What a point? Are trading and investing the same things? It is quite a common assumption. However, there is a decisive point that you need to understand. If you want to find the most profits in your money, you can either trade or invest in something. The factor of time is the real key to uncovering success.

Different mindsets for different goals. Traders leverage the uptrends and downtrends of the market to earn much more frequent profits. Meanwhile, investors love to hold their investments and expect much larger profits in a longer time frame. Read on this blog for more information about the difference between trading and investing.

What Is Trading?

Living up to what people call it, trading is a series of selling and buying instruments, such as options, currencies, stocks, etc. Traders make an effort to reach one universal rule – buying low and selling high. The differences in prices in transactions are what traders expect. So, the ups and downs in the way the market moves profoundly impact the earnings of a trader.

The updates of the trading market’s current status speak to great volume in whether you win or lose. It depends on the time frames that traders choose. The specific techniques and strategies will come along to handle the moments when the market is not in their favor. But the underlying principles are to practice the timing skills and how to read through the trading charts.

Instead of waiting, traders love to take timing actions. When the market paves the path for earning profits, they will eagerly grab that moment. When everything is going tough, they try to stop the trades or get out of the market. It puts the role of technical analysis under the spotlight. So, you might find them adore the functions of many tools and indicators. They can speed up the process of developing the trading setups for high profits!

There are different categories of trading, based on the time frames. The following content walks you through the common types, such as:

- Position trading lasts from months to years.

- Swing trading lasts days to weeks.

- Day trading takes place within a day.

- Scalp trading happens in seconds and minutes.

The styles of trading are also various. There are many elements for consideration, such as the account size, trading experience, the mindset towards risks, etc.

What Is Investing?

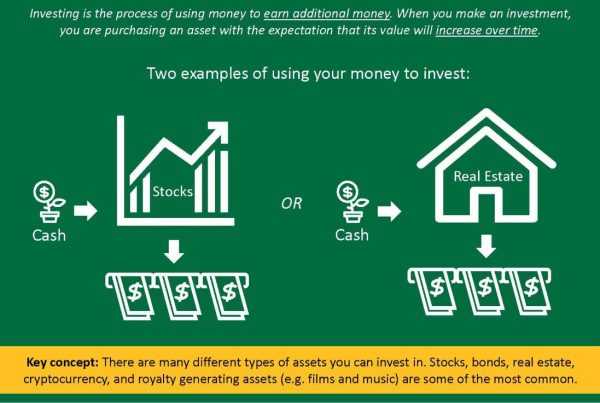

Investors love to look for long-term profitability. It is not for small and frequent earnings. Investments can last years, even decades. The fluctuations of the market do not impact their decisions. The thing that they pay attention to is the market fundamentals. The projection of management and the ratios of price-to-earnings play an important role in profitable investments.

In other words, they pay more attention to the consistency of profit growth than the instantaneous ups and downs. It is common sense that they invest in an account for their retirement, it can last for decades. So, the increasing ratios of earnings speak more value to such investors.

It emphasizes the fact that they need to buy and hold a portfolio of items for a long time. They will wait out the tough and adverse situations of the trading market. Unlike traders, timing is not among the crucial factors for their profitability.

So, What Is The Difference Between Them?

You can spot the difference between trading and investing through the thorough writing above. It is the time span. Traders look forward to the short-term income while investors patiently wait for the large income due to the consistent growth of ratios.

Another way to talk about this aspect. Investing is more about growing the value of your money through time. They can start an investment that lasts for many years. During the time they invest, they might not gain any frequent income. But when looking at the charts and ratios, you will be able to see the growth of their income.

Meanwhile, trading has a shorter-term approach to earnings. You can see this element in the categories mentioned above. The longest trade is only within a year. So, traders will gain back from their investing money in a shorter time frame. Whether it is a loss or gain!

Why Should You Learn This Aspect?

‘Is it secondary to know about such things, isn’t it?’. No, the difference between trading and investing speaks a lot for the way you take action and develop strategies.

First, the way traders aim for the frequency of earnings emphasizes the importance of how often they catch up with the fast pace of the market. They need to get the timing entries or exits for optimal earnings. The risks of downtrends and the potentials of instant earnings are what traders love to take for their considerations!

On the other hand, investors do not get thrilled with how the market fluctuates. If the fluctuations of uptrends or downtrends last for a long time, they will pay attention. Otherwise, the volatility does not impact their emotions or decisions. The ultimate goal is to grow their money through time, so the stability of the growth is the center!