Day trading or any other business in that inventory is bought at a lower price and sold at a higher price. However, there is a difference that in the financial space, both buy and sell transactions can be executed instantly, generating a quick profit or loss, leading to day trading taxes. With the increasing accessibility of day trading, training courses to educate anyone interested in how to trade financial assets have spread across the internet.

As with any business, trading in financial assets requires investments in equipment and the payment of regular expenses including commissions, platform fees, data charges, interest on margin-based loans, and office costs. Profit or loss from day trading has a tax impact on the trader’s other income-generating activities.

How Are Day Trading Taxes Explained?

Day trading is a form of making money quickly thanks to the price difference of the day. However, if the loss or profit is low on target, this will greatly affect the day trading tax.

Day trading taxes are explained to be a complicated round for day traders when it comes to profit and loss reporting. Whether you’re trading full-time for a living or just trying to accumulate cash for your long-term savings, there are many taxes to consider.

Profitable traders pay a tax that reduces their potential profits. Day trading does not qualify for favorable tax treatment compared to long-term buy-and-hold investments.

You manage your portfolios of day transactions like a business and if they meet IRS requirements, the tax impact on your account is somewhat less. It also increases the likelihood of making any net profits subject to self-employment tax.

What Are the Rules of Day Trading Taxes?

- You must pay tax on investment gains in the year you sell

- You can offset your capital gains against your capital losses, but your total return cannot be more than your losses

- Investors can avoid or defer day trading taxes by keeping their investments in a tax-advantaged account, such as a 401(k) or Roth IRA

- Ordinary income tax will apply to any earnings if the investments are held for a year or less

- You can use up to $3,000 in excess loss each year to offset your ordinary income such as wages, interest, or self-employment income on your tax return and carry over any excess losses remaining for next year

- Traders take advantage of lower long-term capital gains tax rates by holding an investment for more than a year

- Capital gains distributions and dividend distributions require investors to pay taxes in the year these distributions are paid off

Which Are Types of Day Trading Taxes?

Taxes on Day Trading Crypto

Your Bitcoin, Ethereum, and other cryptocurrencies are all taxable. The IRS treats crypto holdings as “assets” for tax purposes, which means your virtual currency is taxed just like any other asset you own, like stocks or gold.

The day trading crypto market hit multiple all-time highs and lows throughout the year, resulting in massive gains and losses for many investors.

All things to explain taxes on day trading crypto is that for most people who buy and trade cryptocurrency in online exchanges, it should be relatively easy to calculate it in your tax return. But like most things related to cryptocurrencies, things can get a lot more complicated the more active you are.

The length of time you own the cryptocurrency also plays a part. If you hold a unit of Bitcoin for more than a year, it usually qualifies for long-term capital gain. But if you buy and sell it within a year, it’s a short-term gain. These differences can affect which tax rates are applied.

Tax rates also vary based on your overall taxable income, and there is a limit to how much you can deduct for capital loss if your crypto assets lose value.

Day Trading Futures Taxes

Traders should allow the 60/40 rule to prefer tax rates on futures trades in advance. That means 60% of net gains on futures trading are treated like long-term capital gains. The other 40% is treated as short-term capital gains and taxed like ordinary income. You should visit the IRS website or speak with your tax consultant for more information.

Day Trading Options Taxes

Day Trading Options Taxes includes three main parts:

- Employee stock options: These are typically options contracts given to employees as a form of compensation. For example, motive stock options

- Stock Options: Stock options can be traded on the open market

- Non-Equity Options: These are options contracts on something other than stock or ETF, which can include commodities, futures, or stock market indices. widespread. The IRS often calls these options “section 1256 contracts.” These types of day trading options can also be traded on the open market. Examples include placing or buying gold, pork belly futures, and even the S&P 500 index.

Stock Day Trading Taxes

How are stock day trading taxes explained? An individual shall not be considered a stock trader simply because the individual calls himself or herself a trader or day trader or engages in a limited amount of trading activity, regardless of its nature.

If a day trader qualifies as a stock trader, selling the day trader’s securities results in capital gains and losses. A qualified day trader is considered to be in the business of buying and selling securities, but the trader is not subject to self-employment tax on gains and losses from the sale of his or her securities.

A day trader who qualifies as a stock trader can also deduct expenses from his or her business as business expenses because trading is treated as a business.

How Are Day Trading Profits Taxed?

When you sell your investment for more than the original cost, you gain capital gain. It incurs capital gains tax. To find out how much profit or loss you can make, and how day trading taxes are counted to profits, you can compare the difference between the buy and sell prices.

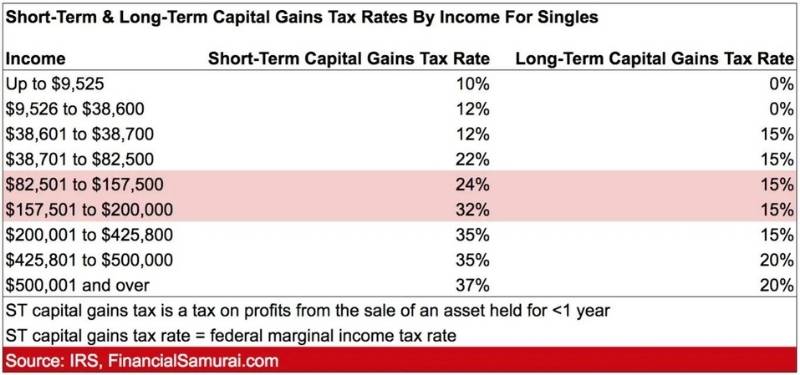

Short-Term vs. Long-Term Capital Gains

How tax is calculated will depend a lot on how long you hold your portfolio. If you hold them for more than a year, you are eligible for favorable (lower) long-term capital gains tax rates. But if you sell earlier, which is common for day traders, then you will have a short-term profit and loss.

Short-term capital gains are taxed at the same rate as ordinary income. This means that any profits added to your annual income will be taxed at the same rate. Those with high incomes pay a similarly high tax.

Day trading taxes rate

You usually only owe tax on profits after you sell your holdings at a profit. But billing periods can be complicated, and you may need to pay estimated day trading taxes quarterly on sales you complete throughout the year. If you pay late, you may owe tax penalties and interest fees, so talk to a tax professional if you’re not sure when your taxes are due.

The day trading taxes rate for long-term capital gains is 15%. For short-term gains, the loss day trading taxes rate can be up to 37%. Day traders pay a short-term capital gain of 28% on any profit. You can deduct your losses from your gains to include in the taxable amount.

How Costs Can Overwhelm Profits

Successful day traders need access to a number of tools to outperform the market. They typically pay for an investment trading platform and purchase tools that provide the research, charting, and other functionality needed to trade profitably.

While brokerage fees have mostly disappeared, some companies still charge fees for certain transactions. Any brokerage fees charged, add up quickly as you buy and sell investments multiple times per day. Compliant fees, although small, add another cost.

Some day traders use margin, or debt, to leverage their trades. This creates the potential for higher profits while exposing traders to a greater risk of loss. Investors must pay interest and may have to pay other fees for using margin.

How To File Taxes as a Day Trader

For those who are completely new to the financial markets, the basic difference in tax structure is between long-term investment and short-term investment. Long-term investments, those held for more than one year, are taxed at a lower rate than transactions held for less than one year, which are taxed at ordinary income.

Taxes are complex, so traders need to spend a lot of time studying them in depth. A professional tax preparer can ensure that your trading activity is reported accurately and you should consult your CPA to avoid problems.

| Gross Annual Income | Long-Term Tax Rate | Regular Tax Rate |

| Up to $9,325 | 0% | 10% |

| $9,326 to $37,950 | 0% | 15% |

| $37,951 to $91,900 | 15% | 25% |

| $91,901 to $191,650 | 15% | 28% |

| $191,651 to $416,700 | 15% | 33% |

| $416,701 to $418,400 | 15% | 35% |

| $418,401 or more | 20% | 39.6% |

Chart describes full of breakdown of the rates

Estimated Taxes

If you profit from day trading, you may need to make estimated tax payments throughout the year to avoid tax penalties and interest fees. It might be wiser to put your funds aside as soon as you realize the gains, so you’re not tempted to spend your money elsewhere.

Where to File

You can only deduct $3,000 in net capital loss per year. However, it is only $1500 if you are married and using different filing status. You should show all profit and loss statements on the 8949 form and the Schedule D.

Traders must provide receipts for specific trades they consider to be losing. And the wash-sell rule states that you cannot hold shares of that stock 30 days before or after the holding period for which you want to claim a tax refund.

Schedule C would then have zero costs and income only. Your trading profits are reflected on Schedule D. Any loss above $3,000 cannot be claimed and is simply carried over to a straight loss.

How To Keep Down Day Trading Taxes

Day Trading Taxes Strategies: Prefer to Investing

One of the best day trading taxes strategies is choosing long-term investing instead of day trading. Long-term investors can take advantage of long-term capital gains tax rates, saving them money in taxes. You can get even more tax benefits when you keep your investments in a tax-advantaged account.

You can help grow your money faster without the risks, costs, stress, and headaches associated with day trading. That said, the future is an uncertain and inherently risky investment. Ultimately, you have to come up with the best investment plan for your unexpected situation.

Long-term investors typically invest in diversified portfolios rather than concentrated positions. Untouched diversified portfolios often outperform traders who miss out on the year’s top ten best-performing days.

Filers can easily import up to 10,000 stock trades from hundreds of Financial Institutions and up to 4,000 crypto trades from leading crypto exchanges. Improve your tax knowledge and understanding while doing taxes.

Retirement Accounts

The next day trading strategy for losing taxes is retirement accounts. Losses and gains in a retirement account usually don’t pay an annual fee. Typically with IRAs, you only owe tax on withdrawals, or with Roth IRAs, you may qualify for free withdrawals.

Day trading carries a lot of risks that come with its ability to make quick profits. Therefore, you should be wary of taking excessive risks just to avoid taxes.

Withdrawals from a pre-tax retirement account are generally taxed as ordinary income. This is similar to short-term capital gains.

However, you don’t necessarily have to take all that income in one year. As a result, you can manage your income so that you can pay taxes at an acceptable rate.

Offsetting Gains and Losses

For day trading taxes strategies, losing is not a good idea in terms of cutting transaction taxes. However, any capital loss you experience can offset the capital gain. Therefore, if you need a loss, it can help reduce the amount of tax you pay.

In particular, traders should learn about the wash sales rules before attempting to generate losses for taxes purposes. A sell-off occurs when you sell a stock at a loss and buy it back within 30 days before or after making a loss. The IRS does not allow deductions for any loss to launder revenue for tax purposes.

Carryover Losses

Worst case scenario is when your losses exceed your earnings for the year. Bhajan can utilize them to cut his tax bills.

The IRS allows day traders to deduct up to $3,000 in losses per year. You can then roll over losses greater than that amount for later use.

Big Notes for Day Traders Through Tax Season

Know Which Reports Are Available

Take the time to research and learn what reports are available from your trading platform. Then provide the above information to the day trading taxes preparer as soon as possible.

Among brokerage firms, the 1099-B form is the most commonly offered. It details your sales for the year, possibly including your cost basis.

Monthly and quarterly reports can also tell you about realized profit and loss, helping you understand your potential liability throughout the year.

Track Expenses

Fees, commissions, and other costs you pay with your purchase can increase your cost base. Recurrent transactions can increase costs even in a low commission environment. With a higher cost base, your taxable profit is smaller, so it’s important to keep track of all transaction costs.

Complications With Crypto

You should prepare for the possibility of additional legal formalities at tax time. The cryptocurrency market is an approximately new medium of exchange. Therefore, tax preparers and other service providers may not have the robust systems and extensive expertise to help you.

Some trading platforms track your purchases and sales. They can provide detailed activity reports. However, it’s important to check so you don’t have to mess around with tax prep. If you mine virtual currency or buy it in other ways (other than buying it on an exchange), determining your cost base can be complicated.

The Bottom Line

Day trading contains a lot of risks that can lead to a higher rate of loss than profit. So, day trading taxes can also take a toll on your account. We have also shared the day trading taxes rate as well as tips to reduce taxes, hope you will help your account. Check out more of our useful blogs because it’s free to learn trading.