Wolfe Wave pattern is highly beneficial and is significantly underutilized. If you have a keen interest in stock markets, forex, commodities, and cryptocurrencies, you have come to the right book.

Book Overview

Wave methodology is the product of about thirty odd years of studying technical analysis. Early on, I had the good fortune of having John Magee of Edwards and Magee fame, introduce me to some excellent books and reliable chart patterns.

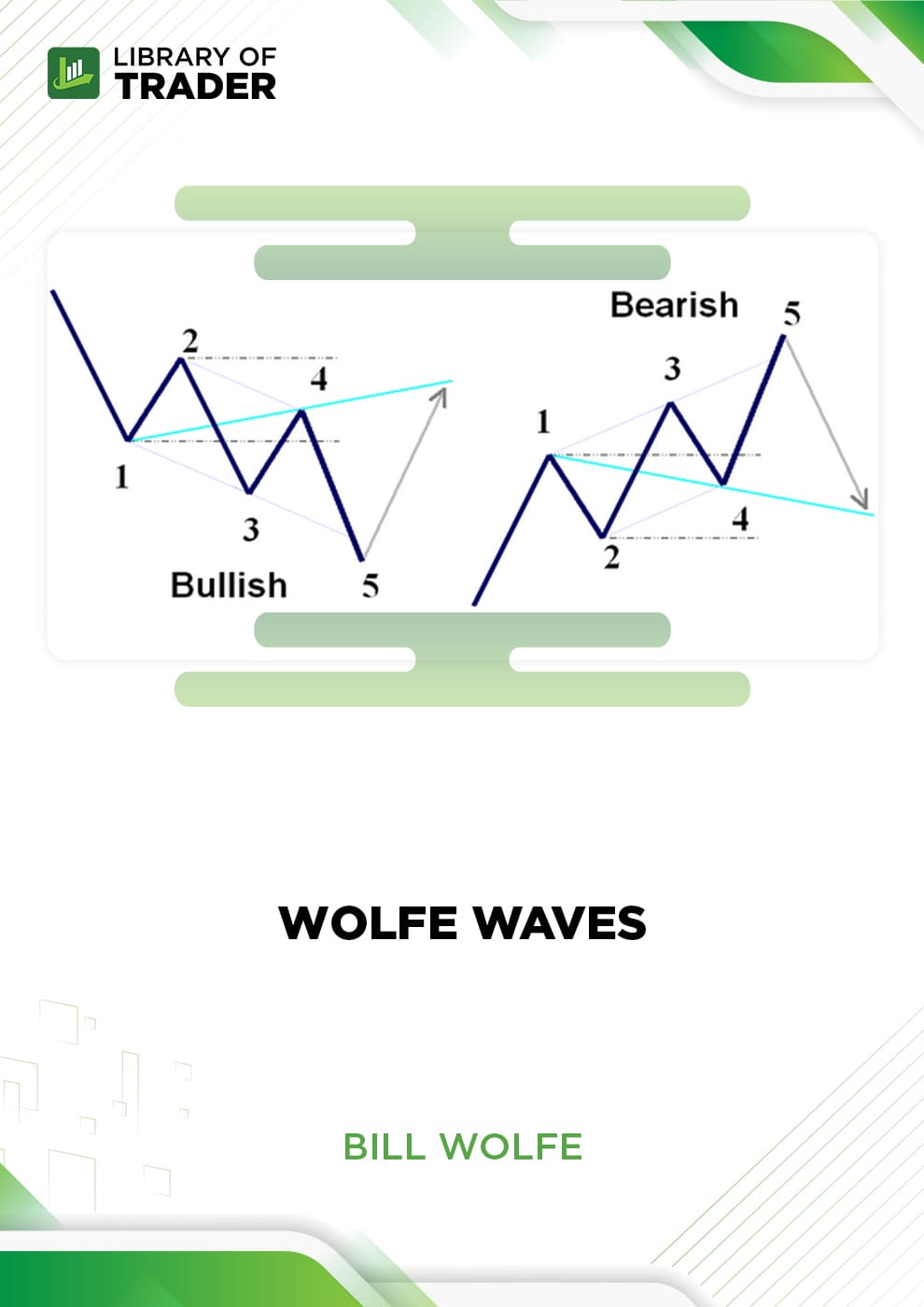

The Wolfe Wave is actually a composition of 5 different wave patterns in price that implies an underlying equilibrium price. It denotes supply and demand through the five waves which fight towards an equilibrium price.

Wolfe Waves can develop on both short terms as well as long term time frames. This could range as fast as a few minutes up to months. It is majorly used by traders to predict where the price is heading and an approximate time when it will get there.

Book Outline

- What is The Wolfe Wave

- The Theory of the Wolfe Wave

- Bullish Wave

- Rules for Bullish Wolfe Wave Structure

- Bearish Wave

- Rules for Bearish Wolfe Wave Structure

- Practical Application

- Tactical Notes (Mental)

- Tactical Notes (Technical)

- Tactical Notes (Chart Reading)

- Tactical Notes (Miscellaneous)

- The better you execute, the better your position!

What Will You Learn?

- Skills to determine the prediction of price movement.

- Skills to build your expertise in the Wolfe Wave strategy that is useful not just in stock trading but also in forex trading.

- Usage of Wolfe Waves as a predictive indicator.

- Easy identification of bullish and bearish trends denoted by the Wolfe Wave.

Who Is This Book For?

- Traders who are interested in The Wolfe Wave

- Traders who want to master the prediction of ‘timing’ in addition to the prediction of price point.

- Traders who want to time your trades based on the resistance and support lines denoted by the pattern.

Bill Wolfe

Please Login/Register if you want to leave us some feedback to help us improve our services and products.

RELATED COURSES

VIEW ALL-

5 Pristine Trading DVDs – Greg Capra – PristineDOWNLOAD5 Pristine Trading DVDs – Greg Capra – PristineUpdate 09 Nov 2022IntermediateDOWNLOAD

5 Pristine Trading DVDs – Greg Capra – PristineDOWNLOAD5 Pristine Trading DVDs – Greg Capra – PristineUpdate 09 Nov 2022IntermediateDOWNLOADThe purpose of the 5 Pristine Trading DVDs – Greg Capra – Pristine is to communicate highly specific chart patterns that identify when a market change is occurring. This system is particularly developed to maximize the likelihood of gains in your account.

Add to wishlist -

Lee Gettess’s Package – Lee GettessDOWNLOADLee Gettess’s Package – Lee GettessUpdate 11 Nov 2022All LevelsDOWNLOAD

Lee Gettess’s Package – Lee GettessDOWNLOADLee Gettess’s Package – Lee GettessUpdate 11 Nov 2022All LevelsDOWNLOADLeading Indicators by Lizard Trader includes 4 parts helping you to get more profit in the short time.

Add to wishlist -

No BS Day Trading Webinar And Starter Course – John GradyDOWNLOADNo BS Day Trading Webinar And Starter Course – John GradyUpdate 09 Nov 2022AdvancedDOWNLOAD

No BS Day Trading Webinar And Starter Course – John GradyDOWNLOADNo BS Day Trading Webinar And Starter Course – John GradyUpdate 09 Nov 2022AdvancedDOWNLOADDay trading simplification and more effectiveness in trading will be what you are getting in No BS Day Trading Webinar And Starter Course by John Grady from No Bs Day Trading.

Add to wishlist -

Comprehensive Market Profile Seminar – Tom AlexanderDOWNLOADComprehensive Market Profile Seminar – Tom AlexanderUpdate 17 Nov 2022All LevelsDOWNLOAD

Comprehensive Market Profile Seminar – Tom AlexanderDOWNLOADComprehensive Market Profile Seminar – Tom AlexanderUpdate 17 Nov 2022All LevelsDOWNLOADComprehensive Market Profile Seminar -Tom Alexander provides you with the valuable information about trading, focusing on auction and price moving principles for higher profits.

Add to wishlist -

Tradingology Options Trading Course – Tradingology SystemDOWNLOADTradingology Options Trading Course – Tradingology SystemUpdate 10 Nov 2022All LevelsDOWNLOAD

Tradingology Options Trading Course – Tradingology SystemDOWNLOADTradingology Options Trading Course – Tradingology SystemUpdate 10 Nov 2022All LevelsDOWNLOADTradingology Options Trading Course – Tradingology System focuses on the concept of diversifying risk across different securities, different price levels, and different time frames.

Add to wishlist -

YTC Price Action Trader – Your Trading CoachDOWNLOADYTC Price Action Trader – Your Trading CoachUpdate 28 Nov 2022All LevelsDOWNLOAD

YTC Price Action Trader – Your Trading CoachDOWNLOADYTC Price Action Trader – Your Trading CoachUpdate 28 Nov 2022All LevelsDOWNLOADThe YTC Price Action Trader by Your Trading Coach focuses on analysis techniques to decode the markets of forex and futures. Thus, you can have valuable insights to develop feasible strategies for maximal profits and minimal risks.

Add to wishlist

Reviews

There are no reviews yet.