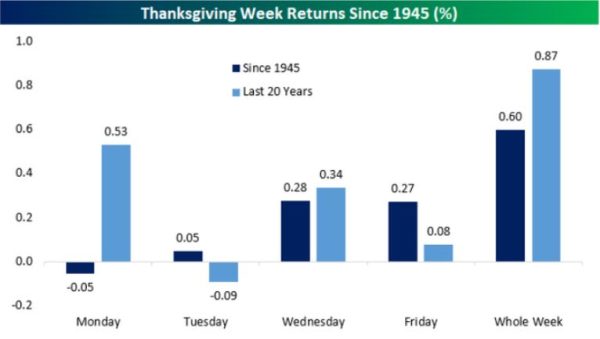

Throughout the history of the stock market, Thanksgiving is attached to going low in trading volumes. Thus, it might cause choppy actions. According to Bespoke Investment Group, there have been modest gains during Thanksgiving week since 1945.

Specifically, it has a 60 basis point on average and advances for the SPX, +0.48%, with the best returns on Wednesday – between the holiday and Black Friday.

Amid the inflation fears and uncertainty about the policies of the Federal Reserve and President Biden, the prospects of gains through the Thanksgiving week can be heart-warming to investors.

This article serves you with some outlooks on what the stock market will be like during the holiday period and what you should do for the best profits.

The Influx of Shopping on Thanksgiving Weekend

There are over 100 million people shopping online for the first time in 2019. Also, the number of online-only shoppers climbed 44% to 95.7 million. Based on the statistics by the National Retail Federation (NRF), people spent about $311.75 through the five-day period, decreasing 13.9% from $361.90 in 2019.

Monday of Thanksgiving week has been synonymous with being negative more times than positive. Tuesday might average a small loss while the Wednesday before Thanksgiving has recorded a positive 78% of the time averaging a gain of 0.3%. Over the past 50 years, the day after Thanksgiving reaches a 0.22% return on average, which has been positive 66% of the time.

Black Friday and Thanksgiving happen in the same week. And it is the festive season for buying new things with appealing discounts. These events have had profound impacts on U.S. economics. However, the U.S. stock markets are closed on Thanksgiving so little impacts of the holiday on the market are recorded.

The stock markets are open only half of the Black Friday. Is there any likelihood of the success of stock traders?

The Effects of Black Friday Weekend and Thanksgiving on Stocks

The sales numbers on Black Friday are what investors will look at to measure the overall state of the entire retail industry. If the number is lower than the average or the one in previous years, it can indicate the slow growth of the economy. It might cause the ‘down mood’ of the stock market, consequently.

The extra days off for holidays like Thanksgiving and Christmas can lead to increased trading activity and higher returns the day before a holiday or a long weekend. People attach the phenomenon to the holiday effect or the weekend effect. Many stock traders take these seasonal effects as a chance to enhance their income.

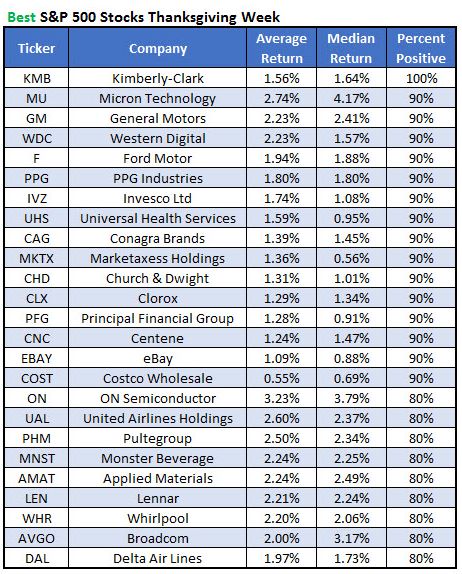

The most energetic sector is retail during the period from one week before to one week after Black Friday and Thanksgiving. The pattern is repeated from 2007 to 2017, a group of S&P 500 retail stocks showed a 5% return, in comparison with the average 3% return for the S&P 500 over the period. The positively-traded period can last around 10 days.

Yet, the market cycle was not broken in 2020 as the S&P 500 returned 4.1% while the retailing industry group only returned 2.2%. It is full of uncertainties. So, what should traders expect from the stock market during the holiday week?

The Forecasts of the Stock Market in the Thanksgiving Week 2022

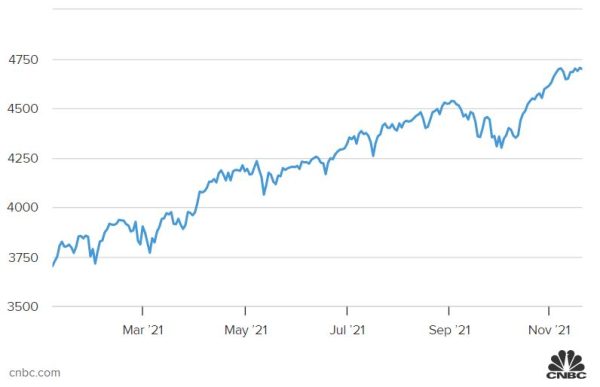

There are positive signals in the upcoming Thanksgiving week. The S&P 500 witnessed slight growth in the past week with a 1.7% jump in October’s retail sales. Wednesday’s personal consumption expenditures will be released with the inclusion of the inflation measure by the Federal Reserve.

If history is a guide, the last five trading days of November will follow the positive trend as it has been since 1950. The chances of the market being up on the day before and after Thanksgiving are 67% and 57%, respectively.

The holiday rally now heavily depends on whether Federal Reserve Chairman Jerome Powell continues to be in his role as his term is about to expire in February. Meanwhile, Fed Governor Lael Brainard, supported by progressive Democrats, had a sit down with President Joe Biden.

Experts anticipate that the market will be stirred around the appointment. Lael Brainard is known to be more dovish than Powell so she might not raise interest rates promptly. It might be a bad sign if Lael Brainard is not aggressive in fighting the elevated levels of inflation.

In the meantime, the spread of Covid in Europe and beyond has become a concern. It can profoundly impact the market movements when the lockdown or social distancing can happen again. Specifically, Austria has announced a three-week lockdown and a vaccine mandate.

The stock market recorded the Austrian news Friday with mixed feelings. The Down is down 1.4% and the Nasdaq is up 1.2%, explained by the growth of tech stocks.

The worry about inflation and Covid spread can lead to overbought conditions. So, the market can move sideways to lower but might end the year at higher points. However, there are a lot of variables for many scenarios, contributing to the unpredictability of the stock market in the upcoming Thanksgiving and Black Friday.

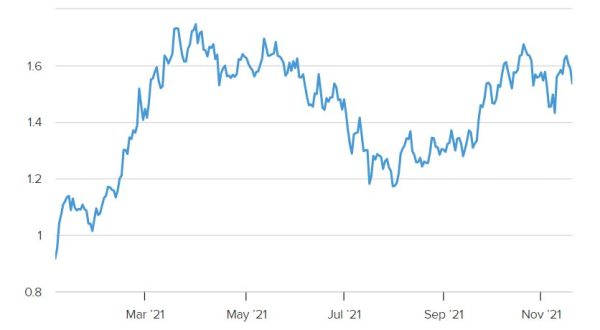

Watching the benchmark 10-year Treasury yield, strategists from Wells Fargo bond indicate that long-term Treasury yields move lower on the Monday and Tuesday before Thanksgiving. Risk appetite seems to be low on both sides of buying and selling. Yet, the yield is expected to rise from Wednesday.

In Conclusion

This article combines information and forecasts about the stock market in the upcoming Thanksgiving holiday from reliable sources. Hopefully, it can bring you some valuable insights into potential trends and solid performances of some stocks throughout history. Hence you can make optimal decisions on whether you should buy, sell, or hold stocks.

As a thank you for your time reading this article, we offer the coupon BLOGNOW10 for a 10% discount when buying trading courses in the Library of Trader.