Trading days are not equally profitable. Some are riskier than others while some offer more luck. If you are new to the trading world, read this blog to know how many trading days in a year to plan your trades properly for better results. If you have been into trading for long, don’t leave just yet. This blog also provides you with useful information and tips to choose which day to sell and buy stocks for more profits and less chances of losing money.

What Is A Trading Day?

A trading day a.k.a regular trading hours (RTH) is any day that a stock exchange is open for trading, as opposed to electronic or extended trading hours (ETH). The trading day normally starts with the ringing of the opening bell and ends with the ringing of the closing bell. When it closes, all share trading ends and is frozen in time until the next trading day begins.

The regular trading hours on the New York Stock Exchange (NYSE) and Nasdaq Exchange is from 9:30 AM Eastern Time to 4:00 PM Eastern Time.

How Many Trading Days In A Year?

Normally, stock exchanges are open during the weekdays, from Monday to Friday, unless there is a holiday or a major event that prevents the market from opening. There are also several days that are shortened due to special circumstances. On such days, the market closes at 1:00 PM, instead of the usual 4:00 PM.

So, how many trading days are there in a year? Normally, there are 365 days in a non-leap year and 366 days in a leap year. To have these numbers, we calculate as below:

Number of days – Number of Weekends – Number of Market Holidays = Total Trading Days per Year

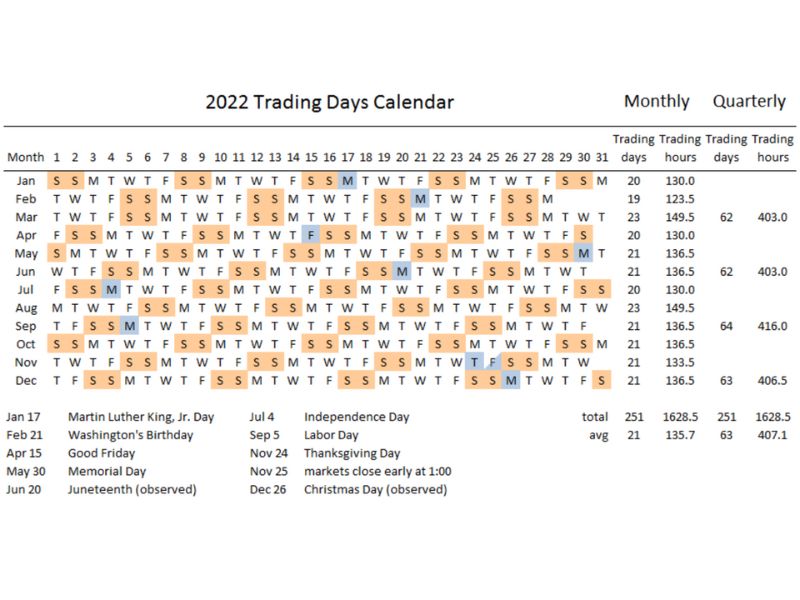

However, the number of trading days varies from year to year. Specifically, how many trading days in a year 2022? In 2022, there are 105 weekend days. As it is not a leap year, its total number of trading days = 365 days – 105 weekend days – 9 market holidays = 251 days.

January: 20 trading days

February: 19 trading days

March: 23 trading days

April: 20 trading days

May: 21 trading days

June: 21 trading days

July: 20 trading days

August: 23 trading days

September: 21 trading days

October: 21 trading days

November: 21 trading days

December: 21 trading days

Your trading days in a year might be limited but you can have as many trades in a day as you like.

How Many Trading Days In A Year Forex?

Like the stock market, the Forex markets are open eight hours a day, five days a week, which means there are also 251 trading days in 2022 for Forex traders. However, unlike the stock market, traders can trade Forex 24 hours a day, seven days a week no matter how many market days in a year there are due to the different time zones the markets are in. These major forex market hours are:

- New York: 1 p.m. GMT – 10 p.m. GMT

- Sydney: 10 p.m. GMT – 7 a.m. GMT

- Tokyo: midnight GMT – 9 a.m. GMT

- London: 8 a.m. GMT – 4 p.m. GMT

Who Sets The Trading Schedule?

The trading schedule is often set by the main stock exchange in each country. For example, in the U.S., NYSE sets the schedule and most of the other exchanges follow the NYSE’s schedule for both days and hours traded. If you are from different time zones but want to trade on the NYSE, be noted that the trading hours (9:30 AM to 4:00 PM) are based on the New York time zones.

Why is The Number Of Trading Days Different From Year To Year?

For most years, there are 252 trading days, but the number can vary a little depending on different factors. These are the factors that cause the difference.

- The Holidays: The market holidays are not the same as federal holidays. For example, the market is open on Veterans Day and Columbus Day, but closed on Good Friday.

- The Weekends: For most years, there are 104 weekend days, but in some years, it can be up to 106.

- Major Events: The market can be closed due to unanticipated events such as terrorist attacks (2001), hurrican (2012), etc.

- Leap Year: A leap year might offer an extra trading day if the extra day falls on a weekday.

Why Aren’t The Stock Market Opened On Weekends?

Stocks stopped trading on weekends in 1952, but why has it not changed given all the advanced technology today? There are actually two reasons why the market is closed for weekends.

The first reason is that many money managers don’t work on Saturdays and Sundays, which causes volatility due to less liquidity. It is also highly likely to have wider spreads between bid and ask.

The second reason is that if a crisis occurs, weekends can be a natural circuit breaker. Weekends can be used to offer time for the market to digest news and for the government to work behind the scenes to calm the market.

Days The Market Closes or Closes Early

As stated above, the stock market also closes for nine holidays a year that include:

- New Year’s Day

- Martin Luther King, Jr Day

- Presidents’ Day

- Good Friday

- Memorial Day

- Independence Day

- Labor Day

- Thanksgiving Day

- Christmas Day

There are also three times a year on which the U.S. stock markets close early. They are July 3rd, the day before Thanksgiving, and Christmas Eve. On these days, the market is only open from 9:30 a.m. to 1 p.m. Eastern Time.

Do You Have to Trade On All Trading Days?

Unlike a 9-5 job, the trading market does not offer independent traders any sick days, vacation, or time off for training. The good thing is, you can trade when you want and take a day off here and there as you please.

Days the Market Are Most Volatile

October is known as the most volatile month of the year in stock trading and the reason can be traced back to the stock market crashes of 1929 and 1987, both of which happened in October. Another reason is the uncertainty created by presidential and midterm elections that happen in early November. August, September, November are also considered more volatile while January tends to be better as traders have more fresh capital available or feel more optimistic about the new year.

These 6 days are also riskier than others. Keep it in mind to trade for better results:

- The 1st day of the month.

- The last day of the month.

- Jobs report on the first Friday of every month.

- Earnings announcement days (for particular stocks).

- Option expiration Friday.

- Fed Days, or Federal Open Market Committee (FOMC) days.

Knowing how many trading days in a year helps you become a more profitable trader with better trading plans, especially for day traders. To equip yourself with more knowledge, skills, and tools to make the most of the trading days, check out our trading courses from trading experts for stocks, Forex, and day trading.